Top 5 Accounting Software Malaysia for 2026

In the rapidly evolving digital economy of Malaysia, finding the right accounting solution for your SME is more critical than ever. With regulatory changes such as the Inland Revenue Board of Malaysia (LHDN) e-Invoicing mandate, increasing adoption of cloud and AI technologies, and growing expectations for seamless integrations, the choice of the right software can make a major difference.

This article walks you through the Top 5 accounting software solutions in Malaysia for 2026, ranked according to a rigorous set of selection criteria. Whether you’re a start-up, a growing local business, or an SME planning expansion, you’ll find a fitting solution here.

Why Choosing the Right Accounting Software Matters?

For many Malaysian businesses, whether you’re a small start-up, a growing SME, or a forward-thinking enterprise, selecting the right one is no longer optional. It’s a strategic foundation for long-term success.

Compliance with LHDN and e-Invoicing Requirements

Malaysia’s tax landscape is evolving, especially with the Lembaga Hasil Dalam Negeri (LHDN) introducing mandatory e-Invoicing. Choosing a software that’s LHDN-compliant ensures your business stays up-to-date with government requirements, minimizing compliance risks and avoiding manual reporting errors.

Cloud Access and Real-Time Control

Modern accounting software allows Malaysian SMEs to work smarter through cloud-based access, mobile apps, and real-time dashboards. You can monitor finances, generate reports, and manage cash flow anytime, anywhere, whether you’re at the office or working remotely.

Integration with Business Workflows

An effective accounting software Malaysia platform should seamlessly connect with your existing workflows, from sales and inventory to bank reconciliation and e-Invoicing.

Without proper integration, you could end up with redundant work, data mismatches, or additional costs for manual adjustments.

Visibility, Control, and Scalability

The right accounting system provides real-time financial insights, enabling better decision-making and long-term planning. As your business grows, scalable ensures you can easily expand operations without overhauling your system.

Beyond Bookkeeping: A Growth Partner

Today’s accounting in Malaysia is not just about tracking income and expenses, it’s about empowering businesses to:

- Automate daily financial tasks

- Generate LHDN-compliant reports effortlessly

- Simplify e-Invoicing processes

- Improve accuracy and decision-making with AI-driven tools

In short, investing in the right accounting software Malaysia solution gives your business a competitive advantage, ensuring compliance, efficiency, and sustainable growth well into 2026 and beyond.

Selection Criteria

Before we dive into the list, here are the criteria we used to evaluate and rank the options, this ensures the ranking is credible, locally focused and fit for Malaysian SMEs.

Strong Malaysian Fit (Localization & Compliance)

The software must support Malaysian accounting standards (MPSAS/MFRS as applicable), SST/GST reporting (where relevant), and integration or readiness for LHDN e-Invoicing (MyInvois) requirements.

AI-Powered Cloud Accessibility

Preference for true cloud platforms with mobility, remote access, and use of AI/automation (e.g., auto-banking feeds, smart categorisation) rather than just legacy desktop.

Recognised Local Presence & Customer Trust

A vendor or partner ecosystem that is established in Malaysia, good testimonials/track record with local SMEs, and local data centre or localised support.

User Experience & Business Accessibility

The interface must be intuitive, suited for non-accountants as well as finance teams, easy onboarding and minimal overhead for SMEs.

Feature Completeness for SMEs

Includes core accounting, accounts payable/receivable, inventory (if needed), payroll/HR integration, multi-currency/branches support as growth demands.

Affordability for SMEs

Pricing (subscription or licence) must make sense for small and medium businesses, with transparent tiers and not just enterprise pricing.

Scalability and Integration Readiness

The product should be able to scale as business grows, integrate with banking, payment gateways, e-commerce platforms, POS, and offer APIs/connectors.

Continuous Development & Local Innovation

The vendor should be actively innovating (cloud upgrades, AI features, local compliance updates) and adapting to Malaysian market changes.

Customer Support & Training

Local support (Malaysia-based), training programmes, partner network, good documentation and user community.

By applying these nine criteria, we aim to present a balanced, Malaysia-appropriate ranking of the top accounting software options for 2026.

Top 5 Accounting Software Malaysia To Look For 2026

1. N3 AI Accounting (formerly QNE AI Cloud Accounting)

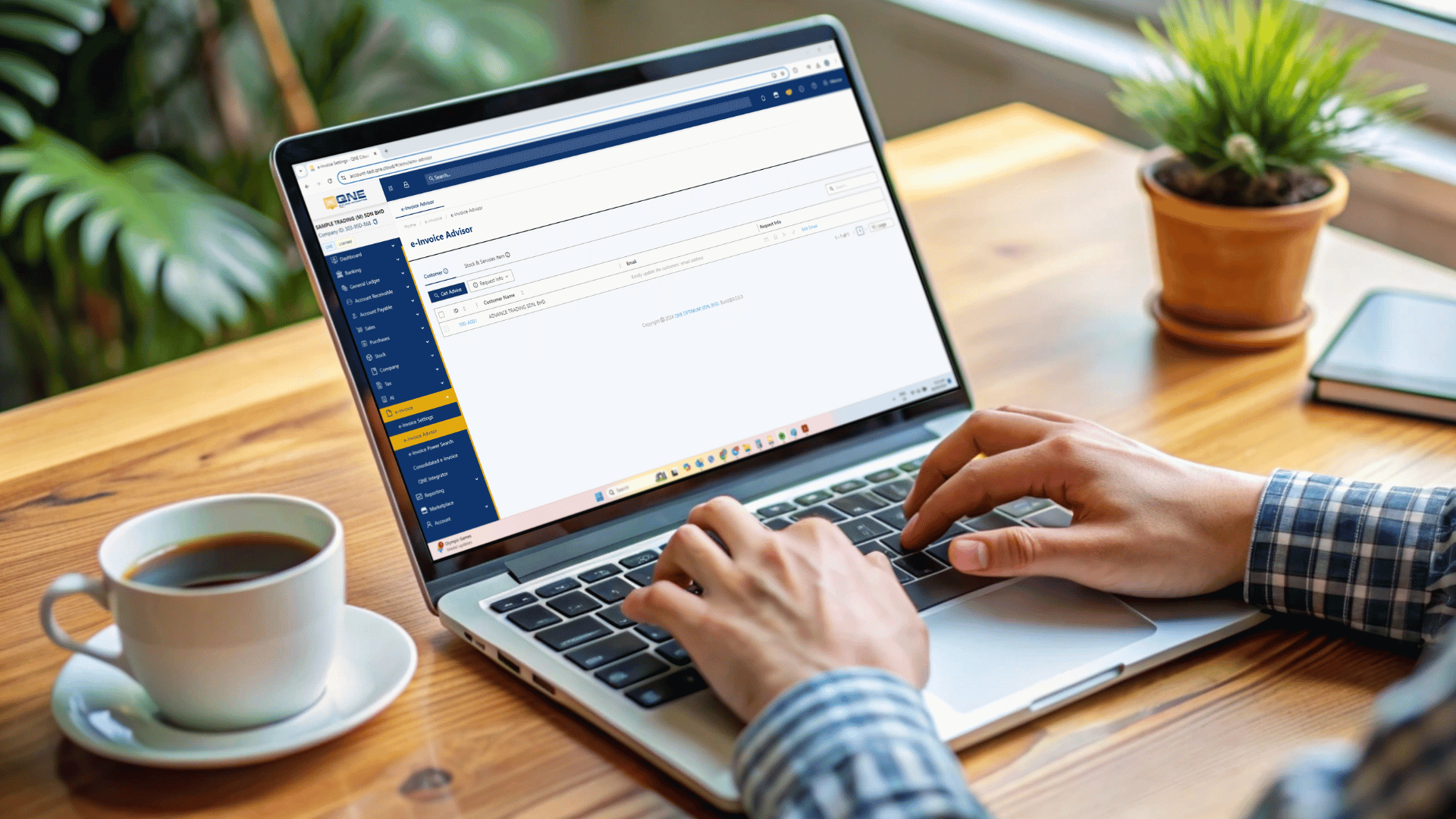

Developed by QNE Software Malaysia Sdn. Bhd., N3 AI Cloud Accounting formerly QNE AI Cloud Accounting is a next-generation, cloud-powered accounting software solution designed specifically for Malaysian SMEs. Known for its LHDN e-Invoicing compliance, AI-driven automation, and intuitive interface, QNE empowers businesses to simplify their finances while staying compliant and future-ready.

Why It Excels Based on the Criteria:

Strong Malaysian Fit (Localization & Compliance)

QNE is fully aligned with Malaysian accounting and tax standards. It supports SST, LHDN e-Invoicing, and local reporting formats, making it a trusted choice for businesses preparing for Malaysia’s digital tax era.

AI-Powered Cloud Accessibility

Built on advanced cloud technology, QNE enables users to securely access and manage their financial data anytime, anywhere. One of its key innovations is Quinny AI, an AI-powered Virtual CFO that provides CFO-level strategic insights and guidance. Quinny AI analyzes financial reports instantly, creates impactful visual summaries, and delivers data-driven recommendations to support smarter business decisions. With its automation and real-time intelligence, Quinny AI helps businesses elevate financial management and stay ahead in today’s fast-paced market.

Recognized Local Presence & Customer Trust

With over 20 years of market experience, QNE has established a strong Malaysian footprint with thousands of clients across industries — proving its reliability and adaptability.

User Experience & Business Accessibility

Its clean dashboard, guided workflows, and customizable templates make accounting straightforward even for non-accountants.

Feature Completeness for SMEs

QNE combines core modules like general ledger, billing, inventory, reporting, and e-Invoicing in one ecosystem.

Affordability for SMEs

Flexible pricing plans make QNE accessible to startups and growing SMEs alike. Businesses pay only for the features they need.

Scalability & Integration Readiness

QNE integrates seamlessly with MyInvois, payroll, POS, and other third-party tools, ensuring scalability as companies expand.

Continuous Development & Local Innovation

QNE actively enhances its platform with AI upgrades and real-time compliance updates, aligning with Malaysia’s digital transformation roadmap.

Customer Support & Training

The company provides localized technical support, webinars, and online resources — offering one of the best after-sales services among Malaysian software providers.

N3 AI Accounting (formerly QNE AI Cloud Accounting) is Malaysia’s top choice for 2026, combining LHDN compliance, AI innovation, and SME affordability. It’s more than software, it’s a strategic business partner for Malaysia’s digital future.

2. AutoCount

AutoCount is one of Malaysia’s most established accounting systems, widely used among SMEs for its comprehensive modules, reliability, and local support. Its hybrid deployment options (desktop and cloud) make it flexible for businesses transitioning into digital accounting.

Why It Excels Based on the Criteria:

Strong Malaysian Fit (Localization & Compliance)

AutoCount is developed in Malaysia and tailored to local accounting practices, supporting SST, multi-language, and LHDN e-Invoicing requirements.

AI-Powered Cloud Accessibility

AutoCount Cloud introduces automation for reporting and data sync, though not as advanced as QNE’s AI suite.

Recognized Local Presence & Customer Trust

A long-standing Malaysian brand, AutoCount is trusted by over 200,000 users across the country.

User Experience & Business Accessibility

The software is user-friendly with a familiar layout, though its desktop version may feel slightly dated compared to newer cloud platforms.

Feature Completeness for SMEs

Covers accounting, inventory, POS, and payroll, making it a one-stop business solution.

Affordability for SMEs

Offers competitive pricing with perpetual licenses, making it a cost-effective choice for smaller firms.

Scalability & Integration Readiness

Supports integration with POS, CRM, and other ERP modules for expanding businesses.

Continuous Development & Local Innovation

AutoCount actively updates its system for LHDN compliance and introduces new features through its AutoCount Cloud 2.0 platform.

Customer Support & Training

Extensive local partner network ensures fast customer assistance and hands-on support.

AutoCount remains a trusted household name in Malaysia’s accounting scene — ideal for SMEs that want robust, LHDN-ready with reliable local support.

3. SQL Account

SQL Account has become a favorite among Malaysian accountants for its powerful features, local adaptability, and budget-friendly pricing. It’s particularly strong in traditional accounting workflows and offers good integration with e-Invoicing and inventory systems.

Why It Excels Based on the Criteria:

Strong Malaysian Fit (Localization & Compliance)

SQL Account is designed for Malaysia’s business environment, featuring SST support, local chart of accounts, and LHDN e-Invoicing compatibility.

AI-Powered Cloud Accessibility

While SQL primarily operates on desktop, its newer cloud extensions offer online access and automation features.

Recognized Local Presence & Customer Trust

SQL has a solid user base among Malaysian SMEs, accountants, and schools for its reliability and ease of training.

User Experience & Business Accessibility

The interface is clean and functional, with a steeper learning curve than QNE or AutoCount for beginners.

Feature Completeness for SMEs

Includes full accounting modules, billing, inventory, multi-location tracking, and customizable reports.

Affordability for SMEs

SQL Account’s licensing structure is among the most affordable in the market.

Scalability & Integration Readiness

Suitable for growing SMEs with add-ons like SQL Payroll and SQL POS, ensuring seamless scalability.

Continuous Development & Local Innovation

SQL continues to modernize its platform and introduce online connectivity features to stay relevant in the digital economy.

Customer Support & Training

Offers excellent in-person training sessions and regional support teams.

SQL Account is a cost-effective, LHDN-compliant solution, ideal for SMEs seeking traditional reliability with evolving cloud options.

4. QuickBooks Online (Malaysia)

QuickBooks Online by Intuit is a global accounting solution trusted by millions worldwide. In Malaysia, it’s popular among startups, freelancers, and service-based SMEs for its clean interface and cloud-first approach.

Why It Excels Based on the Criteria:

Strong Malaysian Fit (Localization & Compliance)

While not built in Malaysia, QuickBooks offers localized tax settings and currency support, though LHDN e-Invoicing integration may require third-party apps.

AI-Powered Cloud Accessibility

QuickBooks excels in automation, from smart categorization to bank feed reconciliation.

Recognized Local Presence & Customer Trust

Supported by Malaysian resellers and accounting firms familiar with its ecosystem.

User Experience & Business Accessibility

Highly intuitive interface, perfect for non-accountants and mobile users.

Feature Completeness for SMEs

Includes invoicing, expense tracking, reporting, and payroll (via integration).

Affordability for SMEs

Subscription-based pricing is higher than local systems but justified by global-grade reliability.

Scalability & Integration Readiness

Integrates seamlessly with 650+ third-party apps including Shopify, PayPal, and HubSpot.

Continuous Development & Local Innovation

Regularly updated with AI-driven features like cash flow forecasting.

Customer Support & Training

24/7 online support, tutorials, and strong community presence.

QuickBooks Online is ideal for Malaysian SMEs seeking international-grade cloud accounting software with strong automation and app integrations.

5. Xero

Xero, a New Zealand-based cloud accounting platform, is known globally for its ease of use and powerful real-time financial tools. In Malaysia, it’s steadily gaining traction among digitally savvy SMEs.

Why It Excels Based on the Criteria:

Strong Malaysian Fit (Localization & Compliance)

Xero supports multi-currency transactions and SST-compliant settings, though LHDN e-Invoicing integration depends on partner apps.

AI-Powered Cloud Accessibility

100% cloud-based, Xero automates bank feeds, reconciliations, and performance insights.

Recognized Local Presence & Customer Trust

Growing presence in Malaysia through official partners and cloud accounting firms.

User Experience & Business Accessibility

One of the most visually appealing and intuitive interfaces among accounting platforms.

Feature Completeness for SMEs

Includes invoicing, inventory, project tracking, and reporting — ideal for service-based and retail businesses.

Affordability for SMEs

Priced slightly above local competitors, but offers high value for cloud-driven users.

Scalability & Integration Readiness

Integrates with 1,000+ third-party apps including payment gateways and CRMs.

Continuous Development & Local Innovation

Frequently enhanced with AI reporting tools and automation updates.

Customer Support & Training

Offers robust online resources, community support, and partner-led training in Malaysia.

Xero stands out as a global cloud accounting software Malaysia users can rely on, best suited for businesses prioritizing mobility, collaboration, and visual simplicity.

Picking the Best Accounting Software Makes a Difference!

Why make the switch now for 2026? Because the regulatory and business environment in Malaysia is rapidly evolving:

- The move toward LHDN e-Invoicing and the MyInvois system is accelerating across industries.

- Cloud-based and remote workflows are becoming the standard — empowering teams to work anytime, anywhere.

- For growing businesses, scalability is essential — you don’t want to outgrow your accounting system within a year or two.

- The Inland Revenue Board of Malaysia (LHDN) is going digital, emphasizing data integration, electronic invoicing, and audit trails — and staying compliant puts your business one step ahead.

Choosing the right accounting software in Malaysia for 2026 is crucial. The regulatory landscape is shifting toward full digitalization, with LHDN’s e-Invoicing implementation becoming the new standard for compliance. Businesses that adopt cloud-based, compliant systems today will be better equipped for tomorrow’s requirements.

A reliable accounting platform doesn’t just help with compliance, it enhances operational efficiency, accuracy, and data-driven decision-making. It’s not just a back-office tool; it’s a growth enabler for every Malaysian business.

Frequently Asked Questions (FAQs)

In Malaysia, N3 AI Accounting (formerly QNE AI Cloud Accounting), AutoCount, and SQL Account are among the most widely used accounting software for SMEs. These systems are trusted for their LHDN e-Invoicing compliance, localization, and ease of use.

Globally, cloud-based platforms like QuickBooks Online and Xero remain popular due to their automation and scalability, but Malaysian businesses often prefer locally developed solutions that align with Malaysia’s tax and business environment.

There are generally four types of accounting software:

- Spreadsheets (e.g., Excel or Google Sheets) – ideal for microbusinesses.

- Commercial Off-the-Shelf Software (e.g., QNE, QuickBooks) – ready-to-use for most SMEs.

- Enterprise Resource Planning (ERP) Systems (e.g., SAP, Oracle) – for large organizations.

Custom-Built Solutions – tailored systems for unique business structures.

Each type differs in cost, scalability, and integration capability

For beginners or small businesses, N3 AI Accounting (formerly QNE AI Cloud Accounting) and AutoCount are among the simplest and most intuitive options. They feature guided setup processes, easy-to-navigate dashboards, and automated reports suited for Malaysian SMEs.

Additionally, QNE’s system is already LHDN e-Invoicing ready, ensuring compliance while simplifying financial management for users with little to no accounting background.

As Malaysia transitions toward full LHDN e-Invoicing adoption, the top accounting software for 2026 will combine automation, compliance, and scalability.

Here are the leading options to consider:

- QNE AI Cloud Accounting – Locally developed, AI-powered, and fully LHDN e-Invoicing compliant.

- AutoCount Accounting Software – Known for GST and LHDN integration, with POS and inventory features.

- SQL Account – A long-time favorite among SMEs, offering localized reports and e-Invoicing readiness.

- QuickBooks Online – Globally recognized with strong multi-currency and cloud access features.

- Xero – Cloud-native, with growing Malaysian integrations and easy mobile access.

These systems lead the market by providing cloud accessibility, local tax compliance, and user-friendly experiences tailored to Malaysian SMEs.

To confirm LHDN compliance, request proof or certification from your accounting software provider. Here’s what to check:

- Ask if the system is LHDN e-Invoicing ready or supports MyInvois integration.

- Request sample LHDN-compliant reports or e-Invoicing output formats (e.g., XML or JSON files).

- Visit the official LHDN e-Invoicing website for updates on accredited or compatible software.

- Ensure your provider regularly updates its system in line with LHDN guidelines and new government regulations.

Choosing a software with continuous updates, such as N3 AI Accounting (formerly QNE AI Cloud Accounting), helps guarantee that your business stays compliant as Malaysia’s digital tax ecosystem evolves.