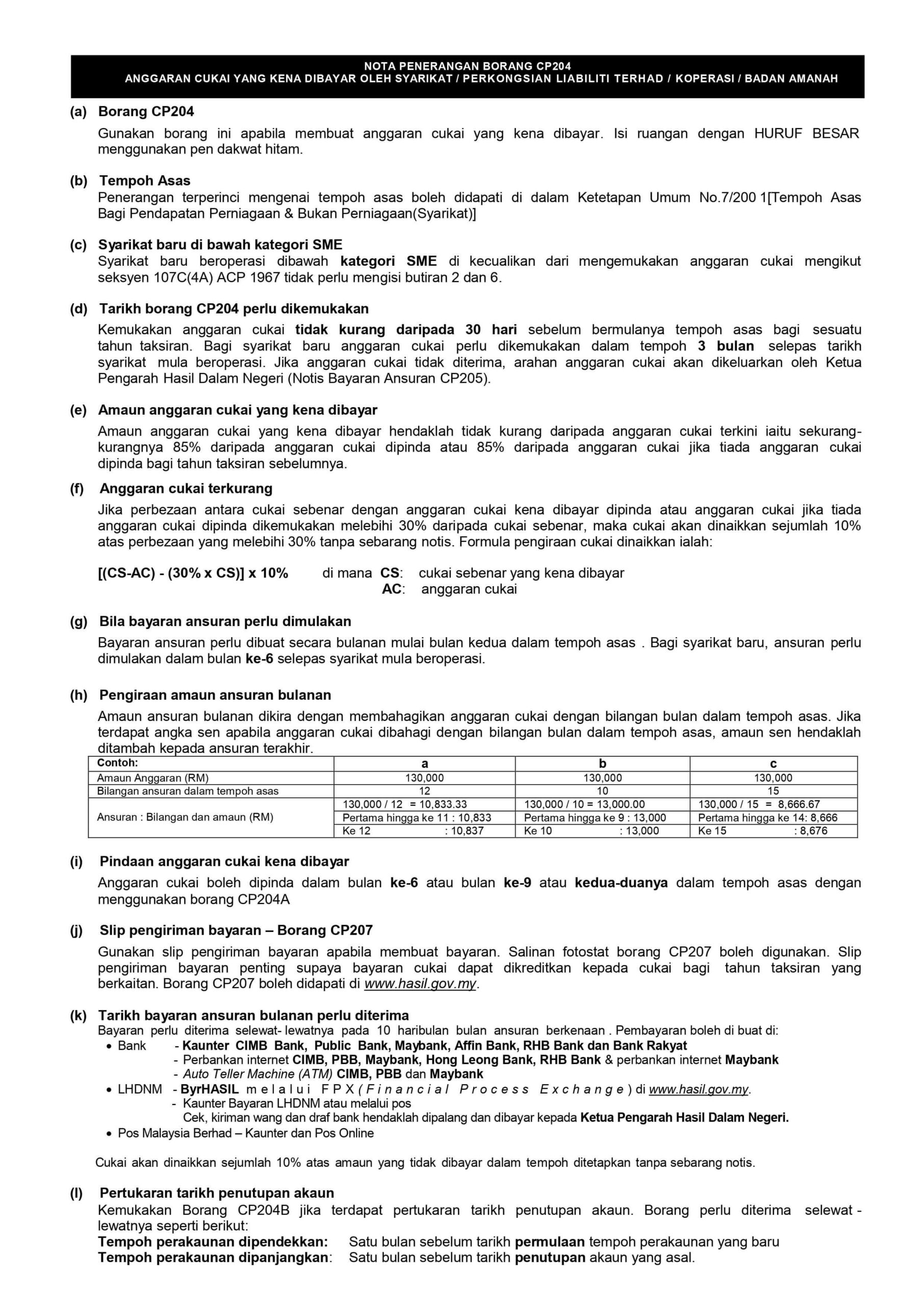

CP204 FORM is the prescribed form used for filing a tax assessment in Malaysia, as mandated under section 107C of the Malaysian Income Tax Act 1967. If a company is starting operations for the first time, the assessment must be filed with the IRB within 3 months from the commencement date of operations, but not earlier than 30 days before the start of the base period. The initial filing requires the submission of the CP204 FORM, while the verification of the initial filing utilizes the CP204A FORM.

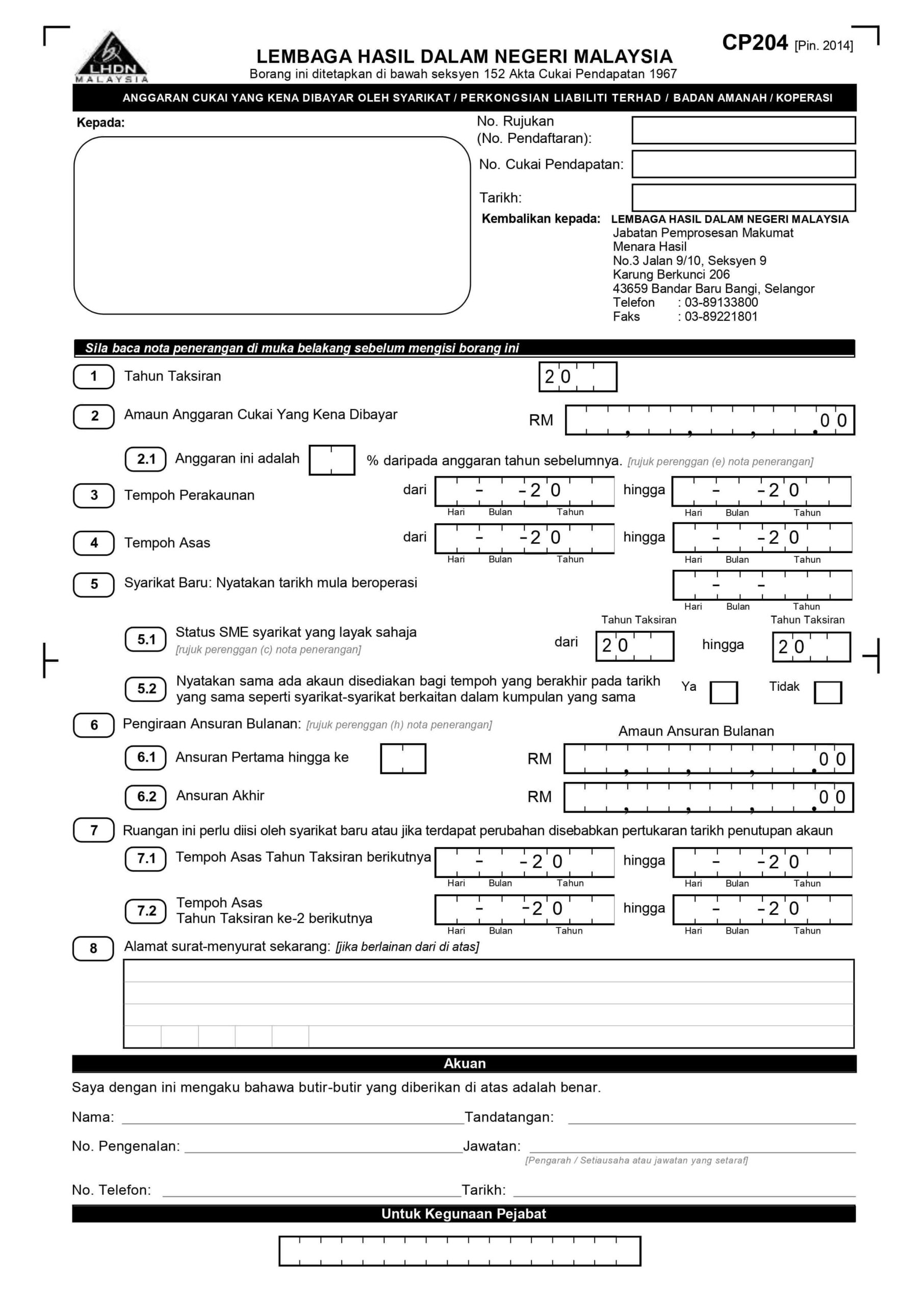

Example of CP204 Form

How to Register Tax Estimation File?

You can register online for submitting tax estimation. You can apply for a tax number at the nearest office at the company’s correspondence address or at any IRBM office convenient to you, without reference to the company’s correspondence address. After registration, you must send the e-CP 204 for tax estimation within 3 months from the date of starting the business. For new companies, instalments must be paid starting from the 6th month of the base period from the start of the operation. CP204 form must be filed within 7 months of the close of the reporting period, which is the base period for the year of the assessment.

Find out how you can handle this process in the 30 days FREE TRIAL of AI CLOUD ACCOUNTING SOFTWARE

How can a company apply for its tax from IRBM?

If the Company requires a tax statement, the Company can obtain it by calling or writing to IRBM’s Tax Collection.

Submission deadline for CP 204 + Monthly Instalments as per Form CP 204

How are Borang CP38 deduction shown on the EA Form?

- SMEs are not required to provide tax estimation or make payments in instalments within 2 years, starting from the year of the estimate in which the SME begins operations.

- The monthly payment of the calculated tax is paid no later than the 15th day of each month.

LHDN’s statement via letter on CP204 form for SMEs

LHDN has made statements on the above for all companies to submit their tax payable estimate via CP204 Form, notifying LHDN of their status as a zero tax payable SME to avoid any possible unnecessary penalties due to administrative issues, even if they are companies not to require to file CP204 form.

If a Section 107C fine is imposed, or if a Section 120 Notice of Litigation is sent to SMEs, you may contact the LHDN branch where the company’s tax returns are kept for an exemption from the fine.

Penalties related to the assessment of tax payable

How are Borang CP38 deduction shown on the EA Form?

- Failure to submit tax estimation liability, Form CP 204 – will be subject to a fine of RM200 to RM2,000, or imprisonment, or both.

- Failure to pay the monthly tax estimation by the 15th of the month, a 10% penalty will be imposed on the balance of the tax payment not paid for the month.

- If the difference between the tax actually payable and the estimated tax payable is more than 30%, a penalty of 10% will be imposed on this difference

- If CP204 form is not provided but the Company has tax payable, the final tax payable must be increased without any further notice by 10% and this amount is refundable as if it were payable under the Income Tax Act.

Find out how you can handle this process in the 30 days FREE TRIAL of AI CLOUD ACCOUNTING SOFTWARE

Digitize Your Software & Build Your Smart Business Today.

Enjoy 30 Days Free Trial of N3 AI Accounting (formerly QNE AI Cloud Accounting) Software, your #1 AI Cloud Accounting Solution in Southeast Asia.