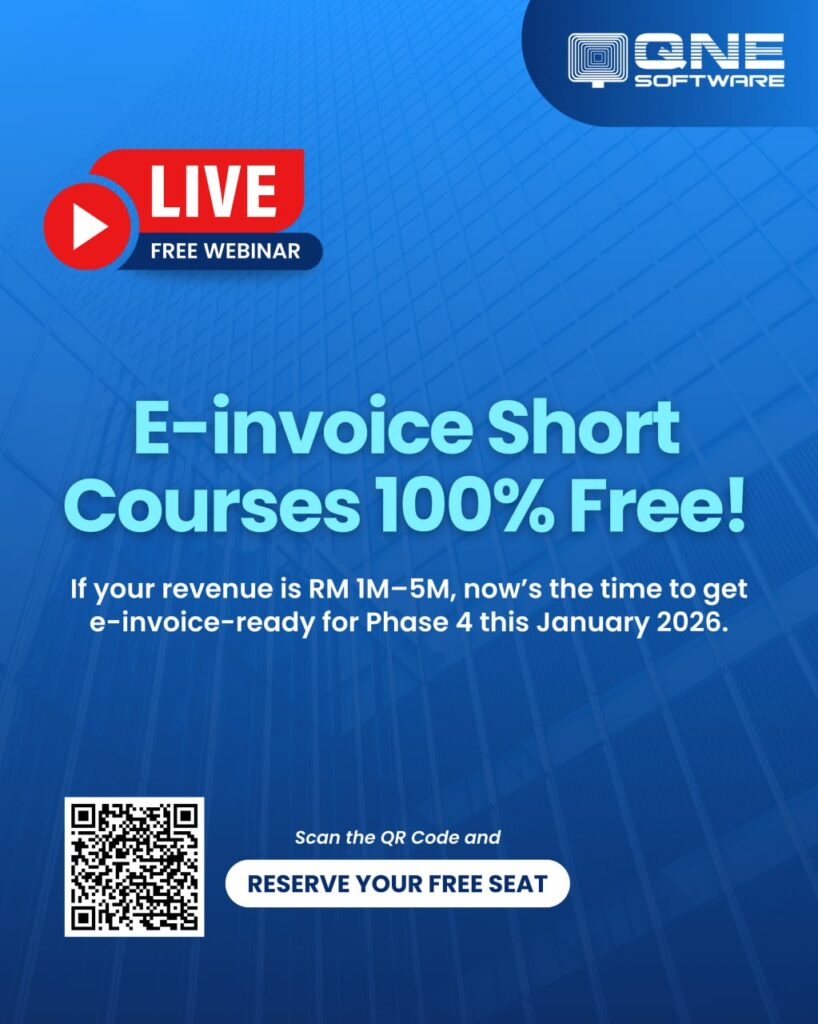

E-INVOICE FREE WEBINARS (6-PART SERIES)

First Session: 29 December 2025

Online | FREE

LHDN has updated the e-Invoice mandate with the final phase starting in 2026, including an RM1 million exemption threshold — but compliance is still critical if your business exceeds RM1M or your records aren’t pristine.

Why Attend These Free Webinars

Most SMEs don’t fail e-Invoicing because they ignore it —

they fail because they think they’re doing it right.

Common issues we see include:

- Incorrect timing of e-Invoice submission

- Validation failures with MyInvois

- Missing or incomplete required fields

- Rejections that slow down operations

- Manual or inefficient workflows

Penalties for non-compliance can range from RM200 to RM20,000 per offence — and errors can add up fast

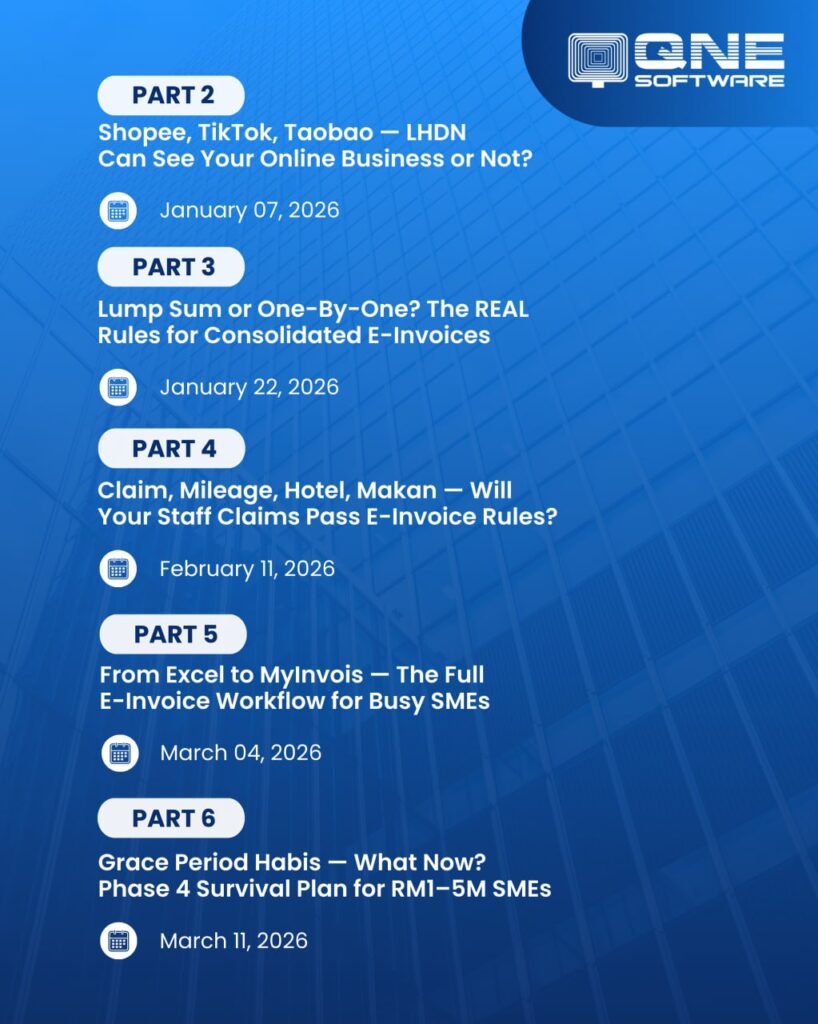

What the 6-Part E-Invoice Webinar Series Covers

Our webinars are designed for real Malaysian business scenarios and real compliance checks — whether you’re just starting or already issuing e-Invoices:

- Understanding e-Invoicing Requirements — What LHDN expects and why it matters

- Timing & Submission Best Practices — Avoid common pitfalls

- Required Fields & Validation Rules — Get it right the first time

- How LHDN Rejects & Re-Validates — Case studies from real business examples

- Efficient Workflow Strategies — Automate and streamline your process

- Q&A with Experts — Bring your specific questions

Prepare properly. Stay compliant. Sleep better.

Who Should Attend

- SME Owners & Business Leaders

- Accountants, Finance Managers & Tax Professionals

- Bookkeepers & Finance Teams

- Any business that issues or plans to issue e-Invoices

Whether you’re just planning your e-Invoice setup or fine-tuning your workflows, these webinars offer actionable guidance you can implement immediately.

Why You Can’t Miss This

Understand how the RM1M exemption works and its limits

Learn practical steps to avoid validation rejection and penalties

Build workflows that save time, reduce errors, and improve cash flow

Ask questions directly to compliance and accounting subject-matter experts