E-Invoice Exemption: RM1 Million Threshold for SMEs Starting 2026

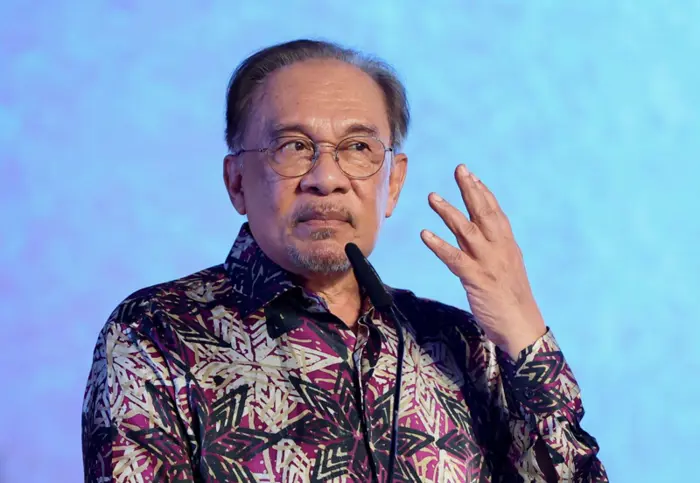

Prime Minister Datuk Seri Anwar Ibrahim announced a major policy change on e-invoicing, exempting companies with annual revenue below RM1 million, up from the previous RM500,000 threshold, effective January 1, 2026. The move aims to ease compliance burdens on SMEs, following feedback that the system could increase costs and pressure on small businesses.

Additionally, the government will double the tax refund allocation from RM2 billion to RM4 billion to speed up outstanding payments. These announcements were made during the ‘Sentuhan Madani Bersama Rakyat Sabah’ programme at the Sabah International Convention Centre (SICC) on December 6, 2025.

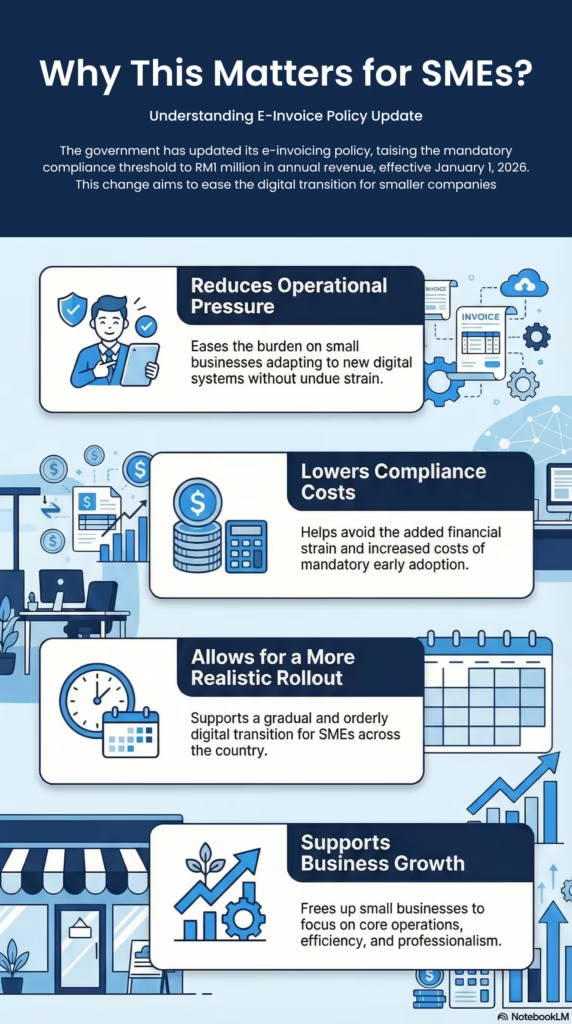

With these measures, the government signals its commitment to supporting SMEs, ensuring that digitalisation efforts move forward without overwhelming smaller businesses.

Rationale: Addressing Pressure and Costs

The government’s decision to raise the e-invoice exemption threshold was a direct response to feedback received from the business community. Small and medium businesses voiced concerns that implementing the e-invoicing system would inevitably “add pressure and costs”. The Cabinet increased the threshold from RM500,000 to RM1 million specifically to ease the operational and financial burden on small businesses.

Prime Minister Anwar Ibrahim acknowledged these grievances, confirming that he “heard them” and that small companies will “no longer be compelled to implement e-invoicing”. The government adjusted the requirement because many SMEs expressed concerns that early adoption would create additional pressure and higher costs. The Cabinet discussed the matter to ensure the rollout is “more realistic, orderly and does not place undue pressure on small businesses still adapting to digital systems”. While small traders receive this e-invoice exemption, the system is still expected to “improve efficiency and professionalism” across major enterprises, which should have no issue adopting it.

Dual Financial Relief: Expediting Tax Refunds

In addition to the updated e-invoice exemption policy, the Prime Minister addressed another significant financial grievance: the slow tax refund process. As an immediate corrective measure, the Federal Government is doubling the allocation for tax refunds. The initial allocation of RM2 billion, set aside to refund businesses and taxpayers for overpaid taxes, has been increased by an additional RM2 billion, bringing the total allocation for tax refunds to RM4 billion. This move was announced in December 2025 and aims at solving “grouses on the ground” and expediting outstanding payments, particularly for small businesses.

The announcement of the elevated e-invoice exemption threshold and the commitment to doubling the tax refund fund signals a clear effort by the government to alleviate specific financial pressures on SMEs. These major announcements concerning the e-invoice exemption and financial relief were delivered by Prime Minister Anwar Ibrahim during the ‘Sentuhan Madani Bersama Rakyat Sabah’ programme held on Saturday, December 6.

Commitment

Anwar emphasized the seriousness of the Federal Government in delivering on promises and addressing pressing issues faced by the people. He stressed that implementation of policies and projects, though sometimes delayed, is a priority.

The announcement of the elevated e invoice exemption threshold and the commitment to doubling the tax refund fund to RM4 billion signals a clear effort by the government to alleviate specific financial pressures on SMEs, ensuring a smoother transition to new systems while addressing current operational bottlenecks.

Future-Proof for 2026 with N3 AI Accounting (formerly QNE AI Cloud Accounting)

The government’s move to raise the e-invoice exemption threshold to RM1 million by 2026 gives SMEs much-needed relief—but digital adoption remains essential for long-term efficiency, compliance, and growth.

N3 AI Accounting (formerly QNE AI Cloud Accounting) empowers MSMEs to modernize their financial processes with smart, automated, and scalable tools built for Malaysia’s tax environment:

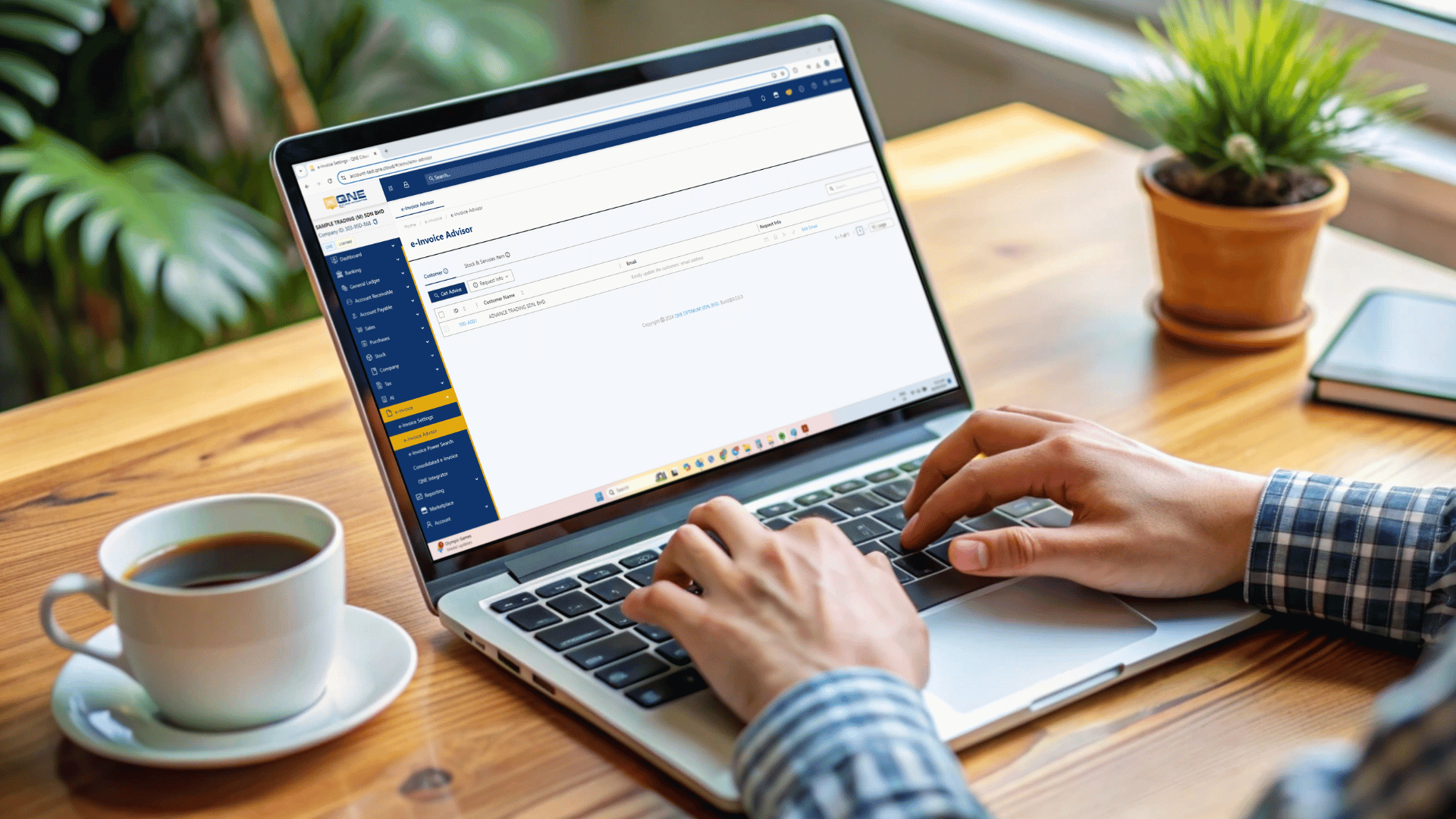

- E-Invoice Ready for Future Compliance: Even if your revenue falls below RM1 million, QNE AI includes the full LHDN e-Invoice Module with validation and MyInvois integration—ensuring smooth transition once your business grows past the threshold.

- Lower Costs with Automation: Reduce the “pressure and costs” of manual work through AI-driven workflows, including automated data entry, invoice creation, AI Auto-Bank Reconciliation, and QuickScan for converting documents into entries.

- Smarter Financial Decisions: With Quinny AI and Qbot AI, get instant insights on cash flow, sales, profits, benchmarks, and performance tips, helping you make faster, data-driven decisions.

- Cloud-Based Collaboration: Access real-time financial data anytime, anywhere, and collaborate securely with clients, accountants, and team members.

N3 AI Accounting (formerly QNE AI Cloud Accounting) is a cost-effective, scalable solution designed to help MSMEs stay compliant, automate operations, and adapt quickly to Malaysia’s evolving tax landscape. Future-proof your finances and eliminate manual work. Whether preparing for e-invoicing or upgrading your accounting processes, N3 AI Accounting (formerly QNE AI Cloud Accounting) is your all-in-one solution.

Frequently Asked Questions (FAQs)

What is the new annual revenue threshold for the e invoice exemption?

Businesses with annual revenue below RM1 million are now exempt from e-invoicing under the updated guideline. This aims to give smaller companies more flexibility and reduce compliance strain.

When will this new e invoice exemption threshold for SMEs take effect?

The exemption for SMEs earning below RM1 million annually will take effect starting January 1, with the new threshold officially applied beginning 2026.

Why did the government decide to raise the e invoice exemption threshold?

The Cabinet increased the threshold from RM500,000 to RM1 million to ease the operational and financial burden on small businesses. Many SMEs expressed concerns that early adoption would create additional pressure and higher costs, prompting the government to adjust the requirement.

What other financial relief measure was announced alongside the e invoice exemption?

To address delays in tax refunds, the government doubled the allocation for tax refunds from RM2 billion to RM4 billion. This aims to speed up refund processing and support small businesses with outstanding claims.

What is the government’s expectation for large companies regarding the e-invoicing system?

While small traders received the exemption, Prime Minister Anwar Ibrahim stressed that large companies should have no issue adopting e-invoicing, as the system is expected to “improve efficiency and professionalism” across major enterprises.