No Penalties for Phase 4 E-invoicing Non-Compliance in Malaysia in 2026

- Published on

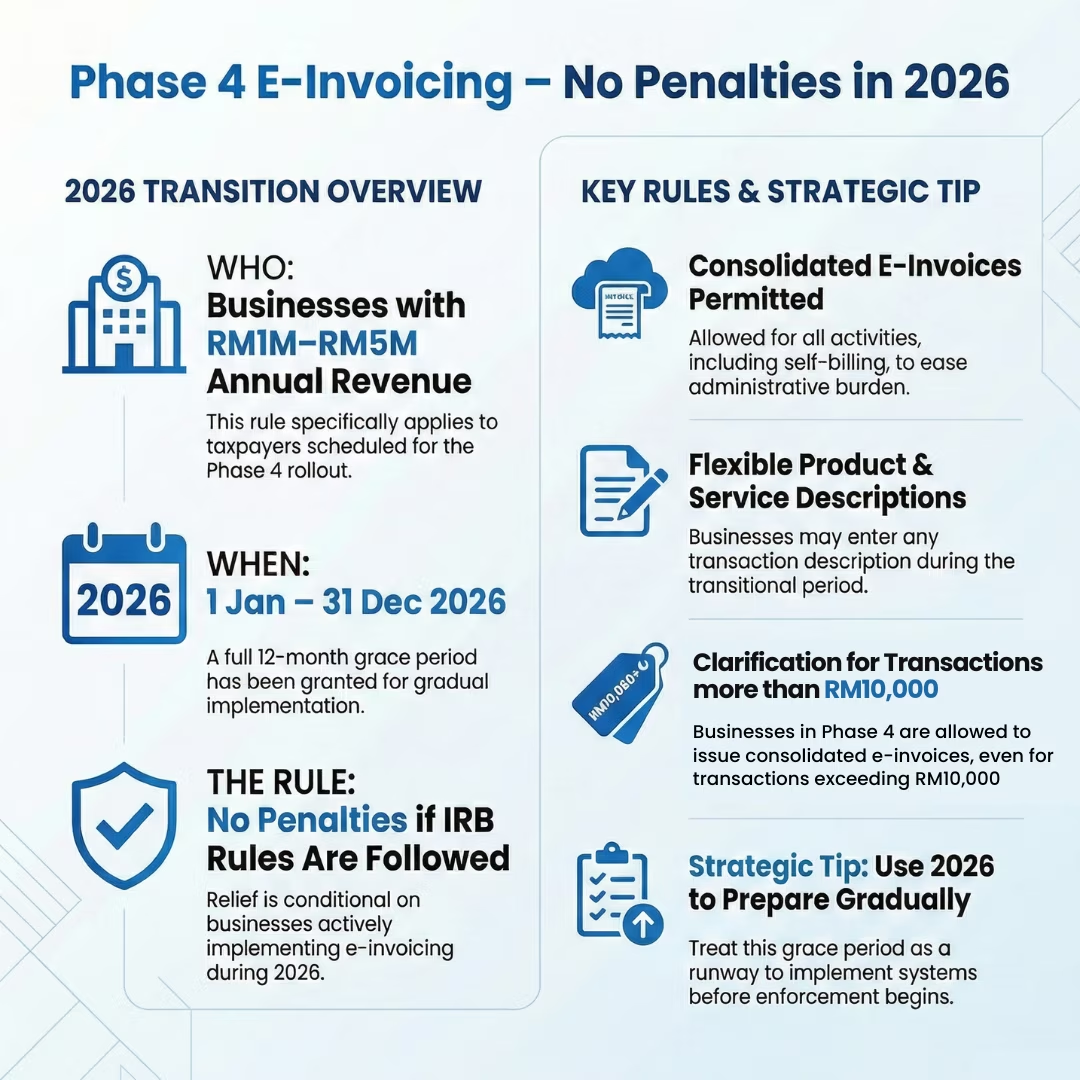

In 2026, there are no penalties for non compliance of e invoicing in Malaysia for Phase 4 taxpayers (businesses with annual revenue between RM1 million and RM5 million), provided they comply with Inland Revenue Board (IRB) transitional regulations.

Crucially, the IRB has clarified that “no penalties” does not mean businesses can avoid implementing e-invoicing; Phase 4 taxpayers are expected to implement e-invoicing from the start of the year and use the extended transitional period to prepare fully.

This development provides a strategic reprieve for eligible MSMEs but sets clear expectations: the relief is intended to give time to prepare and comply, not to defer action indefinitely.

Understanding the IRB's Key Announcements

Is There a Penalty for Non Compliance of e invoicing in Malaysia in 2026?

For Phase 4 businesses (annual revenue RM1 million–RM5 million), no penalties will be imposed from 1 January to 31 December 2026, provided businesses follow the IRB’s transitional rules.

However, the IRB’s leadership emphasised that this penalty relief does not mean businesses can simply skip implementing e-invoicing or delay the process. Even during the interim period, eligible taxpayers must already be implementing e-invoicing in alignment with the law — the grace period only suspends penalties for non-compliance while systems, processes, and workflows are being established.

The Extended Transitional Period

Malaysia’s Phase 4 e-invoicing transitional period has been extended to a full 12 months for taxpayers with annual revenue between RM1 million and RM5 million:

- Duration: 1 January 2026 to 31 December 2026

- Extension: Prime Minister Datuk Seri Anwar Ibrahim confirmed the government’s decision to lengthen the transition from six months to one year.

- Purpose: To allow Phase 4 businesses enough time to implement e-invoicing without facing penalties immediately upon the mandate’s start.

This does not apply to earlier phases; Phase 1–3 timelines and enforcement remain unchanged.

Key E-Invoicing Rules During the Transition

During this extended transitional period, Phase 4 taxpayers may operate under relaxed provisions aimed at easing implementation.

Consolidated E-Invoices Permitted During 2026: Phase 4 businesses may issue consolidated e-invoices for all transactions — including cases where buyers request individual invoices — to ease administrative burden during the transition.

Consolidated Self-Billing E-Invoices Are Also Allowed: Taxpayers may issue consolidated self-billing e-invoices under Section 8.3 of the e-Invoice Specific Guideline.

Flexibility in Product and Service Descriptions: Any transaction description can be used in the Product or Service Description field throughout the transitional period.

Special Clarification for Transactions more than RM10,000: Businesses in Phase 4 are allowed to issue consolidated e-invoices for transactions up to RM10,000, or voluntarily issue individual invoices when buyers request them.

What Non Compliance of e invoicing means for Phase 4 Businesses?

For Phase 4 MSMEs (RM1 Million–RM5 Million Revenue)

For eligible MSMEs, the 2026 transitional period means non compliance of e invoicing will not lead to penalties, provided the IRB’s transitional rules are followed and e-invoicing implementation is underway.

This allows MSMEs to:

- Avoid a rush on vendors and solutions during early 2026

- Conduct proper due diligence on software and workflows

- Build internal capacity and integrate systems gradually

However, the transitional relief is conditional on businesses actively implementing e-invoicing rather than deferring implementation entirely.

pliance of e Invoicing will not result in penalties if IRB rules are followed. It allows them to bypass the initial rush for vendors, conduct thorough due diligence on software solutions, and plan for the cash flow impacts of implementation, thereby mitigating the risk of costly, hasty decisions. This extended timeline helps ensure a smoother adoption process and reduces the immediate stress of compliance, allowing these businesses to adapt at a more manageable pace.

Next Steps: Preparing for Full Compliance

While the grace period offers flexibility, Phase 4 taxpayers should treat it as a runway for proactive implementation — not as a loophole to delay digitising invoicing systems.

Suggested preparation roadmap for Phase 4:

- Q1: Vendor evaluation & selection

- Q2: Process mapping & system integration

- Q3: Staff training & pilot testing

- Q4: Final rollout ahead of post-2026 enforcement

A gap analysis of your order-to-cash cycle will precisely identify which processes must change to achieve compliance well before penalties could begin in 2027.

A Strategic Opportunity for Digital Transition

The IRB’s extended transitional period for Phase 4 (annual revenue RM1 million–RM5 million) is not an invitation to delay e-invoicing implementation — it’s a structured window to prepare your business for full compliance without the immediate pressure of penalties.

Using this period strategically by adopting an IRB-compliant accounting system (like N3 AI Accounting / QNE AI Cloud Accounting) will make e-invoicing seamless and reduce the risk of errors or operational disruption later.

Treat this grace period as a launchpad for readiness, not as a license to postpone action.

Frequently Asked Questions (FAQs)

What are the penalties for non compliance of e Invoicing in Malaysia?

For Phase 4 businesses with annual revenue between RM1 million and RM5 million, the Inland Revenue Board (IRB) has announced that no penalties will be imposed for non compliance of e invoicing from 1 January to 31 December 2026, provided the IRB’s prescribed transitional rules are followed.

This one-year interim relaxation is intended to help Phase 4 businesses, particularly MSMEs, adjust their systems and workflows. However, IRB has clarified that this does not exempt businesses from implementing e-invoicing during 2026; it only suspends penalties while implementation is in progress.

How can I check if my business is compliant with Malaysian e-invoicing regulations?

Phase 4 businesses should review their invoicing processes against the IRB’s e-Invoice Specific Guidelines, including requirements for consolidated invoices, self-billing scenarios, transaction descriptions, and buyer requests for individual e-invoices.

Conducting a gap analysis of the order-to-cash cycle—from sales to invoicing and record-keeping—helps identify what changes are needed before full enforcement resumes after 31 December 2026. Using a cloud-based accounting system with built-in e-invoicing can simplify this assessment, as many compliance checks are system-driven.

Which software solutions help prevent non compliance of e invoicing requirements?

For most Phase 4 businesses, cloud-based accounting systems with IRB-compliant e-invoicing are the most effective solution.

These systems typically:

- Automate e-invoice generation and submission

- Support both consolidated and individual e-invoices

- Maintain proper records and audit trails

- Reduce manual handling and errors

Cloud solutions such as N3 AI Accounting (formerly QNE AI Cloud Accounting) are commonly adopted by Malaysian SMEs to reduce long-term compliance risk and ongoing administrative effort.

How to automate e-invoicing to avoid compliance issues?

Automation can be achieved by implementing an IRB-approved digital or cloud-based invoicing system that handles invoice creation, validation, submission, and record-keeping.

For Phase 4 businesses, the 12-month interim relaxation period in 2026 allows e-invoicing to be phased in gradually—covering vendor selection, system integration, staff training, and pilot testing—so that processes are stable and compliant before penalties apply after the transition period ends.

What are common reasons businesses face non-compliance in Malaysian e-invoicing?

Common reasons include:

- Relying on outdated or manual invoicing processes

- Delaying implementation during the 2026 interim relaxation period

- Using systems that are not fully IRB-compliant

- Insufficient staff training and internal SOPs

- Misunderstanding IRB rules on consolidated invoices and self-billing

Adopting a compliant cloud accounting system and using the 2026 transition period strategically helps Phase 4 businesses address these risks early and avoid future non compliance of e invoicing.