Registration of Books of Accounts:

Mandatory ORUS Registration for Certain Books

- Published on

Disclaimer: QNE Software Philippines, Inc. published Registration of Books of Accounts: Mandatory ORUS Registration for Certain Books blog to inform readers of the latest developments regarding registration of books of accounts through ORUS. The content is for informational purposes only and should not be construed as legal or tax advice. QNE cannot be held liable for any misinterpretation, errors, or actions taken based on this information. Policies and directives from the BIR may change at any time without prior notice.

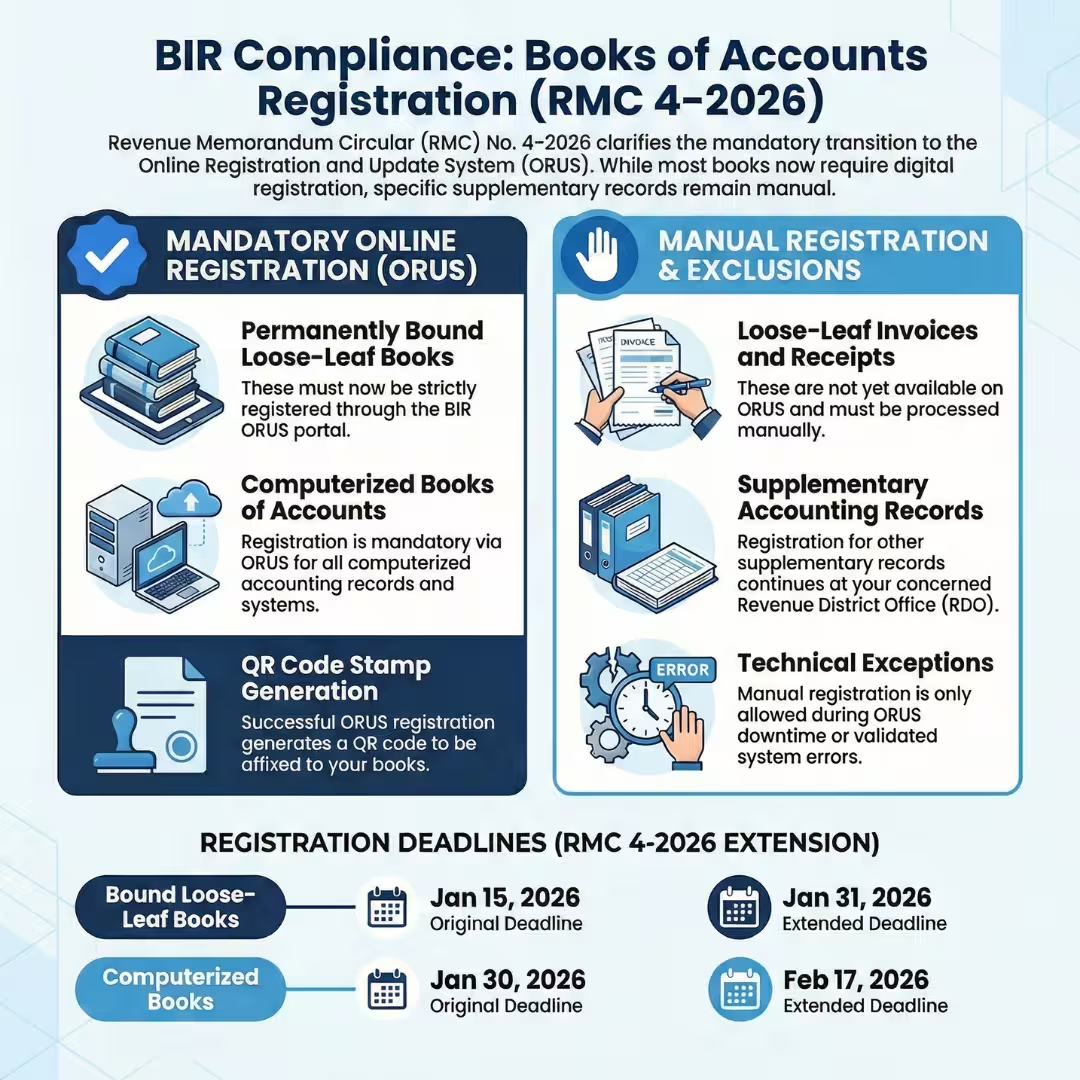

The BIR has released RMC No. 4-2026, another update that could affect how accountants manage records and reporting. Accountants must pay close attention to this circular as it directly impacts the registration process for books of accounts, shifting traditional manual methods to a mandatory online system via the BIR’s ORUS portal and adjusting critical deadlines. Understanding these changes is essential for maintaining compliance and ensuring your accounting workflows are up-to-date.

Registration of Books of Accounts for Specific Books

A Revenue Memorandum Circular (RMC) is an official document issued by the Bureau of Internal Revenue (BIR) to clarify and reinforce existing tax policies for consistent implementation. On January 15, 2026, the BIR issued RMC No. 4-2026, which specifically addresses the mandatory registration of books of accounts for specific books.

This circular requires that the following types of books be registered through the Online Registration and Update System (ORUS):

- Permanently Bound Loose-Leaf Books of Accounts

- Computerized Books of Accounts

It is important to note that not all accounting records fall under this online registration requirement. Loose-leaf invoices, receipts, and other supplementary books are excluded and continue to be processed manually at the taxpayer’s RDO.

Key Points Accountants Must Know

Mandatory Registration of Books of Accounts Through ORUS

- Pursuant to Revenue Memorandum Circular No. 3-2023, the registration of both Permanently Bound Loose-Leaf Books of Accounts and Computerized Books of Accounts must be completed online through the ORUS portal.

- After a successful registration via ORUS, a QR Code stamp will be generated. The handling of this QR code differs based on the type of books:

- For Permanently Bound Loose-Leaf Books of Accounts, the QR Code shall be affixed to the first page of the books.

- For Computerized Books of Accounts, the QR Code shall be printed and kept for record purposes, serving as proof of registration.

Important Reminder:

- Keep a copy of the QR Code for your records. Submission to the RDO is no longer required under RMC No. 91-2024.

- Make sure the QR Code is stored safely and ready in case the BIR requests it during audits or inspections.

Extended Registration of Books of Accounts Deadlines

- Due to intermittent log-in connectivity issues experienced by users of the ORUS platform, the BIR has extended the deadlines for registration as a relief measure.

- Permanently Bound Loose-Leaf Books of Accounts/Invoices and Other Accounting Records: The deadline is extended from January 15, 2026, to January 31, 2026.

- Computerized Books of Accounts and Other Accounting Records: The deadline is extended from January 30, 2026, to February 17, 2026.

Important Exceptions and Exclusions

- Manual Registration of Books of Accounts may be allowed but only under exceptional circumstances. It will be accepted at the RDO Head Office or Branch Office where the taxpayer’s TIN or Branch TIN is registered, but only if one of the following conditions is met:

- An official advisory on ORUS system unavailability has been issued.

- A screenshot of an error message encountered during the online registration process is presented.

- The registration of Loose-Leaf invoices, Receipts, and other similar accounting records is not covered by this online process. These will continue to be processed manually at the concerned RDO.

Practical Implications for Your Accounting Workflow

This circular fundamentally changes the registration workflow from a physical, messenger-driven errand at the RDO to a digital, desk-based process. Accountants must now be proficient with the ORUS portal. Furthermore, the proof of compliance is no longer a physical stamp in a logbook but a generated QR code that requires proper digital archiving and integration into record-keeping protocols. This shift demands a re-evaluation of internal controls around compliance documentation.

While the RMC still outlines procedures for loose-leaf books, the core emphasis on ORUS registration for computerized systems highlights the BIR’s strategic direction. Relying on manual processes and their exceptions introduces compliance risk and operational friction. A robust Computerized Accounting System (CAS) not only generates the required computerized books but also aligns your practice with the clear future of digital tax compliance. Systems like N3 AI Accounting (formerly QNE AI Cloud Accounting), with a proven track record of high BIR CAS Approval and 133/133 Successful CAS certifications, are designed to produce these records, ensuring financial data is centralized, organized, and ready for reporting.

How Accountants Can Stay Ahead of the Curve

- Review your registration processes: Ensure your internal procedures align with the mandatory use of ORUS. This includes creating a step-by-step guide for using the ORUS platform, designating responsible personnel, and establishing a protocol for saving and verifying the generated QR codes.

- Update documentation and calendars: Make a note of the new deadlines—January 31, 2026, and February 17, 2026—in your compliance calendars to ensure all registrations are completed on time.

- Leverage modern accounting tools: Digital accounting tools like QNE help automate these processes, reducing manual work and errors.

Takeaway

In summary, RMC No. 4-2026 reinforces two critical points for accountants: the mandatory use of the ORUS platform for Registration of Books of Accounts, specifically Computerized Books of Accounts and the newly extended deadlines for compliance. To ensure adherence and avoid penalties, it is crucial to adapt your processes accordingly.

We encourage all accounting professionals to review the full text of RMC No. 4-2026 to understand all the details and ensure complete compliance.

Stay compliant and keep your accounting processes efficient with N3 AI Accounting (formerly QNE AI Cloud Accounting), designed to help accountants like you manage updates and deadlines effortlessly.

Frequently Asked Questions (FAQs)

How do I register books of accounts for a corporation in the Philippines?

Register both Permanently Bound Loose-Leaf Books of Accounts and Computerized Books of Accounts online through the BIR’s ORUS portal under RMC No. 4-2026. After registration, a QR code is generated as proof of compliance.

Can I register my books of accounts electronically through government portals?

Yes. Eligible books must be registered digitally via the BIR ORUS portal. Physical submissions are only accepted if ORUS is unavailable, with proper documentation of errors.

What are the steps to get books of accounts registered with the BIR?

- Access the ORUS portal and log in.

- Submit your books (permanently bound loose-leaf or computerized).

- Receive the QR code after successful registration.

- Affix the QR code to loose-leaf books or keep for computerized records.

Are there accounting software providers that assist with book of accounts registration?

Yes. Certified accounting systems like N3 AI Accounting (formerly QNE AI Cloud Accounting) help generate computerized books in the required format and automatically create QR codes for BIR registration.

How to register physical and digital books of accounts differently?

For physical loose-leaf books, affix the QR code to the first page. For computerized books, print and keep the QR code for records. Both types must be registered online via ORUS.