EIS Providers: BIR Advisory on Accreditation Claims

- Published on

The Bureau of Internal Revenue (BIR) has released a crucial Public Advisory that directly impacts how businesses select and engage with EIS providers in the Philippines. This advisory addresses growing confusion around accreditation claims related to the Electronic Invoicing System (EIS), which may lead businesses to make compliance decisions based on inaccurate or misleading information. For business owners, accountants, and financial managers, understanding this clarification is essential to ensuring regulatory compliance and avoiding unnecessary risks as the country advances its digital tax initiatives.

Understanding the BIR’s Electronic Invoicing System (EIS)

The Electronic Invoicing System (EIS) is the BIR’s digital framework designed for the issuance and transmission of electronic invoices and receipts. The primary goal of the Electronic Invoicing System Philippines is to streamline tax compliance, enhance the efficiency of tax administration, and create a more transparent business environment. Crucially, before businesses can adopt the EIS, they must first complete their Computerized Accounting System (CAS) registration, as this is a mandatory prerequisite. This mandatory first step, CAS registration, is a critical benchmark for evaluating a provider’s true capabilities, even before considering their readiness for the Electronic Invoicing System Philippines.

Why the BIR Public Advisory on EIS Providers Matters?

The BIR’s Public Advisory is a critical communication that clarifies the current regulatory landscape and helps protect businesses from misinformation. Its significance lies in three key areas:

- Compliance Risks: The advisory directly warns businesses against misleading claims from vendors. Partnering with a vendor that falsely claims accreditation can lead to significant penalties, operational disruptions, and the rejection of submitted tax documents.

- The Importance of Verification: The BIR explicitly urges the public to remain alert and cautious. Before engaging with any potential EIS Providers, businesses should always verify claims by checking official BIR announcements and circulars to ensure they are acting on accurate, up-to-date information.

- Avoiding Misinformation: The advisory is instrumental in helping businesses distinguish between a vendor claiming to be “EIS-accredited” and one offering software that is “EIS-ready.” This distinction is vital, as the BIR has a clear stance on the current status of accreditation for EIS Providers.

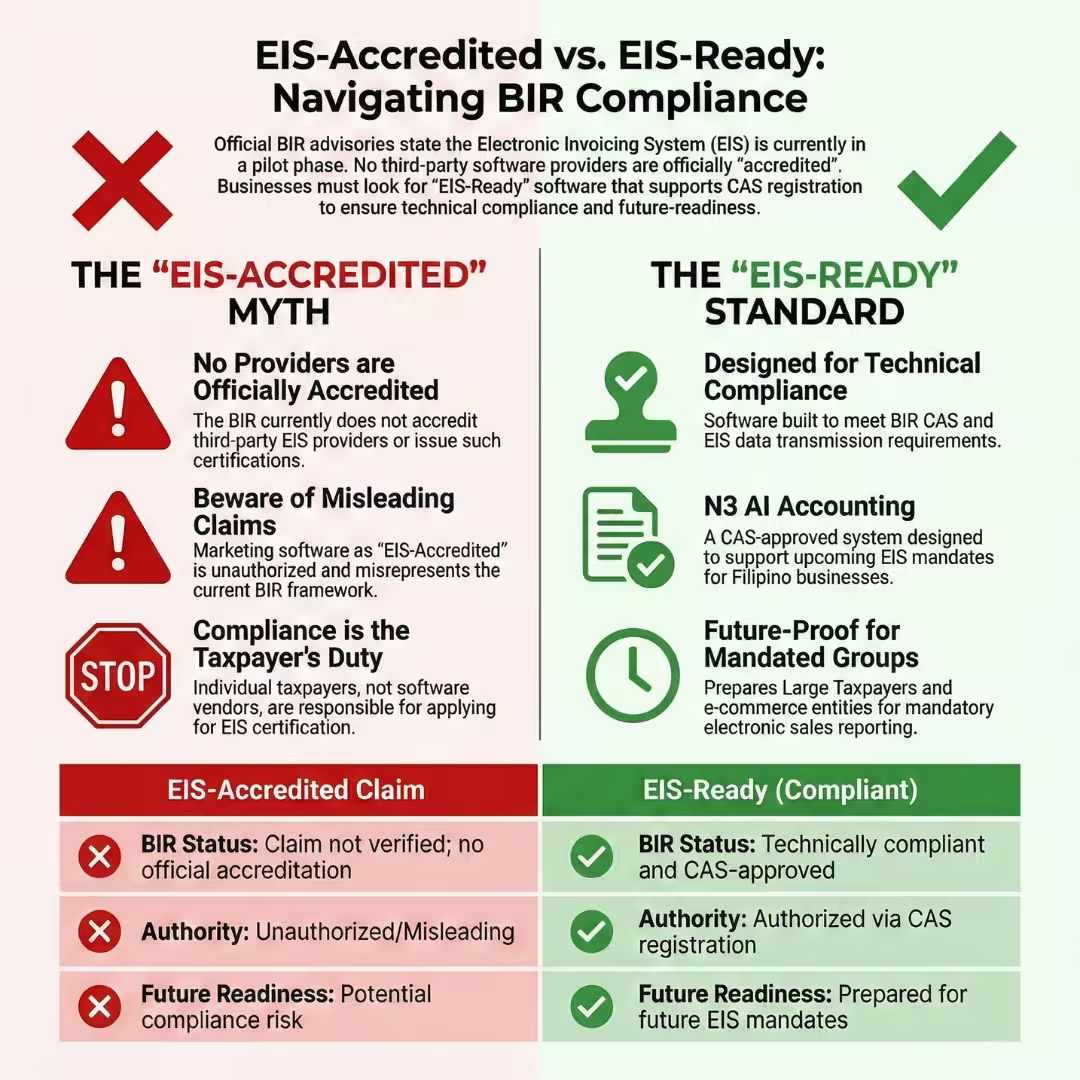

EIS-Accredited vs. EIS-Ready: Key Differences for Filipino Businesses

Understanding the difference between these two terms is fundamental to making a safe and compliant choice for your business.

EIS-Accredited Providers

According to the official BIR Public Advisory, the Bureau does not accredit EIS providers at this time. This is because the Electronic Invoicing System (EIS) is currently in its pilot implementation phase. Therefore, any vendor claims of being one of the first ‘EIS accredited providers‘ are premature and should be verified with extreme caution. Furthermore, the advisory clarifies that the responsibility for EIS certification falls on the taxpayer, not the software provider, reinforcing that the concept of third-party ‘accreditation’ is not part of the current framework.

EIS-Ready Software

An “EIS-Ready” solution refers to accounting software, such as N3 AI Accounting (formerly QNE AI Cloud Accounting), that is technically designed to comply with the requirements of both the Bureau of Internal Revenue’s Computerized Accounting System (CAS) and the Electronic Invoicing System (EIS). Since CAS Registration is a mandatory prerequisite before a taxpayer can issue electronic invoices, an EIS-ready system must first be CAS-ready.

Being “EIS-Ready” means the software is prepared to support a business in meeting EIS requirements once the taxpayer is officially mandated or notified by the BIR to adopt electronic invoicing. It reflects the system’s technical readiness and alignment with current regulatory standards, not an official BIR endorsement or accreditation of the software provider.

How to Protect Your Business When Selecting an EIS Solution

Given the current regulatory environment, businesses must be diligent. Here are actionable steps to take when selecting an EIS solution provider:

- Steps to Verify All Claims: Institute a policy of verifying all vendor claims against primary sources, such as official announcements on the BIR website, Revenue Memorandum Circulars, and the specific Public Advisory discussed here.

- Focus on Readiness, Not Accreditation: The safer and more practical approach is to find EIS-ready software from reliable EIS Providers. A key indicator of a provider’s readiness is their proven ability to guide clients through the prerequisite CAS registration. This focus shifts your evaluation from a vendor’s marketing claim to their tangible capabilities, directly impacting your operational readiness and minimizing future compliance risks.

- Partner with Transparent Vendors: Choose vendors who are honest and upfront about their current status. The best partners are those who focus on helping clients with tangible, immediate compliance steps, like CAS registration, while transparently preparing their systems for future EIS mandates.

QNE Software Philippines: Committed to EIS-Ready Solutions

At QNE Software Philippines, Inc. we are transparent about our current position. While QNE is EIS-ready and continuously aligning Our AI powered accounting solution (N3 AI Accounting) with BIR’s evolving requirements, we do not claim EIS accreditation. Our focus is on ensuring our clients are prepared for every stage of their compliance journey. Here is how we support businesses:

- Proven CAS Registration Success: We have a high approval rate for BIR CAS Registration, having successfully guided over 133 (as of January 27, 2026) clients through the process, a mandatory prerequisite for issuing electronic invoices.

- Continuous Alignment: Our AI powered accounting solution (N3 AI Accounting) is consistently updated to meet evolving BIR regulations, ensuring that our clients are always using a system that is aligned with current tax laws.

- Support for SMEs & Accountants: Our AI powered accounting solution (N3 AI Accounting) is specifically designed to help SMEs, accountants, and bookkeeping firms streamline operations and maintain robust BIR compliance.

Future-Ready Solutions: Choosing an EIS-ready system like QNE prepares your business for future BIR mandates, ensuring a smoother transition when the time comes.

Key Takeaways for Businesses Choosing an EIS Providers in the Philippines

To navigate the transition successfully, keep these critical points in mind:

- Stay Informed: Always rely on official announcements and circulars directly from the BIR, not just vendor marketing claims.

- Challenge Accreditation Claims: Based on the latest BIR Public Advisory, no software providers are currently accredited. Scrutinize any vendor who claims otherwise.

- Prioritize Transparency & Readiness: Choose transparent partners who can prove their system’s readiness, for instance, through a strong track record of successful CAS registration support.

- Future-Proof Your Compliance: Selecting a robust, EIS-ready software today prepares your business for a smooth and compliant transition when BIR mandates are fully implemented.

Navigating the Philippines’ transition to digital tax compliance demands absolute diligence. By staying informed through official BIR channels and scrutinizing vendor claims, businesses can protect themselves from misinformation and make strategic decisions that ensure long-term compliance. As EIS implementation progresses, businesses are encouraged to partner with software providers who prioritize compliance, transparency, and long-term readiness.

Frequently Asked Questions (FAQs)

How to choose the right EIS provider for my company size?

Choose EIS-ready software that supports CAS registration, not based on accreditation claims. Select vendors with a proven track record and transparent processes.

Affordable EIS providers offering cloud-based solutions

Cloud-based, EIS-ready software is suitable for SMEs and small businesses seeking affordability and flexibility. Look for vendors who clearly communicate compliance readiness.

EIS providers offering free trials or demos

Many EIS-ready software providers offer free trials or demos to test compliance capabilities before committing. This helps businesses assess usability and CAS registration support.

EIS providers with strong data security and privacy policies

Prioritize providers that implement encryption, secure cloud storage, and robust access controls to protect your financial and employee data.

How to protect your business when choosing an EIS solution?

Verify all vendor claims against official BIR announcements and focus on EIS-ready software from transparent providers. Avoid vendors claiming premature accreditation.