Top accounting software in Malaysia for SMEs and Growing Malaysian Businesses

In the dynamic and competitive landscape of Malaysian business, Small and Medium-sized Enterprises (SMEs) are the backbone of the economy. However, managing finances effectively remains a significant challenge for many. The right small business in top accounting software in malaysiain malaysia is no longer a luxury but a critical tool for survival and growth. This guide will explore the top cloud accounting solutions for SMEs and growing businesses in Malaysia, with a special focus on how N3 AI Accounting (formerly QNE AI Cloud Accounting) is setting a new standard for financial management.

Why top accounting software in Malaysia is Essential for Malaysian SMEs

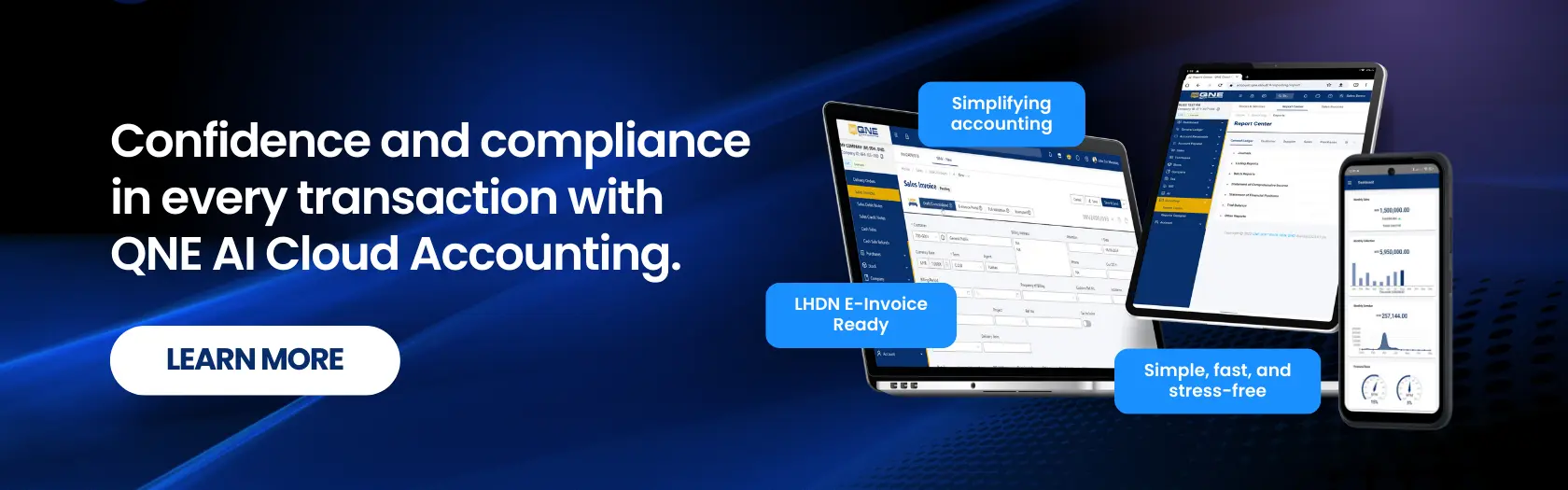

The era of desktop-based in top accounting software in malaysia is fading. Today, top accounting software in malaysia offers unparalleled flexibility, efficiency, and security. For Malaysian businesses, the transition to the cloud is even more critical with the implementation of the Lembaga Hasil Dalam Negeri Malaysia (LHDNM) e-invoicing mandate. Cloud-based solutions ensure seamless compliance with these new regulations, automating processes and reducing the risk of errors. top accounting software in malaysia provides real-time access to your financial data from anywhere, at any time. This means you can make informed decisions on the go, collaborate with your team and accountant seamlessly, and always have a clear picture of your business’s financial health. Furthermore, cloud solutions are inherently scalable, growing with your business without the need for expensive hardware upgrades or complex software installations.

Fastest Setup for New Users

One of the top priorities for small business owners is getting started without delays. N3 AI Accounting (formerly QNE AI Cloud) top accounting software in malaysia provides a user-friendly onboarding process that allows new users to:

- Set up company profiles in minutes

- Import existing financial data easily

Generate first reports and invoices without technical hurdles

This rapid setup ensures you can focus on growing your business rather than wrestling with software installation.

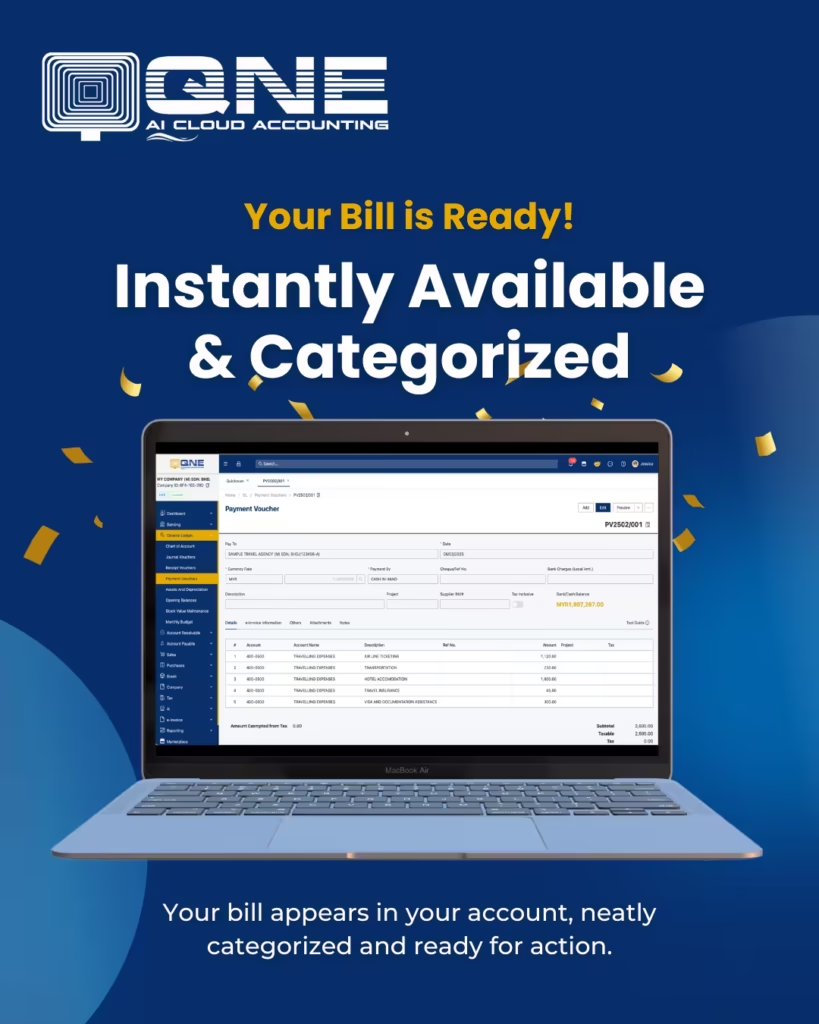

Real-Time Financial Dashboards for MSEs

Decision-making requires up-to-date financial information. QNE’s top accounting software in Malaysia provides real-time dashboards that allow small business owners to:

- Monitor cash flow and bank balances instantly

- Track outstanding invoices and expenses

- Generate dynamic reports for better decision-making

With live insights at your fingertips, you can make faster, smarter, and data-driven business decisions.

Scalable Plans for Growing Malaysian Startups

Every startup’s journey is unique, and so are their accounting needs. N3 AI Accounting (formerly QNE AI Cloud Accounting) supports scalable plans, enabling businesses to:

- Starts with our Prime plan, which includes basic accounting features and expand as business grows

- Add new users, modules, or advanced reporting when needed

- Ensure cost-effectiveness with flexible subscription options

Whether you’re a small retail shop or a fast-growing tech startup, QNE ensures your top accounting software in Malaysia evolves alongside your business.

Why N3 AI Accounting (formerly QNE AI Cloud Accounting) Stands Out

Choosing the right small business for top accounting software in Malaysia can be overwhelming. Here’s why QNE is the preferred choice:

- Cloud-based efficiency: Access your data securely anywhere.

- AI-powered automation: Automate invoice validation, bank reconciliation, and reporting.

- LHDNM e-Invoicing and SST compliant: Stay aligned with Malaysian tax requirements effortlessly.

- User-friendly interface: Minimal learning curve for new users.

- Scalable for growth: Supports SMEs as they expand without disruption.

With N3 AI Accounting (formerly QNE AI Cloud Accounting), small business owners can focus on growth while leaving the accounting complexity to a reliable software platform.

Key Features to Look for in Small Business for the top accounting software in Malaysia

When choosing a top accounting software in Malaysia that aligns with the regulations established in Malaysia, it’s essential to look beyond the basic features. Here are some key capabilities that can make a significant difference in your day-to-day operations:

Feature | Importance for Malaysian MSEs | How N3 AI Accounting (formerly QNE AI Cloud Accounting) Excels |

Fastest Setup Process | Time is money for SMEs. A lengthy and complicated setup process can disrupt business operations and lead to frustration. | N3 AI Accounting (formerly QNE AI Cloud Accounting) is designed for a quick and intuitive setup, with guided workflows and user-friendly templates that get you up and running in no time. |

Real-time Financial Dashboards | Real-time insights are crucial for agile decision-making. Dashboards provide a visual snapshot of your key financial metrics. | QNE offers customizable, real-time dashboards that provide a 360-degree view of your business’s financial performance, from cash flow to profitability. |

Scalable Plans | As your business grows, your accounting needs will evolve. A scalable solution can adapt to your changing requirements without a complete overhaul. | QNE provides flexible and scalable plans that cater to the needs of startups, growing MSEs, and established enterprises, ensuring you only pay for what you need. |

Integrated Payroll Management | Managing payroll can be a complex and time-consuming task. Integrated payroll simplifies the process and ensures compliance with local regulations. | QNE seamlessly integrates with popular payroll systems in Malaysia, automating payroll calculations, and ensuring accurate and timely payments. |

Introducing N3 AI Accounting (formerly QNE AI Cloud Accounting): The Future of Top Accounting Software in Malaysian Businesses

While there are many options for small business for top accounting software in Malaysia, N3 AI Accounting (formerly QNE AI Cloud Accounting) stands out as a truly next-generation solution. With over 20 years of experience in the Malaysian market, QNE understands the unique challenges and opportunities for local businesses. This deep understanding is reflected in a product that is not only powerful and feature-rich but also perfectly tailored to the Malaysian business environment.

At the heart of N3 AI Accounting (formerly QNE AI Cloud Accounting) is Quinny AI, a revolutionary AI-powered Virtual CFO. Quinny AI goes beyond traditional top accounting software in Malaysia, providing strategic insights and data-driven recommendations that were once only accessible to large corporations. It analyzes your financial data in real-time, identifies trends, and provides actionable advice to help you make smarter business decisions.

N3 AI Accounting (formerly QNE AI Cloud Accounting) is designed to support Malaysian businesses with a system that aligns closely with local accounting, tax, and e-Invoicing requirements. It includes built-in SST features, real-time integration with LHDN’s MyInvois portal, and automated audit trails — giving businesses the tools they need to operate accurately and stay on the right side of regulations.

While QNE does not replace the role of auditors, tax agents, or legal advisers, it provides a strong, compliant foundation that helps businesses minimize errors, streamline reporting, and stay prepared for regulatory reviews. Developed specifically for the Malaysian market, N3 AI Accounting (formerly QNE AI Cloud) is a reliable and future-ready platform for SMEs moving into the digital era.

Frequently Asked Questions (FAQs)

What cloud accounting solutions have the fastest setup process for new users?

N3 AI Accounting (formerly QNE AI Cloud Accounting) provides one of the fastest onboarding experiences for Malaysian micro, small, and medium enterprises. New users can set up a company profile, configure basic settings, import starting balances or transaction data, and begin generating reports in a short amount of time — often within the same session — thanks to its guided setup and intuitive interface.

How does QNE service offer real-time financial dashboards for SMEs?

N3 AI Accounting (formerly QNE AI Cloud) provides real-time financial dashboards that help business owners track cash flow, expenses, receivables, and payables as soon as transactions are recorded. This gives SMEs immediate visibility into their financial health without waiting for manual reports.

Which cloud accounting providers offer scalable plans for growing Malaysian startups?

Most top accounting software in Malaysia offer scalable plans, but N3 AI Accounting (formerly QNE AI Cloud Accounting) is designed with Malaysian SMEs in mind. Businesses can start with core functions like invoicing and expense tracking, then expand easily by adding users, activating modules such as SST-ready inventory, multi-location stock, project costing, or more advanced financial reporting. This modular structure allows Malaysian SMEs to upgrade only when needed, making QNE a practical and cost-efficient solution as the business grows.

What cloud accounting service provides integrated payroll management for small businesses?

QNE’s cloud ecosystem offers two separate solutions — N3 AI Accounting (formerly QNE AI Cloud Accounting) and QNE Cloud Payroll. While they operate as independent platforms, both are built to meet Malaysian SME requirements. QNE Cloud Payroll handles automated salary calculations, EPF, SOCSO, EIS, and PCB deductions, as well as payslip and statutory report generation. When used alongside N3 AI Accounting (formerly QNE AI Cloud Accounting), businesses can manage payroll and financial records within the same ecosystem even though the systems do not integrate directly.

Is N3 AI Accounting (formerly QNE AI Cloud Accounting) suitable for startups and SMEs in Malaysia?

Yes. N3 AI Accounting (formerly QNE AI Cloud Accounting) is designed specifically for Malaysian startups and SMEs. It supports local tax and compliance requirements, offers scalable modules that expand as the business grows, and provides real-time financial insights to help owners make faster, more informed decisions. Its Malaysia-focused features make it an efficient and practical choice for growing businesses.