The Form CP500 is issued by LHDN if a taxpayer has income other than employment—such as business, rental, or royalties—that was reported in previous years. This important tax form notifies the taxpayer to make six scheduled bi-monthly installment payments for the next taxable period, with the exact payment dates clearly stated in the official notice (CP500 Payment).

Watch Form CP500 LHDN | CP500 Payment on YouTube

Form CP500 LHDN Installment Scheme

- Form CP500 LHDN is a tax installment scheme for a taxpayer that has income other than employment income such as business income, rental income and royalties.

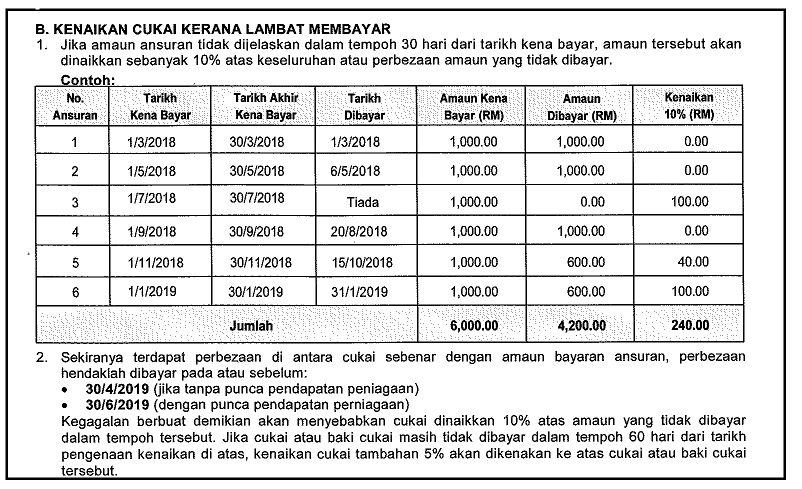

- Form CP500 Payment should be made within 30 days from the date payable (Tarikh Kena Bayar).

- Failure to remit the tax installment (if any) by the filing deadline will result in a 10% penalty being imposed on the outstanding balance. The penalties are to be self-assessed and paid to the Malaysian Inland Revenue Board (MIRB).

- For the individual that did not receive the Form CP500 LHDN, they can visit or call LHDN Branch that handles the file or call the Hasil Care Line at 1-800-88-5436.

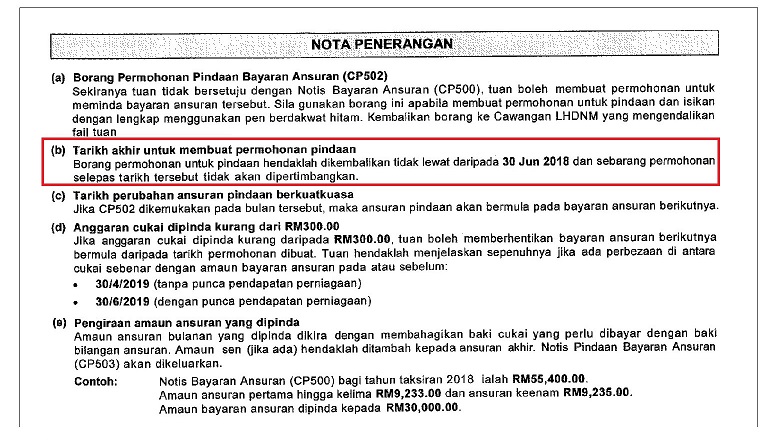

- Form CP500 LHDN can be revised by completing the Form CP502 and send it to the respective LHDN Branch before 30 June for the current year of assessment.

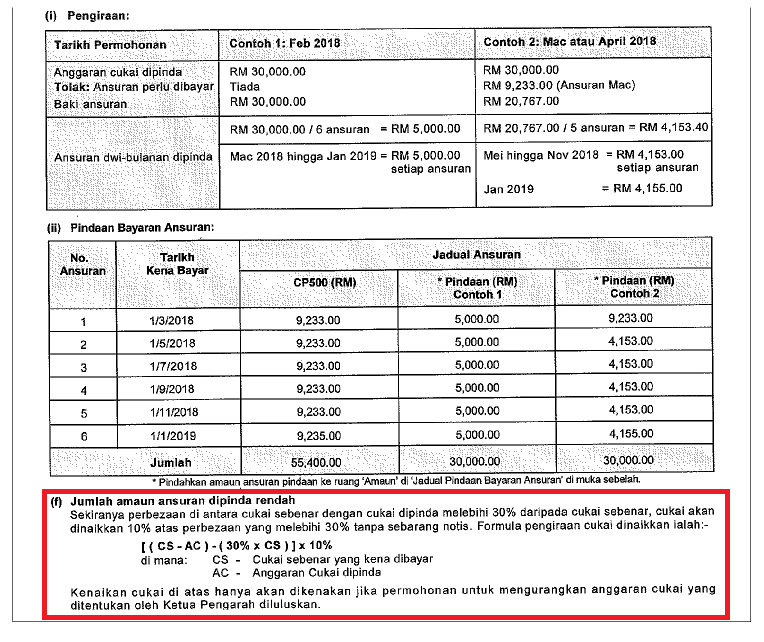

- However, if the revised tax installment (Form CP502 LHDN) is 30% lower than the actual tax payable, the difference will be subject to a penalty of 10%.

- The formula to calculate the amount of tax to be increases is as follows: = [(Actual tax payable – Estimated tax payable) – (30% x Actual tax payable)] x 10%

Who will received?

For those taxpayer having income other than employment such as business, rental and royalties, he/she is required to make a 6 bi-monthly installment payments, commencing from the month of March. The installment dates will be prescribed in the notice of the installments to be paid (CP500 PAYMENT). IRBM will estimate the amount for each installment and notify taxpayers of the given the amount, due date and number of installments the taxpayer have to pay.

When will receive?

In February every year, Form CP500 LHDN will be send out to taxpayer by Inland Revenue Board (IRB).

What is the due date?

CP500 Payment should be made within 30 days from the payable date (Tarikh Kena Bayar).

10% penalty will be imposed on the outstanding balance if taxpayer fail to remit the tax installment (if any) by the filing deadline. The penalties are to be self-assessed and paid to the Malaysian Inland Revenue Board (MIRB).

How can I get it if I don’t receive it?

Taxpayer can visit or call LHDN Branch that handle the file or call the Hasil Care Line at 1-800-88-5436.

Revision of Form CP 500 can be done by completing the Form CP502 and send it to the respective LHDN Branch before 30 June for the current year of assessment.

However, if the revised tax installment (Form CP502) is 30% lower than the actual tax payable, the difference will be subject to a penalty of 10%.

The formula to calculate the amount of tax to be increases is as follows: = [(Actual tax payable – Estimated tax payable) – (30% x Actual tax payable)] x 10%

To find out more about Mr. Patrick Luah, kindly visit PLC Consulting & Solution homepage by clicking on the link below

MR. PATRICK LUAH

PLC Consulting & Solution https://www.plctax.solutions

- Corporate Coach

- Tax Consultant

- Chartered Accountant

- Corporate Secretary

- PSMB/HRDF Trainer

- Vistage Member

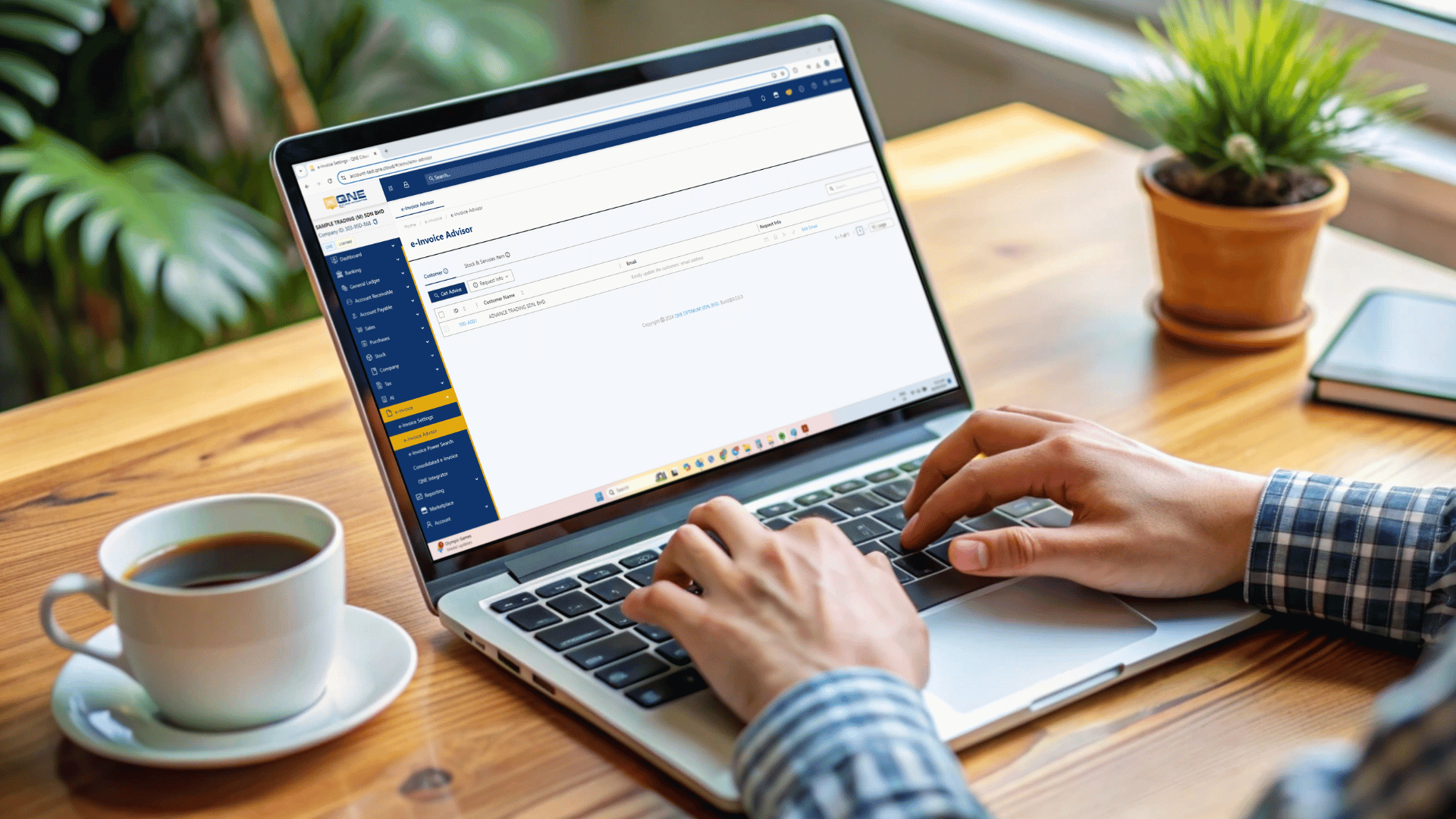

Digitize Your Software & Build Your Smart Business Today. Enjoy 30 Days Free Trial of N3 AI Accounting (formerly QNE AI Cloud Accounting) Software, your #1 AI Cloud Accounting Solution in Southeast Asia.