Invoice sample Malaysia is essential for businesses to follow when issuing tax invoices under the SST system. SST (Sales and Service Tax) shall be levied and charged on the taxable supply of goods and services made in the course or furtherance of business in Malaysia by a taxable person.

It is crucial to issue correct and proper Tax Invoice to the customer for companies registered under the SST Malaysia system. It acts as the primary evidence to support an Input Tax Credit claim. It is compulsory to issue a tax invoice showing the amount of SST charged and the price of the supplies separately. This ensures transparency in business transactions and prevents disputes during tax audits or financial reviews.

A professionally formatted invoice helps in maintaining clear records and enhances your brand’s credibility. Moreover, consistent invoicing supports better cash flow tracking and customer trust. You may use a free accounting software Malaysia to generate the sst invoice or refer the sample sst invoice format below.

How Invoice Format Malaysia Affects Taxation Accuracy?

The term invoice format malaysia refers to how your invoice is visually and structurally designed to align with legal expectations. While “format” and “format” may seem interchangeable, businesses searching for layout examples online often use “invoice format malaysia” when browsing templates or regulatory references. A well-planned invoice format malaysia allows businesses to:

- Present SST information clearly

- Minimize calculation errors

- Provide transparency to clients

- Reduce disputes over charges or tax application

For example, if a company uses the wrong invoice format malaysia, they might miss placing the SST registration number in a visible spot — potentially leading to non-compliance.

In addition, poorly structured invoices can create misunderstandings with clients, especially when line items are unclear or when amounts are not itemized properly. Clients may question charges, delay payments, or even reject invoices if information is ambiguous or incomplete. Over time, such issues can impact cash flow and customer satisfaction. This is why structuring invoices with attention to spacing, alignment, and logical flow is more than just a design choice—it’s a functional necessity.

Another critical area impacted by invoice formatting is system automation. When companies rely on automated accounting or ERP platforms, templates must match the software’s data input fields. Any mismatch in structure—such as missing fields, misaligned tables, or inconsistent labeling—can result in processing errors or failed data imports. This is particularly important for businesses managing high volumes of transactions, where manual corrections are not sustainable.

A good invoice structure should also support language consistency and localization. In Malaysia, invoices can be issued in Bahasa Malaysia or English. If your company deals with international clients, including dual-language labels may enhance understanding and reduce confusion, especially when tax authorities in other countries request supporting documents.

Moreover, a compliant format facilitates internal audits. Finance teams can quickly assess whether required fields are filled, if tax amounts are calculated correctly, and whether document versions meet the latest legal standards. This reduces the risk of tax penalties, eases audit preparations, and improves transparency during financial reviews.

Ultimately, investing time into designing a proper structure supports legal accuracy, operational efficiency, and customer trust—all of which are fundamental to a healthy business.

Leveraging Technology for SST Invoice Format Compliance

Accounting systems today are equipped with built-in templates that follow the sst invoice format required by Malaysian tax laws. These templates make it easier to input relevant data like taxable value, SST rate, and total charges. Whether you’re managing service taxes or sales taxes, the sst invoice format built into digital systems helps businesses remain compliant with evolving regulations.

When comparing software options, ensure it provides invoice templates that follow the latest sst invoice format so you don’t need to manually adjust for changes in SST structure. Some platforms even allow you to set automated tax rules, attach supporting documents, or trigger alerts if required fields are left incomplete. These features help minimize human error and reduce reliance on paper-based processes. For growing businesses, scalable digital invoicing tools also support real-time reporting, analytics dashboards, and audit trails—all of which contribute to smoother compliance, better record-keeping, and faster response times when dealing with tax authorities or financial institutions.

Why Choosing the Right Malaysia Invoice Template Makes a Difference?

Every business, whether small or enterprise-scale, benefits from a professionally structured malaysia invoice template. It not only provides a uniform structure across all invoices but also minimizes the risk of missing any key compliance information. Using a downloadable or digital invoice template ensures repeatable accuracy while saving time. Many accounting solutions now provide customizable malaysia invoice template layouts tailored for SST compliance.

In addition, a standardized layout enhances the readability of billing documents for clients and auditors alike. This consistency also streamlines internal reviews, supports faster reconciliation, and ensures that all required transactional information is recorded properly. Having a reliable format simplifies training for new staff, especially in finance and operations, and helps establish strong record-keeping practices.

Beyond compliance, consistent documentation supports business credibility. Clear, organized invoices can help reduce disputes and improve customer relationships. It also plays a role in financial planning, as uniform records make tracking revenue, forecasting trends, and managing cash flow much more efficient. Implementing best practices in invoice preparation is not only a matter of regulation but also an operational advantage that contributes to long-term growth and smoother audit processes. Businesses that invest in consistent systems often find themselves better positioned to scale and adapt to changes in reporting standards or taxation updates.

SST Invoice Format for Sales Tax in Malaysia:

SALES TAX

Issuance of Invoices:

- Mandatory for registered manufacturer who sells taxable goods

- Hard copy or electronically

- Containing prescribed particulars

- National Language or English Language

Credit Notes and Debit Notes:

- Registered Taxable Service Provider is allowed to issue

- Shall make an adjustment in his return

- Shall contain the prescribed particulars

SERVICE TAX

Issuance of Invoices:

- By Registered person who provides any taxable services

- Hard copy or electronically

- Containing prescribed particulars

- National Language or English Language

Credit Notes and Debit Notes:

- Registered Taxable Service Provider is allowed to issue

- Shall make an adjustment in his return

- Shall contain the prescribed particulars

Any person who contravenes above commits an offence

When issuing invoices under the Sales Tax and Service Tax regimes, businesses must strictly follow regulatory guidelines. For Sales Tax, only registered manufacturers dealing in taxable goods are required to issue invoices. These must be in either hard copy or electronic form and should include all officially prescribed particulars. Importantly, the invoice must be written in either the national language or English to ensure clarity for both local and international stakeholders.

For Service Tax, the responsibility lies with registered service providers offering taxable services. Similar to Sales Tax requirements, invoices must be properly formatted, delivered in physical or electronic form, and contain all mandated fields. Language requirements also mirror those of Sales Tax, ensuring consistent communication standards across sectors.

In both systems, Credit Notes and Debit Notes are equally important. These documents allow for financial adjustments due to overcharging, undercharging, or cancellations. The issuer must ensure that adjustments are reflected in tax returns and that all required details are included. Failing to meet these conditions can lead to non-compliance and potential penalties.

By adhering to these structured processes, businesses not only fulfill legal obligations but also establish clear documentation trails that support financial transparency and accountability.

To simplify compliance, many businesses opt to use a customizable template integrated within their accounting software. These templates are often built around the correct invoice formaat malaysia, reducing the risk of omitting essential elements like the SST breakdown or registration number. It’s advisable to cross-check your invoice layout with the official format to avoid penalties or rejections during tax audits. A well-structured template also improves internal workflow, supports consistency across departments, enhances data accuracy, and reduces manual entry errors during high-volume billing cycles for growing businesses with expanding operational demands and responsibilities across multiple divisions or teams.

Why Understanding Malaysia Invoice Requirements Matters?

To stay compliant with local tax regulations, it is vital to understand all Malaysia invoice requirements under SST. Whether you are issuing invoices for goods or services, specific elements must be present. These include:

- Business name and SST registration number

- Invoice number and issuance date

- Customer’s details

- Itemized list of goods/services

- SST rate and amount

- Total invoice value

These details form the basis of a valid invoice format Malaysia businesses can rely on, particularly when subject to SST audits or inspections.

Not all invoices are created equal. The malaysia invoice requirements not only ensure legality but also provide clarity for customers and vendors. Companies using manual templates should periodically review their documents to verify if they align with current sst invoice format standards. Using the wrong structure—like mixing personal and business information or skipping SST tax lines—can result in your invoices being rejected.

How to Use a Malaysia Invoice Template Efficiently?

A pre-designed invoice format malaysia simplifies invoicing and helps standardize formatting. Templates—whether built-in your accounting software or downloaded—ensure you never forget to include the essential data. They also promote a more professional appearance. An editable invoice template Malaysia can include dynamic fields for tax rates, due dates, and totals.

One of the benefits of a standardized invoice template is scalability. As your business grows, having a repeatable process ensures consistency across teams and departments. Whether printed or emailed, your invoices must reflect a professional invoice formaat malaysia, complete with dynamic fields for pricing, taxes, and payment instructions. Most cloud-based solutions today offer editable templates designed to meet malaysia invoice requirements. In addition, adopting digital invoicing tools can streamline approval workflows, reduce paper usage, and improve overall operational efficiency. Automated features like recurring billing and reminders can help businesses manage time better and maintain strong client relationships through timely communications.

Invoice Sample Malaysia: Key Features to Look For:

A proper invoice sample Malaysia typically includes all the required fields in a clean layout. It should reflect the legal SST invoice, including:

- Header: “Tax Invoice” or “SST Invoice” label

- Seller’s and buyer’s details

- Table of items or services with quantities and prices

- Clear breakdown of SST

- Grand total

Having a clear and compliant invoice sample is useful for both training new staff and ensuring operational consistency. Here is where businesses often rely on a reliable invoice sample malaysia to guide them in creating legally compliant tax documents. Instead of designing one from scratch, many companies prefer importing a proven malaysia invoice template from their software’s library, ensuring the output mirrors the correct invoice formaat malaysia.

Common Mistakes in SST Invoice Format

Businesses must avoid the following issues when issuing SST invoices:

- Omitting SST registration number

- Failing to show tax amount separately

- Incomplete item descriptions

- Using wrong invoice dates or duplicate numbers

By following an approved SST invoice, such issues can be easily avoided, ensuring accuracy and legal compliance.

Aside from registration errors, businesses often confuse invoice formaat malaysia layout conventions. For instance, skipping a bilingual format or missing customer identification fields can create disputes. Always verify that your invoice template includes each of the prescribed details in the correct visual arrangement as outlined in the sst invoice checklist.

Additionally, using outdated templates or inconsistent formatting across departments may result in discrepancies during audits. Failure to update templates in accordance with revised tax rates or regulatory changes can lead to complications. Regular internal checks, automated tools, and training sessions can significantly help reduce these risks and maintain proper invoicing discipline.

Digitize Your Software & Build Your Smart Business Today!

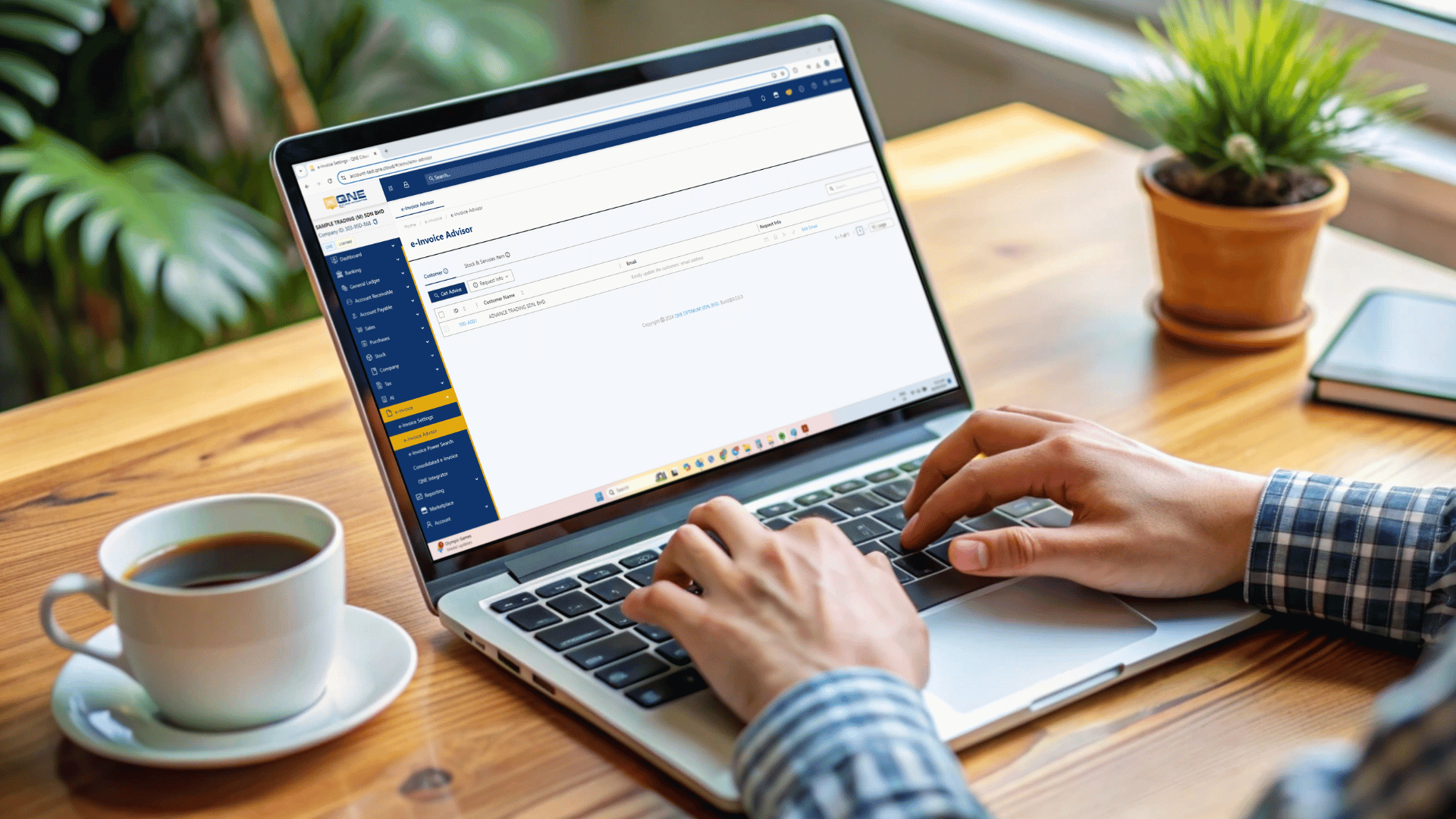

invoice format malaysia Digitizing your invoice process with accounting software reduces manual work and errors. Most modern platforms come with ready-to-use invoice format options and automatically generate compliant SST invoices in just a few simple clicks. This helps ensure your invoice format malaysia includes all mandatory elements for legal and tax compliance. Digital solutions can also alert you when an invoice does not meet requirements. This kind of automation ensures that even newly onboarded staff follow consistent practices. Additionally, choosing software that allows easy updates to your malaysia invoice template ensures you stay compliant when rules evolve.

Digitize Your Software & Build Your Smart Business Today.

Enjoy 30 Days Free Trial of N3 AI Accounting features (formerly QNE AI Cloud Accounting) Software, your #1 Hybrid Cloud Accounting Software & Cloud Payroll Software in Malaysia!