TRANSITION GUIDE TO THE CHANGES IN THE SERVICE TAX RATE FROM 6% to 8% (SST 2024)

Changes in the service tax rate or SST from 6% to 8% in 2024 have significant implications for Malaysian businesses. Understanding how and when to apply the correct tax rate is crucial for accurate billing and full compliance with SST regulations. This blog will guide you through the updated rules issued by the Royal Malaysian Customs Department (RMCD), focusing on taxable services and transitional scenarios.

General Concepts of Changes in Tax Rate (Taxable Services Provided)

As part of Malaysia’s continuous efforts to ensure efficient tax administration and clarity in transitional periods, understanding how the Service Tax rate applies to taxable services is crucial. Businesses, especially those in service industries, need to understand how to navigate changes in tax rates to ensure compliance and accurate billing.

This guide will walk you through the essential principles laid out by the Royal Malaysian Customs Department (RMCD), especially as the SST 2024 updates take effect. It’s essential for every business owner to familiarize themselves with the structure and timeline of SST 2024 to avoid future tax issues.

Determining the Applicable Tax Rate

- The determination of the service tax rate for taxable services provided shall be based on the date the service is provided.

- In the event that taxable services are provided in full before the effective date of the tax rate change, taxable services are charged at the old rate.

- In case the taxable service is fully provided on/after the effective date of the tax rate change, the taxable service is charged at the new rate.

- In the event that taxable services are provided before the effective date of the tax rate change and beyond the effective date of the tax rate change, the service tax rate shall be apportioned as follows:

a) taxable services provided before the effective date of the tax rate change are subject to service tax at the old rate; and

b) taxable services provided on/after the effective date of the tax rate change are subject to service tax at the new rate.

This means that businesses must be mindful not just of invoicing and payment schedules, but also of when the actual service is delivered. The key factor in determining the tax rate is the date of service provision, not merely the administrative details of payment or invoice issuance. For smooth compliance, businesses should integrate SST 2024 tax settings into their billing systems ahead of time.

For example, if a cleaning company performs a full-service session on February 28, 2024, and the new tax rate applies starting March 1, then the old tax rate applies regardless of whether the customer pays on March 2.

However, for services that span across February and March, such as a project-based service or recurring consultation, the service provider must calculate the portion of the service provided before and after the rate change. This requires a careful breakdown of service timelines, ensuring the correct SST rate is applied for each respective portion.

This approach helps businesses avoid common errors, especially during transitional periods. It’s also advisable for service providers to keep proper documentation to justify how the split in service dates was determined.

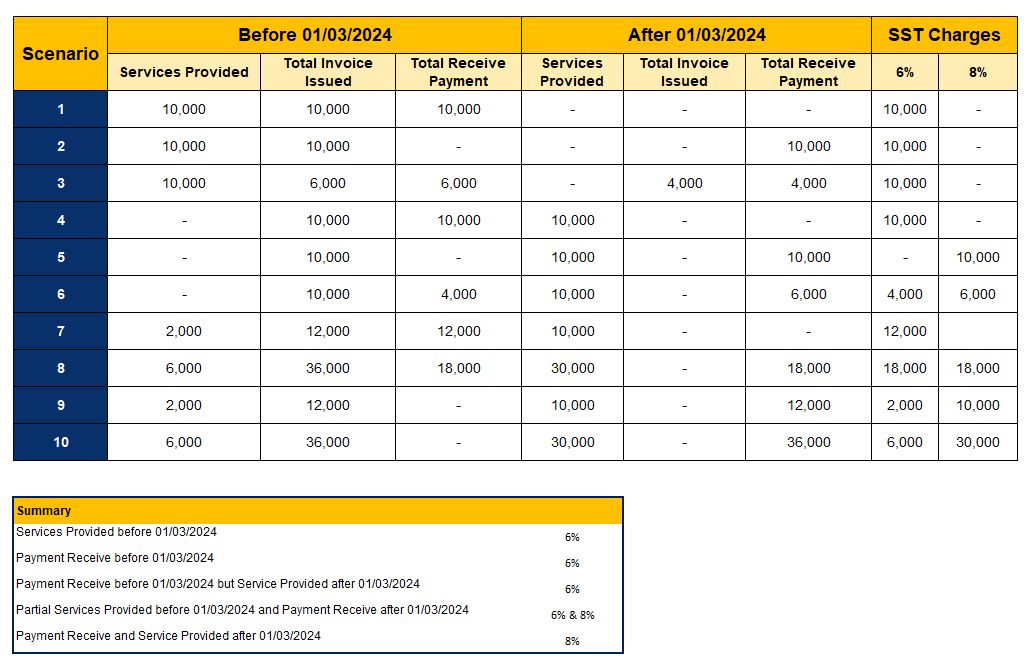

Sample Scenario for SST 2024 Update

To better visualize this, let’s say your business offers technical support from February 25 to March 5. Since the service is delivered across the change period:

February 25–29 will follow the old rate

March 1–5 will be taxed at the new rate

This apportionment ensures accuracy and compliance with RMCD’s latest transition rules. Businesses are encouraged to review each invoice during this period carefully to ensure the correct SST 2024 tax rate is applied to the corresponding service date.

Read this article to know more about this update:

PANDUAN PERALIHAN PERUBAHAN KADAR CUKAI PERKHIDMATAN

Why It Matters?

These guidelines are especially important for businesses using automated invoicing and accounting systems. Be sure to update your system settings or consult your accounting software provider to adjust tax rules as needed. Misapplication of SST rates could lead to audits or penalties, which can be avoided by ensuring that staff and systems are aligned with these rules.

For business owners and finance teams, staying updated on transitional tax rules like SST 2024 ensures smooth operations and continued compliance with Malaysian tax regulations.

Properly applying the changes in the service tax rate from 6% to 8% is not just about compliance, it’s about building trust with clients, avoiding penalties, and ensuring your business continues to operate without disruption during this transitional period.

For more details on how QNE can help you automate tax compliance, check out our article about the power of AI Cloud Accounting System.

Frequently Asked Questions (FAQs)

Why did Malaysia's Service Tax (SST) rate change from 6% to 8% in 2024?

Malaysia’s Service Tax rate was updated from 6% to 8% in 2024 as part of the government’s ongoing efforts to improve tax administration and revenue efficiency. This change was issued by the Royal Malaysian Customs Department (RMCD) and applies to all taxable services under the SST framework. Businesses are required to apply the new rate starting from the effective date of the change.

How do I know which SST rate to apply — the old 6% or the new 8%?

The applicable SST rate is determined by the date the service is actually provided, not the date of payment or invoice issuance. If a service is fully completed before the effective date of the rate change, the old 6% rate applies. If it is fully completed on or after the effective date, the new 8% rate applies. This is an important distinction businesses must understand to avoid billing errors and potential penalties.

What happens if a service spans both before and after the SST rate change date?

If a taxable service is provided across the rate change date — for example, a project that runs from late February into March 2024 — the service tax must be apportioned. The portion of the service delivered before the effective date is taxed at the old 6% rate, and the portion delivered on or after the effective date is taxed at the new 8% rate. Businesses should maintain clear documentation of service timelines to support this calculation during any RMCD audit.

Does the date of invoice or payment determine which SST rate to use?

No. According to RMCD guidelines, the date of invoice or payment does not determine the applicable SST rate. What matters is the date the service is provided. For example, if a cleaning company completes a full service session on February 28, 2024, the 6% rate applies — even if the customer pays on March 2, after the new rate takes effect. Businesses must align their billing practices with the actual service delivery date, not the transaction date.

How should businesses update their systems to comply with the SST 2024 rate change?

Businesses should update their accounting and invoicing software to reflect the new 8% SST rate starting from the effective date. It is also recommended to train finance staff on the apportionment rules for services that straddle the transition period. Using an automated cloud accounting system — like QNE AI Cloud Accounting — can help businesses apply the correct rate automatically, reduce human error, and maintain full compliance with RMCD’s SST 2024 guidelines.