Why N3 AI Accounting (formerly QNE AI Cloud Accounting) Is the Best Accounting Software for Malaysian Businesses

The business landscape in Malaysia is rapidly shifting, driven by two major forces: the necessity for modern digital tools and the tightening regulatory environment, particularly regarding the LHDN e-Invoice implementation.

For Malaysian SMEs (Small and Medium Enterprises) and enterprises, N3 AI Accounting (formerly QNE AI Cloud Accounting) stands out as an optimal choice, offering a powerful, SST-ready and E-Invoice Ready business solution tailored specifically to local requirements.

How to know it's the Best Accounting Software for Malaysian Businesses?

A best accounting software for Malaysian businesses must be user-friendly, accessible, and capable of adapting to the fast-changing business environment. Essential features include:

- Malaysian Compliance: The software must be designed to Comply with Malaysia Government Tax Requirements quickly and easily, including tracking SST and generating SST Forms & Reports. It must also be E-Invoice Ready.

- Automation: The system should streamline workflows and handle repetitive tasks—such as data entry, invoice generation, and bank reconciliation—effortlessly to reduce human errors.

- Security & Cloud Access: Provides secure, role-based user access with detailed permission controls, allowing users to view financial data in real time, anytime, anywhere, from any device.

- Mobility: In Malaysia’s fast-paced digital economy, mobility is key. SMEs need flexible tools to handle accounting, sales, and customer management wherever they are.

Many Malaysian SMEs struggle with outdated or manual accounting, which involves tremendous paperwork and manual data entry, leading to slow and ineffective processes.

Common Accounting Problems in the Malaysia

Traditional or non-integrated accounting software often create significant roadblocks for growth. Common problems include:

- Manual encoding errors: Repetitive tasks handled manually increase the risk of human errors.

- Slow month-end closing: Without automated reconciliation, matching transactions with bank statements is time-consuming.

- Difficulty meeting LHDN deadlines: Traditional processes rush accountants to meet reporting deadlines.

- No real-time visibility over finances: Decision-making suffers when financial data is not immediately accessible or insightful.

- Unintegrated systems causing inefficiencies: Managing different processes (accounting, sales, inventory) across separate systems hinders streamlined operations.

How QNE Solves These Accounting Challenges?

N3 AI Accounting (formerly QNE AI Cloud Accounting) is designed to overcome these challenges, transforming accounting from a reactive function into a proactive tool.

- Eliminating Manual Errors: QNE streamlines workflows using powerful automation. The QuickScan feature allows users to scan printed or written text from documents (like receipts) and automatically convert it into accurate transaction entries.

- Speeding Up Closing: The AI Auto-Bank Reconciliation feature automates transaction matching with your bank statement, reducing errors and saving time.

- Ensuring Compliance & Extended Deadlines: QNE is LHDN‑Ready. For companies required to file under the appropriate schemes, the standard submission deadline is observed and where applicable, extensions may be granted, helping reduce the pressure of last‑minute submissions.

- Providing Real-Time Visibility: QNE delivers real-time insights through a powerful custom dashboard and intuitive financial reports accessible anytime, anywhere. Enhanced by Quinny AI, your Virtual CFO, the system highlights key figures, trends, and insights to support smarter, faster decisions. With the Quinny AI, users can ask plain-English questions and receive clear, data-driven answers, significantly reducing reporting turnaround time.

- Integrating Operations: QNE helps businesses streamline operations by managing accounting, sales, and inventory all within one centralized system.

Best Accounting Software With Mobile Apps for Business Owners in Malaysia

A mobile-ready accounting software is essential in the current digital economy. The N3 AI Accounting (formerly QNE AI Cloud Accounting) Apps on Google Play are now officially available, a milestone that makes QNE more accessible, secure, and user-friendly for SMEs across Malaysia.

The mobile app allows owners and managers to enjoy:

- Real-time Monitoring: Business owners can track sales and record customer collections in real time.

- Instant Reporting: Users can generate Profit & Loss and Balance Sheet reports with “One Click Report”.

- Convenience: The launch on Google Play provides a trusted and secure download directly from Malaysia Google Play and offers seamless updates.

Currently, the N3 AI Accounting (formerly QNE AI Cloud Accounting) App is only available for Android users in Malaysia via Google Play, with an iOS version coming soon.

Best Accounting Software and Affordable for Micro, Small, and Medium Enterprises (MSMEs)

N3 AI Accounting (formerly QNE AI Cloud Accounting) is designed specifically for MSMEs, providing a complete yet cost-effective solution that supports growth and compliance.

QNE offers several pricing tiers to suit different business needs:

- The Prime Plan starts at RM 62 Monthly (based on an annual subscription). It includes 3 users plus 1 accountant, Basic Bookkeeping, and is LHDN-Ready.

- The Essential Plan is available for RM 100 (based on an annual subscription).

- QNE also offers monthly billing options, with the Prime plan starting at RM 80 per month.

QNE’s Standout Features That Make It the Best Accounting Software in 2026

N3 AI Accounting (formerly QNE AI Cloud Accounting) is powered by advanced AI technology, delivering intelligent financial insights and smarter workflows.

Key features that solidify QNE as the leading choice include:

- Quinny AI: Acting as a Virtual CFO, Quinny AI is a suite of tools built to assist Philippine SMEs and enterprises in making smart, confident decisions.

- Report Analyzer: Allows users to ask questions in plain English (e.g., “Quinny, compare the profit and loss reports for May and June 2025 and share your insights.”) and receive clear, data-driven answers, reducing reporting turnaround time.

- Financial Advisor: Compares business performance against industry benchmarks and offers quick, actionable tips to boost profitability.

- Report Designer: Simplifies report customization, ensuring consistent formatting and suggesting optimal layouts.

- QBot AI Assistant: This 24/7 intelligent financial assistant simplifies financial management with instant insights on sales, profit, and bank balance. The Qbot AI Assistant also guides users through the QNE system step-by-step.

- QuickScan: This Scan and Save feature converts receipts or other printed documents into transaction entries automatically, saving time and improving data accuracy.

- Quinny AI: Acting as a Virtual CFO, Quinny AI is a suite of tools built to assist Philippine SMEs and enterprises in making smart, confident decisions.

Why Choose QNE Over Other Accounting Software?

Malaysian businesses prefer QNE because of its commitment to localized compliance excellence and dedicated support.

- Localized Compliance Excellence

N3 AI Accounting (formerly QNE AI Cloud Accounting) is designed specifically for Malaysian businesses, ensuring full support for SST compliance, LHDN e-Invoicing (MyInvois), and other local statutory requirements. - E-Invoicing Ready for Malaysia

QNE is fully equipped for Malaysia’s nationwide e-Invoicing rollout. Its seamless integration with LHDN’s MyInvois Portal makes invoice validation, transmission, and compliance simple and efficient. - AI-Powered SST Reporting

With the built-in SST Advisor, businesses can automatically review and verify SST reports before submission—reducing errors and helping ensure compliance with Customs requirements. - Automated Document Processing

Through its OCR/QuickScan technology, QNE converts scanned invoices and receipts into digital transaction entries, saving time and minimizing manual data entry. - Dedicated Local Support

QNE provides strong Malaysia-based customer support, offering local expertise to help businesses navigate compliance, reporting, and system setup with confidence.

Why 2026 Is the Best Time to Switch to QNE?

Digital transformation is moving forward rapidly, and the conversation has shifted from if a business should embrace digital tools to how quickly it can adapt.

By switching to N3 AI Accounting (formerly QNE AI Cloud Accounting), businesses are proactively managing their compliance and growth:

LHDN E-Invoice Readiness: Implementing QNE ensures the business is ready to comply with the LHDN’s e-Invoice requirements, futureproofing the operation. N3 AI Accounting (formerly QNE AI Cloud Accounting) is designed to Comply with Malaysia Government Tax Requirements quickly and easily and is an E-Invoice Ready solution. QNE provides features like e-invoice validation on every transaction screen and has achieved Successful LDHN e-invoice IRBM Sandbox Integration.

Gaining a Competitive Edge: Businesses leveraging QNE are getting ahead of the curve. N3 AI Accounting (formerly QNE AI Cloud Accounting) is powered by advanced AI technology, delivering intelligent financial insights and smarter workflows. By utilizing Quinny AI, the AI Accounting Assistant tailored for Malaysia, which acts as a Virtual CFO, along with real-time data and intelligent recommendations, businesses can enable faster, smarter decision-making. Quinny AI helps businesses make smart, confident decisions without the guesswork through tools like the Financial Advisor (offering quick tips to boost financial performance) and Report Analyzer (reducing reporting turnaround time).

Ready to upgrade your financial management and ensure compliance with LHDN’s e-Invoice requirements?

Unlock the power of AI for your business today. Schedule a Consultation with QNE to kick start your seamless transition with the LHDN e-invoice implementation and ensure you Comply with Malaysia Government Tax Requirements quickly and easily. N3 AI Accounting (formerly QNE AI Cloud Accounting) is an E-Invoice Ready solution that has achieved Successful LDHN e-invoice IRBM Sandbox Integration.

Book your free demo today and experience the best accounting software. You can also Book An Appointment directly with QNE.

Frequently Asked Questions (FAQs)

N3 AI Accounting (formerly QNE AI Cloud Accounting) is considered one of the best accounting software for Malaysian businesses because it is LHDN e-Invoice Ready and SST-ready, affordable for SMEs, equipped with mobile apps, and powered by AI automation designed specifically for the Malaysian market.

Yes. N3 AI Accounting (formerly QNE AI Cloud Accounting) is designed to Comply with Malaysia Government Tax Requirements quickly and easily. It is a SST-ready solution that supports the printing of SST Forms and Reports. Furthermore, QNE is an E-Invoice Ready solution and has achieved Successful LDHN e-invoice IRBM Sandbox Integration.

QNE offers flexible pricing tailored for SMEs. The pricing starts at RM 62 per month (based on the Prime annual subscription rate). This Prime plan includes 2 users plus 1 Accountant and the e-Invoice module. All listed prices are subject to 8% SST.

Yes. The N3 AI Accounting (formerly QNE AI Cloud Accounting) Apps on Google Play are now officially available for Malaysian businesses. This mobile-first solution is designed for Malaysian SMEs, entrepreneurs, accountants, and businesses. Users can track sales, record customer collections in real time, and generate Profit & Loss and Balance Sheet reports with “One Click Report” using the app. Currently, the app is available for Android users in Malaysia via Google Play, with an iOS version scheduled for release soon.

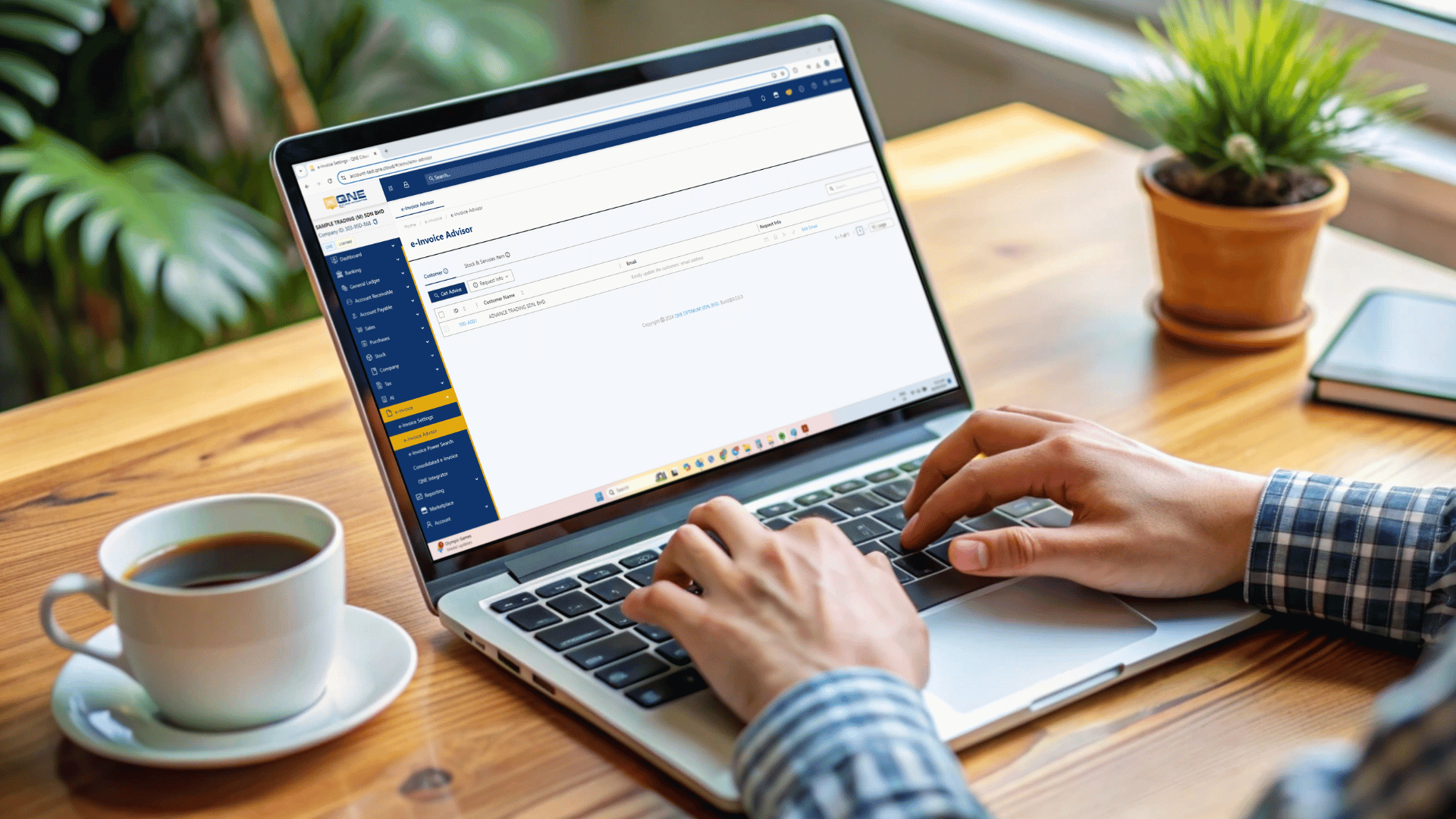

QNE helps Malaysian businesses prepare for the LHDN e-invoice implementation. N3 AI Accounting (formerly QNE AI Cloud Accounting) is E-Invoice Ready and features integrated tools to automate compliance, including:

- E-invoice validation that lets you submit and validate the e-invoice on every transaction screen, ensuring fast and accurate data.

- Support for generating Standard e-Invoices, Consolidated e-Invoices (especially useful for cash sales transactions), and Self-Billed e-Invoices (for transactions like purchasing from foreign suppliers).

- The ability to check the status of LHDN e-invoices inputted in the software.

Successful LDHN e-invoice IRBM Sandbox Integration.