Tax Calendar 2026: January BIR Deadlines You Can’t Miss

Disclaimer: QNE Software Philippines, Inc. published this Tax Calendar 2026: January BIR Deadlines You Can’t Miss blog to inform readers of the latest news regarding Tax Calendar 2026. The content is for informational purposes only and should not be construed as legal or tax advice. QNE cannot be held liable for any misinterpretation, errors, or actions taken based on this information. Policies and directives from the BIR may change at any time without prior notice.

The Tax Calendar 2026 outlines all BIR filing, payment, and submission deadlines Philippine businesses must comply with, including VAT returns, withholding taxes, inventory lists, and annual information returns. Missing these deadlines may result in penalties, surcharges, and compliance issues with the Bureau of Internal Revenue (BIR).

As we step into a fresh year of business growth, January marks the most critical period for tax compliance in the Philippines. For accountants, MSMEs, and bookkeepers, this month is not just about starting new projects, it is about finalizing previous year records and meeting annual registration requirements to ensure your business remains in good standing with the Bureau of Internal Revenue (BIR).

Staying proactive this January helps you avoid penalties, surcharges, and unnecessary disruptions to your operations.

What Is the Tax Calendar 2026?

The Tax Calendar 2026 is a formal schedule issued by the Bureau of Internal Revenue (BIR) that outlines specific deadlines for the filing, payment, and submission of various tax returns and administrative requirements. Its primary purpose is to ensure regulatory compliance by requiring taxpayers to remit withheld taxes and register essential business records, such as inventory lists and books of accounts, within strictly mandated timeframes. Adhering to this calendar is crucial for businesses and practitioners to maintain legal standing and avoid the significant penalties associated with late filings or non-compliance.

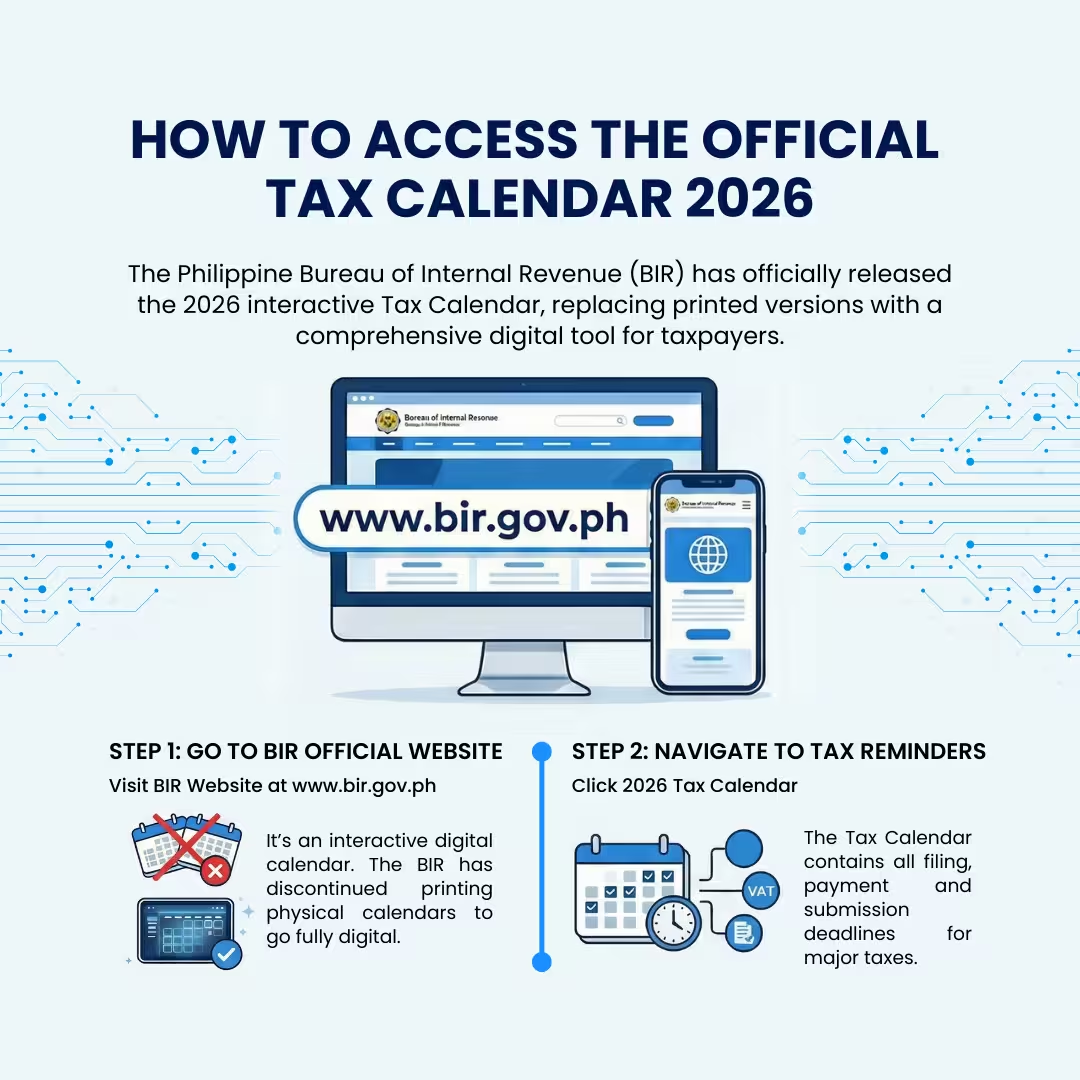

How to Access the Official Tax Calendar 2026?

To access the official schedule, taxpayers should visit the Bureau of Internal Revenue (BIR) website at www.bir.gov.ph. According to Revenue Memorandum Circular No. 110-2025, the bureau has transitioned to a 2026 BIR Interactive Tax Calendar to support its digital transformation and reduce printing costs. Consequently, the BIR has officially discontinued the distribution of printed tax calendars.

The interactive online version is a comprehensive resource designed to assist with more than just tracking deadlines; it includes several key features for accountants and business owners:

- Direct Links to Forms: Users are provided with a list of BIR Forms that link directly to their respective PDF files.

- Compliance Guidance: The calendar offers directions on required attachments and reports for specific tax returns.

- Administrative Directories: It includes an updated BIR Directory with contact information for officials and a list of Authorized Agent Banks (AABs) that accept tax payments.

- Social Media & Guides: The platform provides links to official BIR social media accounts and a specific user guide on how to navigate the interactive features.

By utilizing this official digital tool, taxpayers can ensure they are viewing the most accurate and up-to-date filing and payment schedules for Income Tax, VAT, Withholding Tax, and other recurring obligations.

How to use a tax calendar to avoid penalties in the Philippines 2026?

To navigate the “January Rush” effectively, consider these practical tips:

- Identify Your Tax Types: Determine if your business is VAT-registered or subject to Percentage Tax to ensure you use the correct forms.

- Prepare Documentation Early: Start consolidating your 2025 inventory lists and employee compensation data in the first week of the month.

- Monitor Staggered Filing: If you use eFPS, note that filing dates for forms like the 1601-C are often staggered between the 11th and 14th based on your industry group.

- Coordinate with Local Renewals: Remember that besides BIR deadlines, Mayor’s Permits and Barangay Clearances are typically due for renewal by January 20.

January 2026 Calendar BIR Tax Compliance Deadlines

January is the final checkpoint for closing the previous tax year. Businesses must reconcile all 2025 records, submit Inventory Lists, issue BIR Form 2316 to employees, and file annual information returns such as Forms 1604-C and 1604-F. Completing these requirements on time ensures that all tax obligations for the prior year are properly closed and compliant with BIR regulations.

| Deadline | Category | Description | BIR Form / Requirement | Affected Taxpayers |

|---|---|---|---|---|

| Jan 1, 2026 (Thu) | Submission | Consolidated return of all transactions based on reconciled stockbroker data (Dec 16–31, 2025) | Consolidated Return | Stockbrokers |

| Submission | Engagement letters and renewals/subsequent agreements for financial audit by independent CPAs (FY beginning Mar 1, 2026) | Engagement Letters / Audit Agreements | Corporations required to undergo audit | |

| Jan 5, 2026 (Mon) | Submission | Summary report of certifications issued by NHMFC – December 2025 | Summary Report | NHMFC |

| e-Filing & Payment | Monthly Documentary Stamp Tax return – December 2025 | BIR Form 2000 | Taxpayers subject to DST | |

| e-Filing & Payment | Documentary Stamp Tax return for one-time transactions – December 2025 | BIR Form 2000-OT | Taxpayers with one-time DST transactions | |

| Jan 8, 2026 (Thu) | Submission | Transcript Sheets of Official Register Books (ORBs) for December 2025 | Transcript Sheets of ORBs | Dealers/manufacturers/importers of excisable goods |

| e-Submission | Monthly e-Sales Report (TIN last digit: Even) – December 2025 | Monthly e-Sales Report | CRM/POS users (Even TIN) | |

| Jan 10, 2026 (Sat) | Submission | List of sugar buyers with advance VAT certificates – December 2025 | Buyer List + VAT Certificates | Sugar cooperatives |

| Submission | Information return on releases of refined sugar – December 2025 | Information Return | Sugar refineries/mills | |

| e-Submission | Monthly e-Sales Report (TIN last digit: Odd) – December 2025 | Monthly e-Sales Report | CRM/POS users (Odd TIN) | |

| e-Filing & Payment | Excise tax on metallic minerals – December 2025 | BIR Form 2200-M | Buyers of metallic minerals | |

| e-Filing & Payment | Excise tax on cosmetic procedures – December 2025 | BIR Form 2200-C + Summary | Clinics/hospitals | |

| e-Filing & Payment | VAT/Percentage Tax withheld with MAP – December 2025 | BIR Form 1600-VT / 1600-PT + MAP | Withholding agents (eFPS & Non-eFPS) | |

| e-Filing & Payment | Withholding tax on onerous transfer of real property – December 2025 | BIR Form 1606 | Property sellers/buyers | |

| e-Filing & e-Payment | VAT/Percentage Tax withheld – December 2025 | BIR Form 1600-VT / 1600-PT | National Government Agencies | |

| Jan 11, 2026 (Sun) | e-Filing | Withholding tax on compensation – December 2025 | BIR Form 1601-C | eFPS Filers (Group E) |

| Jan 12, 2026 (Mon) | e-Filing | Withholding tax on compensation – December 2025 | BIR Form 1601-C | eFPS Filers (Group D) |

| Jan 13, 2026 (Tue) | e-Filing | Withholding tax on compensation – December 2025 | BIR Form 1601-C | eFPS Filers (Group C) |

| Jan 14, 2026 (Wed) | e-Filing | Withholding tax on compensation – December 2025 | BIR Form 1601-C | eFPS Filers (Group B) |

| Jan 15, 2026 (Thu) | Registration | Registration of permanently bound loose-leaf books (CY 2025) | Books of Accounts (ORUS/Manual) | All registered taxpayers |

| Submission | Notarized income payee’s sworn declaration (CY 2026) | Sworn Declaration | Individual income payees | |

| Submission | Quarterly list of medical practitioners (Q4 2025) | Practitioner List | Hospitals/clinics | |

| Submission | Quarterly list of government contractors (Q4 2025) | Contractor List | LGUs | |

| e-Filing & Payment | Withholding tax on compensation – December 2025 | BIR Form 1601-C | Non-eFPS Filers | |

| e-Filing & Payment | Excise tax on mineral products (Q4 2025) | BIR Form 2200-M | Mineral product taxpayers | |

| e-Filing & Payment | Annual income tax return (FY ending Sept 30, 2025) | BIR Form 1702-RT / EX / MX | Corporations (Fiscal Year) | |

| e-Filing & Payment | Annual CGT return on shares not traded | BIR Form 1707-A | Corporate taxpayers | |

| e-Filing | Withholding tax on compensation – December 2025 | BIR Form 1601-C | eFPS Filers (Group A) | |

| e-Filing & e-Payment | Withholding tax on compensation – December 2025 | BIR Form 1601-C | National Government Agencies | |

| Jan 16, 2026 (Fri) | Submission | Consolidated stockbroker transactions (Jan 1–15, 2026) | Consolidated Return | Stockbrokers |

| Jan 20, 2026 (Tue) | Submission | Quarterly report on OFW remittances exempt from DST (Q4 2025) | Quarterly Report | Banks & money transfer agents |

| Submission | Quarterly report of printers (Q4 2025) | Printer’s Quarterly Report | Accredited printers | |

| e-Filing & Payment | Percentage tax on winnings – December 2025 | BIR Form 1600-WP | Race track operators | |

| e-Payment | Withholding tax on compensation – December 2025 | BIR Form 1601-C | eFPS Filers (Groups A–E) | |

| Jan 25, 2026 (Sun) | Submission | Quarterly VAT SLSP (Q4 2025) | SLSP | VAT-registered (Non-eFPS) |

| Submission | Sworn statement on sales of excisable goods (Q4 2025) | Sworn Statement | Manufacturers/importers | |

| e-Filing & Payment | Quarterly VAT return (Q4 2025) | BIR Form 2550Q | VAT-registered taxpayers | |

| e-Filing & Payment | Quarterly percentage tax return (Q4 2025) | BIR Form 2551Q | Percentage tax taxpayers | |

| e-Filing & Payment | Quarterly VAT return for nonresident digital service providers | BIR Form 2550-DS | NRDSPs | |

| Jan 29, 2026 (Thu) | e-Filing & Payment | Quarterly income tax return with SAWT (Qtr ending Nov 30, 2025) | BIR Form 1702Q + SAWT | Corporations & partnerships |

| Jan 30, 2026 (Fri) | Submission | eAFS attachments (FY ending Sept 30, 2025) | eAFS | Corporations |

| Submission | Inventory list with sworn declaration (CY 2025) | Inventory List | All businesses | |

| e-Submission | Quarterly VAT SLSP (Q4 2025) | SLSP | VAT-registered (eFPS) | |

| Online Registration | Registration of computerized books (CY 2025) | ORUS Registration | Computerized taxpayers | |

| Jan 31, 2026 (Sat) | Distribution | Issuance of Certificate of Compensation (CY 2025) | BIR Form 2316 | Employers |

| Submission | Various annual sworn statements and information returns | Multiple Requirements | Various taxpayers | |

| e-Filing | Annual withholding information returns (CY 2025) | BIR Form 1604-C / 1604-F | Employers & withholding agents | |

| e-Filing & Payment | Quarterly withholding and final tax returns (Q4 2025) | BIR Forms 1601-EQ, 1601-FQ, 1602Q, 1603Q, 1621 | Withholding agents & banks |

For Philippines corporate tax calendar 2026 important dates, the key tax deadlines for January 2026 include:

- January 15: Submit permanently bound Loose Leaf Books of Accounts for the 2025 calendar year.

- January 25: File Quarterly VAT Returns (Form 2550Q) and the Summary List of Sales, Purchases, and Importations (SLSP) for non-eFPS taxpayers.

- January 26: File Quarterly Income Tax Returns (Form 1702Q) for corporations and partnerships with a fiscal quarter ending November 30, 2025.

- January 30: Submit Inventory Lists and hardbound Computerized Books of Accounts for 2025.

- January 31: Distribute BIR Form 2316 to employees and file Annual Information Returns (Forms 1604-C and 1604-F) for all 2025 withholding taxes.

Key Compliance Reminders for the New Year

- Books of Accounts: While manual books must be registered before use, those using computerized or loose-leaf systems must ensure their 2025 records are submitted or finalized by January 15.

- Annual Alpha Lists: The 1604-C (Annual Information Return of Income Taxes Withheld on Compensation) is due on January 31. This must accurately reflect the total taxes withheld from employees throughout 2025.

- Employee Requirements: You must provide all employees with their copy of BIR Form 2316 by January 31 to facilitate their own tax compliance or substitute filing.

Why January Is the Most Critical Month for BIR Compliance?

January serves as the definitive bridge between tax years, making it the most intensive month for regulatory compliance. It is the period when businesses must finalize their Books of Accounts, with permanently bound Loose Leaf records due by January 15 and Hardbound Computerized Books due by January 30. For businesses maintaining physical stock, January 30 is also the deadline for submitting comprehensive Inventory Lists and schedules for the calendar year ending December 31, 2025.

Furthermore, January concludes with vital annual filings and distributions that directly impact both the BIR and your employees. By January 31, employers are required to distribute BIR Form 2316 (Certificate of Compensation Payment/Tax Withheld) to their staff. Simultaneously, withholding agents must submit their Annual Information Returns, specifically Forms 1604-C and 1604-F, to provide the BIR with a summarized report of all compensation and final taxes withheld throughout the previous year. Missing these deadlines can lead to severe administrative penalties, as these documents represent the final, official reconciliation of the preceding year’s taxable activities.

Navigating the January tax calendar is like completing a year-end inventory of a massive library. Throughout the year, businesses record daily transactions such as VAT and withholding taxes. In January, however, they must organize and finalize every record, submitting Inventory Lists, issuing BIR Form 2316 to employees, and filing annual information returns. This process ensures that all financial “volumes” from the previous year are properly accounted for and compliant with BIR requirements.

How Accounting Systems Simplify Compliance?

Managing these overlapping deadlines manually can lead to errors that result in costly audits. Modern solutions like N3 AI Accounting (formerly QNE AI Cloud Accounting) are designed specifically to support Philippine businesses in staying compliant.

N3 AI Accounting (formerly QNE AI Cloud Accounting) a BIR CAS and EIS Ready system helps organize your data so that generating tax-ready reports, such as the Annual Inventory List or VAT summaries, VAT filing requirements becomes a matter of clicks rather than days of manual labor. By automatically tracking VAT and withholding taxes throughout the year, the system ensures your figures are accurate and ready for the January filing season.

Additionally, AI-driven tools like Quinny AI act as a virtual assistant, highlighting key figures and trends in your financial reports to ensure you catch any discrepancies before submission.

Stay Compliant Effortlessly with N3 AI Accounting

In an era of increasing digitalization, N3 AI Accounting (formerly QNE AI Cloud Accounting) has become an essential tool for Philippine businesses striving for perfect BIR compliance. Being a BIR CAS and EIS Ready solution, QNE is specifically designed to meet local regulations, enabling you to generate tax-ready reports and forms with ease. By following this January guide and utilizing intelligent tools to keep your records organized, you can focus on your new year’s resolutions and business growth rather than tax-related stress.

Beyond simple record-keeping, its AI-powered features, like Quinny AI and QBot, act as a virtual financial assistant, analyzing your data to ensure accuracy and providing instant insights into your financial health. Whether you are an accountant managing multiple clients or an MSME owner, QNE helps you stay ahead of the BIR calendar so you can focus on what matters most: growing your business.

Frequently Asked Questions (FAQs)

Where to find updates on tax deadline changes for 2026 Philippines?

To access the official Tax Schedule 2026, visit the BIR website at www.bir.gov.ph. Under Revenue Memorandum Circular No. 110-2025, the BIR has moved to an Interactive Tax Calendar, discontinuing printed calendars to support digitalization.

This online tool helps taxpayers track deadlines and includes:

- Direct links to BIR forms in PDF format.

- Compliance guidance on required attachments and reports.

- Administrative directories, including BIR contacts and Authorized Agent Banks (AABs).

- Links to official BIR social media accounts and a user guide for navigating the calendar.

Using the Interactive Tax Calendar ensures access to the most accurate and up-to-date schedules for Income Tax, VAT, Withholding Tax, and other obligations.

I use a computerized accounting system. When do I need to submit my books?

For taxpayers using a Computerized Accounting System (CAS) or loose-leaf books, the submission for the calendar year ending December 31, 2025, is due on January 15, 2026.

Where to Download an Official Tax Calendar for 2026 Philippines?

The BIR has officially discontinued the distribution of printed tax calendars to go fully digital.

Can an accounting system help me with my Annual Inventory List?

Yes. Systems like N3 AI Accounting (formerly QNE AI Cloud Accounting) track inventory movements in real-time, allowing you to generate the required Annual Inventory List for the BIR by the January 30 deadline with ease.

Are local business permits also due in January?

Yes. While not a BIR requirement, the renewal of your Mayor’s Permit and Barangay Clearance is generally due by January 20.