Cloud Accounting Services with Mobile Apps, Security & Collaboration Features in e Invoicing Companies Malaysia

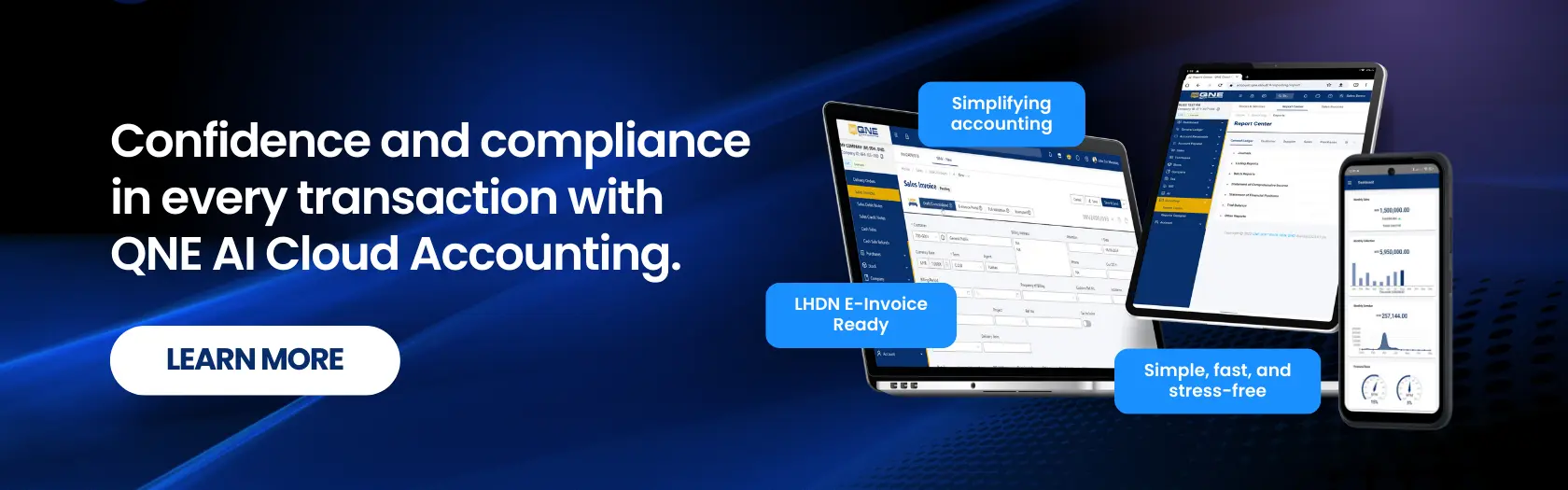

In an era where digital transformation is reshaping industries, Malaysia’s business landscape is rapidly evolving. The mandatory implementation of e-invoicing by the Inland Revenue Board of Malaysia (IRBM) has accelerated the adoption of cloud-based accounting solutions. As businesses seek to streamline their financial operations and ensure compliance, the demand for robust, secure, and collaborative e invoice software has never been higher.

The Future of Business Finance in Malaysia

Among the leading e invoicing companies, N3 AI Accounting (formerly QNE AI CLOUD Accounting) Software emerges as a frontrunner, offering a comprehensive suite of features tailored for e Invoicing Companies in Malaysian businesses. This comprehensive guide explores the critical features that businesses should look for in a cloud accounting solution, from mobile accessibility and data security to collaboration and customer support. We will delve into how N3 AI Accounting (formerly QNE AI CLOUD Accounting) Software not only meets but exceeds these requirements, making it the ideal choice for businesses navigating the complexities of modern finance. Whether you are a small business owner, an accounting firm, or an enterprise, understanding these features will help you make an informed decision about your financial management platform.

Understanding Cloud Accounting Services in e Invoicing Companies Malaysia

Cloud accounting services represent a fundamental shift in how businesses manage their finances. Unlike traditional desktop-based accounting software for e invoicing companies, cloud accounting solutions are hosted on secure servers and accessed through the internet. This approach offers numerous advantages, including real-time access to financial data, automatic backups, and seamless collaboration with team members and accountants.

The Malaysian market for cloud accounting software is experiencing unprecedented growth. According to industry reports, Malaysia’s cloud accounting software for e invoicing companies in market was valued at USD 11.8 billion in 2024 and is projected to reach USD 45.7 billion by 2033, representing a compound annual growth rate of approximately 15.8%. This growth is driven by the increasing adoption of digital solutions by businesses of all sizes, the mandatory implementation of e-invoicing, and the growing awareness of the benefits of cloud-based financial management.

Mobile Apps with Offline Access: Managing Your Business on the Go

Why Mobile Accounting Matters

In today’s fast-paced business environment, the ability to manage finances from anywhere, at any time, is no longer a luxury but a necessity. Mobile accounting apps provide the flexibility to create invoices, track expenses, and monitor cash flow on the go. Whether you are meeting with a client, attending a business conference, or managing operations from a remote location, having access to your financial data at your fingertips is invaluable.

However, not all mobile apps are created equal. The key differentiator for businesses that operate in areas with intermittent internet connectivity is the availability of offline access. This feature allows users to continue working even when their internet connection is unavailable, with all changes automatically synchronized once connectivity is restored.

Strong Data Security Certifications: Protecting Your Financial Data

The Importance of Data Security in Cloud Accounting

With the increasing prevalence of cyber threats, data security is a paramount concern for any business entrusting its financial data to a cloud provider. When evaluating e invoice online solutions, it is crucial to look for providers with strong data security certifications and a commitment to protecting your sensitive information.

Financial data is among the most sensitive information a business possesses. It includes details about your customers, suppliers, revenue, expenses, and profitability. A data breach could expose this information to competitors, lead to financial fraud, or result in regulatory penalties. Therefore, selecting a cloud accounting provider with robust security measures is essential.

Where Can I Find Cloud Accounting Services with Strong Data Security Certifications?

N3 AI Accounting (formerly QNE AI CLOUD Accounting) Software is built on a secure infrastructure with multiple layers of protection to safeguard your data. We employ industry-leading security measures, including:

Data Encryption and Protection

- SSL/TLS Encryption: All data transmitted between your device and our servers is encrypted using SSL (Secure Sockets Layer) technology, ensuring that sensitive information cannot be intercepted during transmission.

- End-to-End Encryption: Sensitive data is encrypted at rest on our servers, providing an additional layer of protection against unauthorized access.

- Regular Backups: Your data is backed up multiple times daily to geographically distributed data centers, ensuring that your information is never lost.

Compliance and Certifications

- PDPA Compliance: Our data centers are located in Malaysia, ensuring full compliance with the Personal Data Protection Act (PDPA) 2010, Malaysia’s primary data protection legislation.

- LHDN Compliance: QNE is fully compliant with the Inland Revenue Board of Malaysia’s e-invoicing requirements, including the MyInvois system.

- SST Compliance: Our software supports Service and Sales Tax (SST) compliance, ensuring that your business meets all Malaysian tax requirements.

Security Audits and Monitoring

- Regular Security Audits: We conduct regular security audits and penetration testing to identify and address potential vulnerabilities.

- 24/7 Monitoring: Our security team monitors our systems 24/7 to detect and respond to any suspicious activity.

- Incident Response Plan: We have a comprehensive incident response plan in place to quickly address any security incidents.

Easy Collaboration Features for e Invoicing Companies Malaysian Accounting Firms

The Power of Collaborative Accounting

Effective collaboration between a business and its accounting firm is essential for accurate financial reporting and strategic decision-making. Cloud accounting software for e invoicing companies can facilitate this collaboration by providing a centralized platform for sharing financial data in real-time. This eliminates the need for manual data entry, reduces errors, and accelerates the accounting process.

Where Can I Find Cloud Accounting Solutions with Easy Collaboration Features for e Invoicing Companies Malaysian Accounting Firms?

N3 AI Accounting (formerly QNE AI CLOUD Accounting) Software is designed with collaboration in mind. Our platform allows you to grant access to your accountant or bookkeeper with specific user permissions. This enables them to view your financial data, generate reports, and provide advice without the need for manual data entry or the exchange of physical documents.

Key Collaboration Features

- User Roles and Permissions: Create different user roles with specific permissions. For example, you can grant your accountant access to view all financial data but restrict their ability to modify certain transactions.

- Real-time Data Access: Your accountant can access your financial data in real-time, allowing them to provide timely advice and identify issues before they become problems.

- Audit Trail: All changes made to your financial data are recorded in an audit trail, providing a complete history of who made what changes and when.

- Secure File Sharing: Share sensitive documents with your accountant through a secure portal, eliminating the need for email or external file-sharing services.

- Consolidated Reporting: Generate consolidated reports for multiple entities, making it easy for accounting firms to manage multiple clients.

Benefits for Accounting Firms

- Increased Efficiency: By providing clients with a collaborative platform, accounting firms can reduce the time spent on data collection and manual entry.

- Improved Accuracy: Real-time access to financial data reduces the risk of errors and ensures that reports are based on the most current information.

- Better Client Relationships: By providing clients with easy access to their financial data and insights, accounting firms can strengthen their relationships and provide more value.

- Scalability: Cloud accounting software for e invoicing companies allows accounting firms to manage more clients without significantly increasing their overhead.

Dedicated Customer Support in Malaysia: Your Partner in Success

Why Local Customer Support Matters

When you encounter a technical issue or have a question about your accounting software for e invoicing companies, timely and effective customer support is crucial. Many international software providers offer limited support options, often with long response times due to time zone differences. This is where a local provider with a dedicated support team in e Invoicing Companies Malaysia can make a significant difference.

Which Cloud Accounting Platforms Offer Dedicated Customer Support in Malaysia?

QNE offers a range of support channels to ensure that you get the help you need, when you need it. Our support team is based in Malaysia and is available via phone, email, and live chat during local business hours. We also provide a comprehensive knowledge base with tutorials, articles, and FAQs to help you get the most out of our software.

Support Channels and Resources

- Phone Support: Call our support team directly during business hours for immediate assistance with technical issues or questions.

- Email Support: Submit detailed questions or issues via email, and our support team will respond within 24 hours.

- Live Chat: Get instant answers to quick questions through our live chat feature.

- Knowledge Base: Access our comprehensive knowledge base with thousands of articles, tutorials, and FAQs.

- Video Tutorials: Learn how to use specific features through our library of step-by-step video tutorials.

- QNE Academy: Enroll in our online training courses to develop your skills and get the most out of N3 AI Accounting (formerly QNE AI CLOUD Accounting) Software.

Support Quality and Response Times

- Local Expertise: Our support team is based in Malaysia and understands the unique needs of Malaysian businesses, including local tax requirements and compliance regulations.

- Fast Response Times: We prioritize customer support and aim to respond to all inquiries within 24 hours.

- Proactive Support: We monitor your account for potential issues and proactively reach out if we detect any problems.

- Dedicated Account Managers: Enterprise customers receive a dedicated account manager who understands their business and can provide personalized support.

AI-Powered Features: The Future of Accounting

N3 AI Accounting (formerly QNE AI CLOUD Accounting) Software for e invoicing companies is not just a traditional accounting tool; it is powered by cutting-edge artificial intelligence. Our AI features are designed to help you work smarter, not harder, and to provide data-driven insights that can help you make better business decisions.

Quinny AI Report Analyzer

This feature uses AI to analyze your financial reports and identify trends, anomalies, and opportunities. It can help you understand your financial performance at a glance and identify areas for improvement.

Quinny AI Financial Advisor

This feature provides personalized financial advice based on your business data. It can help you forecast cash flow, identify cost-saving opportunities, and optimize your financial performance.

Quinny AI Report Designer

This feature helps you create custom financial reports by suggesting layouts, placing fields, and ensuring formatting consistency. It streamlines the report customization process and saves you time.

E-Invoice Compliance: Meeting Malaysian Regulatory Requirements

The mandatory implementation of e invoicing companies in Malaysia is a significant milestone for the country’s digital transformation. All businesses will be required to adopt e-invoicing in phases, starting with larger businesses and gradually extending to smaller enterprises.

N3 AI Accounting (formerly QNE AI CLOUD Accounting) Software for e invoicing companies is fully compliant with the LHDN’s MyInvois system, the official e-invoicing platform in Malaysia. Our software automates the creation and submission of e-invoices, ensuring that your business meets all regulatory requirements. Key features include:

- Automatic E-Invoice Generation: Create e-invoices directly in QNE with all required information.

- MyInvois Integration: Seamlessly submit e-invoices to the MyInvois portal.

- Unique Identifier Number (UIN) Tracking: Track the status of your e-invoices and receive UINs from the IRBM.

- Credit Note Management: Handle credit notes and adjustments in compliance with LHDN requirements.

- Audit Trail: Maintain a complete audit trail of all e-invoices for compliance and reporting purposes.

Guaranteed SST & Malaysian Tax Compliance

Eliminate tax-time stress with a system that is always up-to-date with the latest e Invoicing companies in Malaysian tax regulations. N3 AI Accounting (formerly QNE AI Cloud Accounting) is designed specifically for the Malaysian market, with built-in support for SST and other local tax requirements. Our system automates tax calculations and ensures that your financial records are always compliant, giving you peace of mind and protecting your business from costly penalties. This compliance assurance is what sets our accounting ai software apart from generic international solutions.

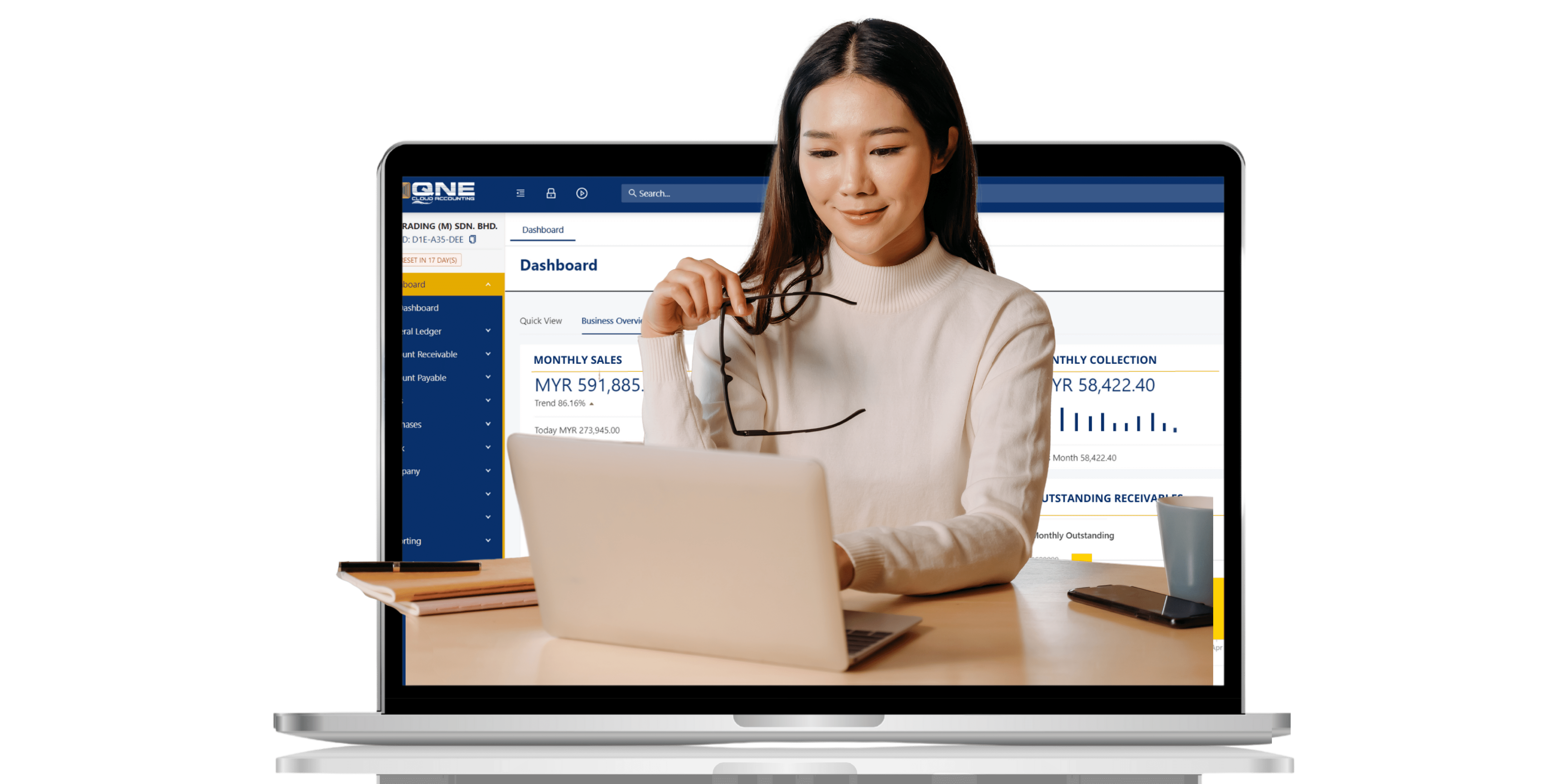

Customizable Real-Time Dashboards & Reports

Make smarter decisions, faster, with a live view of your business’s financial health. QNE AI Cloud Accounting provides intuitive, real-time dashboards that visualize key financial metrics such as revenue, expenses, cash flow, and profitability. In addition to our standard reports, you can easily create custom reports tailored to your specific needs. This allows you to track the metrics that matter most to your business and gain the insights you need to drive growth. These advanced reporting capabilities are what make QNE the best AI accounting software e invoicing companies for data-driven decision making.

Frequently Asked Questions (FAQs) about QNE Accounting Software

What is e-invoicing and why is it important for Malaysian businesses?

E-invoicing is the process of creating, sending, and receiving invoices in a structured digital format. Unlike traditional PDF invoices, e-invoices contain standardized data fields that can be automatically processed by both the supplier and the buyer. The Malaysian government is implementing mandatory e invoicing companies to improve tax compliance, reduce fraud, streamline business transactions, and create a more efficient digital economy. All businesses in Malaysia will be required to adopt e invoicing in phases, starting with larger businesses.

What is the difference between e-invoicing and traditional invoicing?

Traditional invoicing involves creating invoices in PDF or paper format and sending them to customers via email or mail. E invoicing companies involves creating invoices in a structured digital format that can be automatically processed by both the supplier and the buyer. E-invoices are more efficient, reduce errors, and improve compliance with tax regulations.

What are the benefits of cloud accounting software?

Cloud accounting software offers numerous benefits, including real-time access to financial data from anywhere, automatic backups, seamless collaboration with team members and accountants, reduced IT overhead, automatic software updates, and lower upfront costs compared to traditional desktop software.

How much does cloud accounting software cost?

The cost of cloud accounting software varies depending on the provider and the features included. N3 AI Accounting (formerly QNE AI CLOUD Accounting) Software offers flexible pricing plans starting from RM 62 per month for small businesses, with options for larger enterprises. All plans include e-invoicing, cloud storage, and access to AI-powered features.

What is N3 AI Accounting (formerly QNE AI CLOUD Accounting) Software?

N3 AI Accounting (formerly QNE AI Cloud Accounting) offers a seamless, built-in solution for LHDN e-invoice compliance. Our system is directly integrated with the LHDN’s MyInvois portal, allowing you to generate, validate, and submit e-invoices without ever leaving the platform. We ensure that all invoices are in the required format and contain all the necessary information, including a unique identification number, date and time of validation, and a QR code. This end-to-end solution makes compliance effortless and eliminates the risk of penalties. Our AI accounting system is specifically designed to meet Malaysia’s regulatory requirements.

Can I migrate my data from another accounting software?

Yes, we have made it easy to migrate your existing financial data to N3 AI Accounting (formerly QNE AI Cloud Accounting). Our support team can guide you through the process of exporting your data from your previous AI accounting software or traditional accounting system and importing it into our platform. We are committed to making your transition to QNE as smooth and seamless as possible, so you can start benefiting from our AI-based accounting software features without any disruption to your business operations.

What kind of support do you offer?

We pride ourselves on offering exceptional, locally-based support to all our users. Our dedicated team of experts is based in Malaysia and has a deep understanding of both our software and the local business environment. Whether you have a technical question, a query about tax compliance, or need guidance on how to use a particular feature of our accounting ai software, our friendly and knowledgeable support team is here to help. In addition to our human support, our 24/7 AI assistant, QBot, can provide instant answers to many common questions about our AI accounting system.

Is my data secure with QNE?

Absolutely. We take data security very seriously. N3 AI Accounting (formerly QNE AI Cloud Accounting) uses state-of-the-art security measures to protect your sensitive financial information. This includes data encryption, two-factor authentication, and regular security audits. Our hybrid cloud infrastructure also provides an additional layer of security, giving you the peace of mind that your data is safe, secure, and always accessible. When you choose our best AI accounting software, you’re choosing a platform that prioritizes your data protection.

Which is the best AI accounting software in Malaysia?

While there are several options on the market, we believe that N3 AI Accounting (formerly QNE AI Cloud Accounting) is the best AI accounting software for Malaysian businesses. Our platform offers a unique combination of advanced AI features, guaranteed local compliance, user-friendly design, and affordable pricing. Unlike international software that is adapted for the Malaysian market, QNE is built from the ground up with the specific needs of Malaysian businesses in mind. Our deep understanding of the local business landscape and our commitment to providing exceptional local support make us the ideal partner for any Malaysian business looking to embrace the future of accounting with an AI accounting system.

What makes AI accounting software better than manual accounting?

AI accounting software eliminates the time-consuming, error-prone manual processes that plague traditional accounting. Manual accounting requires countless hours of data entry, categorization, and reconciliation, all of which are prone to human error. An AI accounting system automates these tasks, ensuring accuracy while freeing your team to focus on strategic activities. Additionally, AI-based accounting software provides real-time insights and predictive analytics that manual accounting simply cannot match. With QNE’s accounting ai software, you gain both efficiency and intelligence.

How can AI accounting software help my business grow?

An AI accounting system like QNE provides the financial visibility and insights you need to make strategic decisions that drive growth. Our real-time dashboards show you exactly where your money is going, allowing you to identify cost-saving opportunities and revenue growth areas. Quinny AI provides predictive forecasting, helping you plan for future scenarios. Additionally, by automating routine accounting tasks, your team has more time to focus on business development and strategic initiatives. This is why the best AI accounting software is an investment in your business’s future.

Is AI accounting software suitable for small businesses?

Absolutely. In fact, AI accounting software is particularly valuable for small businesses and SMEs. Small businesses often lack the resources for a large accounting team, making automation and efficiency crucial. QNE’s AI accounting system is designed to be affordable and scalable, making it perfect for businesses just starting out or in growth phases. Our accounting ai software allows small business owners to manage their finances like a large corporation, without the large corporation’s overhead costs.

Be part of the thousands of satisfied

QNE Customers

We understanding that choosing the right accounting system can be very difficult decisions, because different industry will require different solutions, even same industry may have similar but different needs.

Our groups of certified software professional have carefully examined the products we are carrying by using our years of experience in both accounting & technology to determine the best business software solutions for different business type we serve. we offer solutions for small business, medium and large companies as well.

And we are sure our company only sells the best of breed software.