E-Invoicing Update: Exemptions and Extended Deadlines for MSMEs

The Malaysian government has made significant changes to the e-invoicing regulations, which will greatly benefit small traders and micro, small, and medium-sized businesses (MSMEs). The latest e-invoicing update reflects the government’s commitment to fostering a smooth transition to digital compliance. By making the switch to the e-invoicing system easier, these modifications provide businesses with enough time to adjust while staying in compliance with evolving tax policies.

The Ministry of Finance (MOF) and the Inland Revenue Board of Malaysia (LHDN) recognized that many MSMEs faced challenges in adapting to the initial deadlines. Thus, this latest e-invoicing update offers an extended deadline to accommodate smaller businesses, giving them the space to integrate necessary technologies and prepare operationally.

Key Updates

Small Business Exemption

One of the most impactful parts of the e-invoicing update is the revised exemption threshold. Businesses earning under RM150,000 in annual sales are no longer required to implement e-invoicing. This change significantly lowers the regulatory burden for over 700,000 small traders, providing relief especially to sole proprietors and very small enterprises. This adjustment ensures that micro-businesses can focus on growth without the immediate pressure of compliance costs.

Additionally, this exemption creates a more inclusive digital economy strategy by ensuring that compliance demands are proportionate to business size and capacity.

New Deadline for MSMEs

For MSMEs, the government has introduced an extended deadline. Businesses with yearly sales between RM150,000 and RM500,000 now have until January 1, 2026, to comply with the e-invoicing mandate. This extended deadline ensures that MSMEs are not rushed into technological changes that could otherwise strain their resources.

Moreover, a six-month transition period will be provided after the mandate takes effect. This grace period enables MSMEs to fully adapt their processes without facing penalties, ensuring a smoother and more practical transition to the new system.

These adjustments under the latest e-invoicing update are part of the broader strategy to digitize Malaysia’s economy while ensuring that no business segment is left behind.

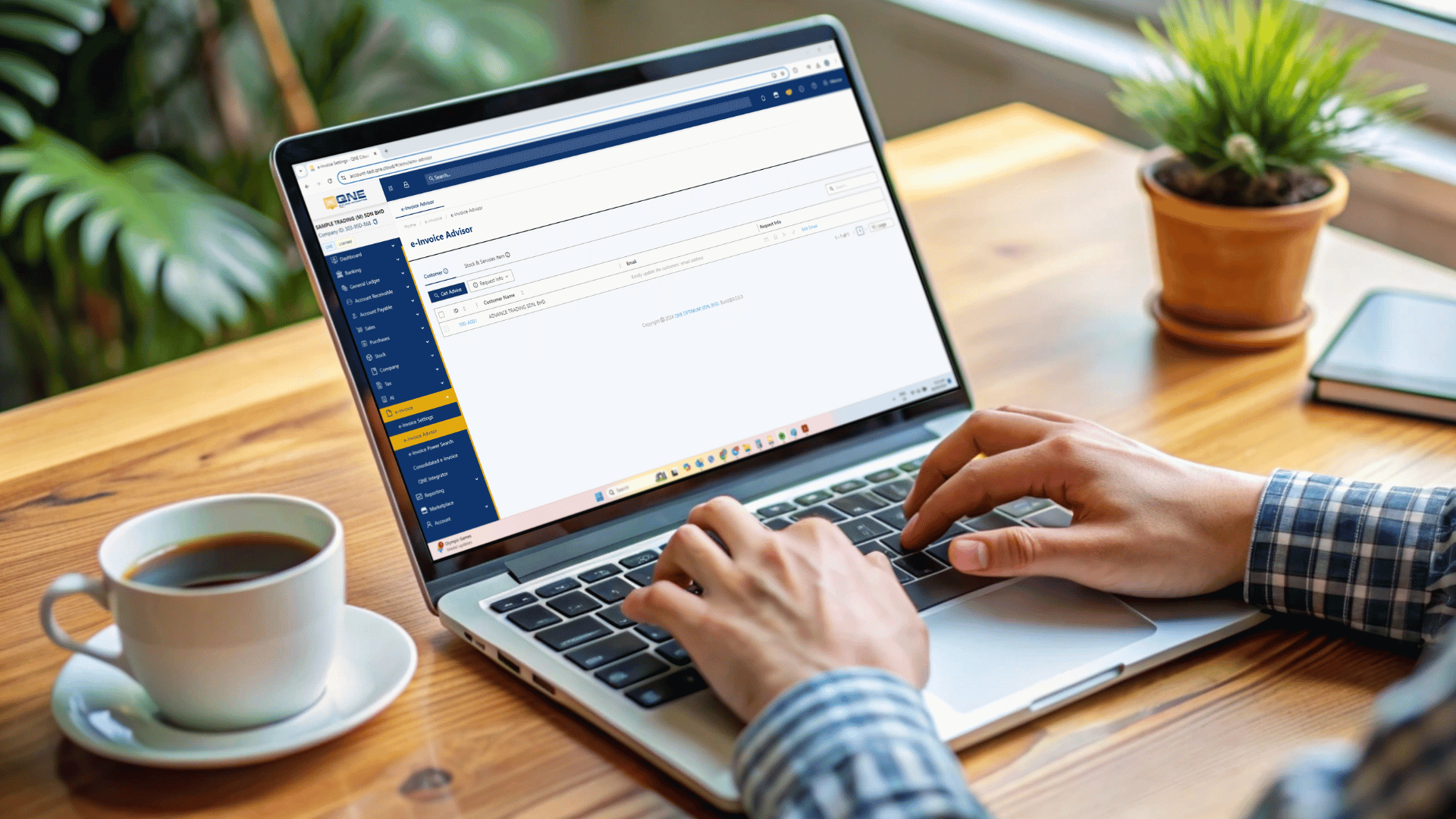

N3 AI Accounting (formerly QNE AI Cloud Accounting) Will Help You Stay Ahead!

Early preparation is essential for smooth compliance, especially with the extended deadline now in place. N3 AI Accounting (formerly QNE AI Cloud Accounting) is designed to streamline your e-invoicing process and assist your company in staying ahead of regulatory developments. Our solution aligns with the latest e-invoicing update, providing MSMEs and growing businesses with the tools to effortlessly generate, track, and submit e-invoices according to LHDN requirements.

With user-friendly features, automated capabilities, and seamless integration with existing business systems, N3 AI Accounting (formerly QNE AI Cloud Accounting) simplifies compliance. Businesses can reduce the risk of errors, improve financial transparency, and ensure that they are well-prepared long before the extended deadline arrives.

By embracing digital accounting solutions now, MSMEs can build resilience, optimize their workflows, and position themselves competitively in Malaysia’s rapidly digitalizing market.

Why Act Now Despite the Extended Deadline?

Although the extended deadline offers more time, early adopters of e-invoicing systems stand to gain significant advantages. These include:

- Increased operational efficiency: Automating invoice management reduces administrative workload.

- Enhanced compliance: Staying ahead of regulatory timelines minimizes risks of penalties.

- Data-driven insights: Digital invoicing provides better visibility into cash flow and business performance.

- Readiness for future mandates: Preparing early positions businesses to adapt easily to future compliance updates.

Waiting until the last minute to comply can lead to rushed implementations, increased costs, and potential disruptions to business operations. Leveraging the benefits of this e-invoicing update and the extended deadline helps future-proof your business.

Frequently Asked Questions (FAQs)

What is the purpose of the latest e-invoicing update?

The update aims to help small traders and MSMEs transition smoothly to digital invoicing. MOF and LHDN revised the rules after recognizing the challenges smaller businesses faced with earlier deadlines.

Which businesses are exempt from e-invoicing?

Businesses earning below RM150,000 annually are exempt from the e-invoice mandate.

What is the new deadline for MSMEs above the exemption threshold?

MSMEs with annual sales of RM150,000–RM500,000 must comply by January 1, 2026.

Why prepare early?

Early compliance provides:

Faster, more efficient invoicing

Reduced compliance risks

Better cash flow visibility

Smoother transition and lower implementation costs

Last-minute adoption can cause delays and operational issues.

How can N3 AI Accounting (formerly QNE AI Cloud Accounting) help?

N3 AI Accounting (formerly QNE AI Cloud Accounting) automates the creation, tracking, and submission of e-invoices aligned with LHDN requirements. It simplifies compliance, improves efficiency, and integrates seamlessly with business workflows—making it ideal for MSMEs preparing for e-invoicing.

Future-Proof Your Business Today!

The transition to electronic invoicing need not be too difficult. Start preparing in advance and benefit from clever accounting solutions that simplify compliance. N3 AI Accounting (formerly QNE AI Cloud Accounting) is here to assist businesses in navigating the complexities of the e-invoicing update while making the most of the extended deadline.

Contact us today to start your journey toward a streamlined, future-ready e-invoicing process. Don’t just comply, thrive in the digital economy with QNE.