How to apply for BIR Loose Leaf?

BIR LOOSE LEAF DEFINITION

First, let us talk about Loose Leaf Bookkeeping. This is one of the Bureau of Internal Revenue’s (BIR) prescribed way of recording books of accounts. One of the commonly used Loose Leaf Bookkeeping application is Microsoft Excel spreadsheets. The recording of sales, purchases and general ledger transactions were done and printed through excel spreadsheets. Other computer applications also can be treated as loose-leaf as long as it prints the format of the books of accounts that the BIR requires. Usually, companies use Loose Leaf before acquiring a BIR Ready Accounting Software.

GETTING READY TO APPLY FOR BIR LOOSE LEAF

To apply for BIR Loose Leaf, a company must initially apply for a Permit to Use (PTU) Loose-leaf books of accounts with the BIR. According to Revenue Memorandum Circular (RMC) No. 68-2017 Loose-leaf book is still manual event if it is created and printed using a machine.

Meanwhile, application for PTU Loose-Leaf is currently under the supervision of Regional District Office (RDO).

But before heading to the RDO, please make sure to prepare the following requirements:

- Duly accomplished BIR Form No. 1900.

- Sample format and printout to be used.

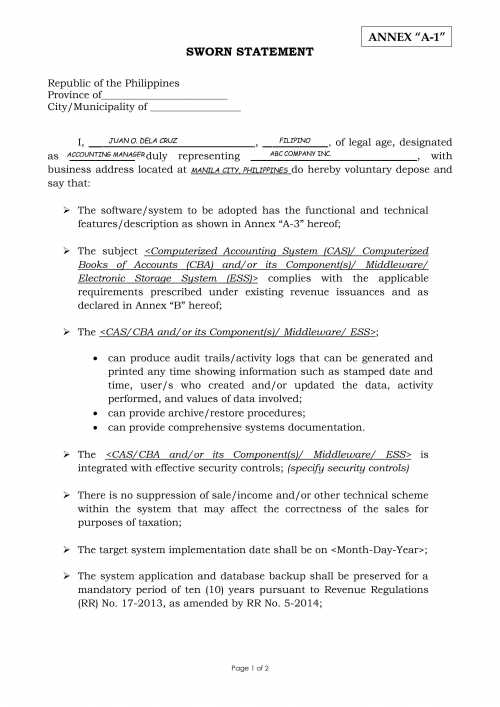

- Sworn Statement BIR Loose Leaf specifying the following:

Identify the books to be used, invoices/receipts and other accounting records together with the serial numbers of principal and supplementary invoices/receipts to be printed.

Commitment to permanently bind the loose-leaf forms within 15 days after the end of each taxable year or upon the termination of its use.