Before starting up a new business, you might need to spend some time exploring which Cloud Accounting System, Accounting Software, or ERP Software in Malaysia you would like to apply to monitor your entire business process, cash flow, reports, and more. When searching for accounting software solutions, one of the most critical factors in your decision will be whether to deploy it on an in-house server or in the cloud.

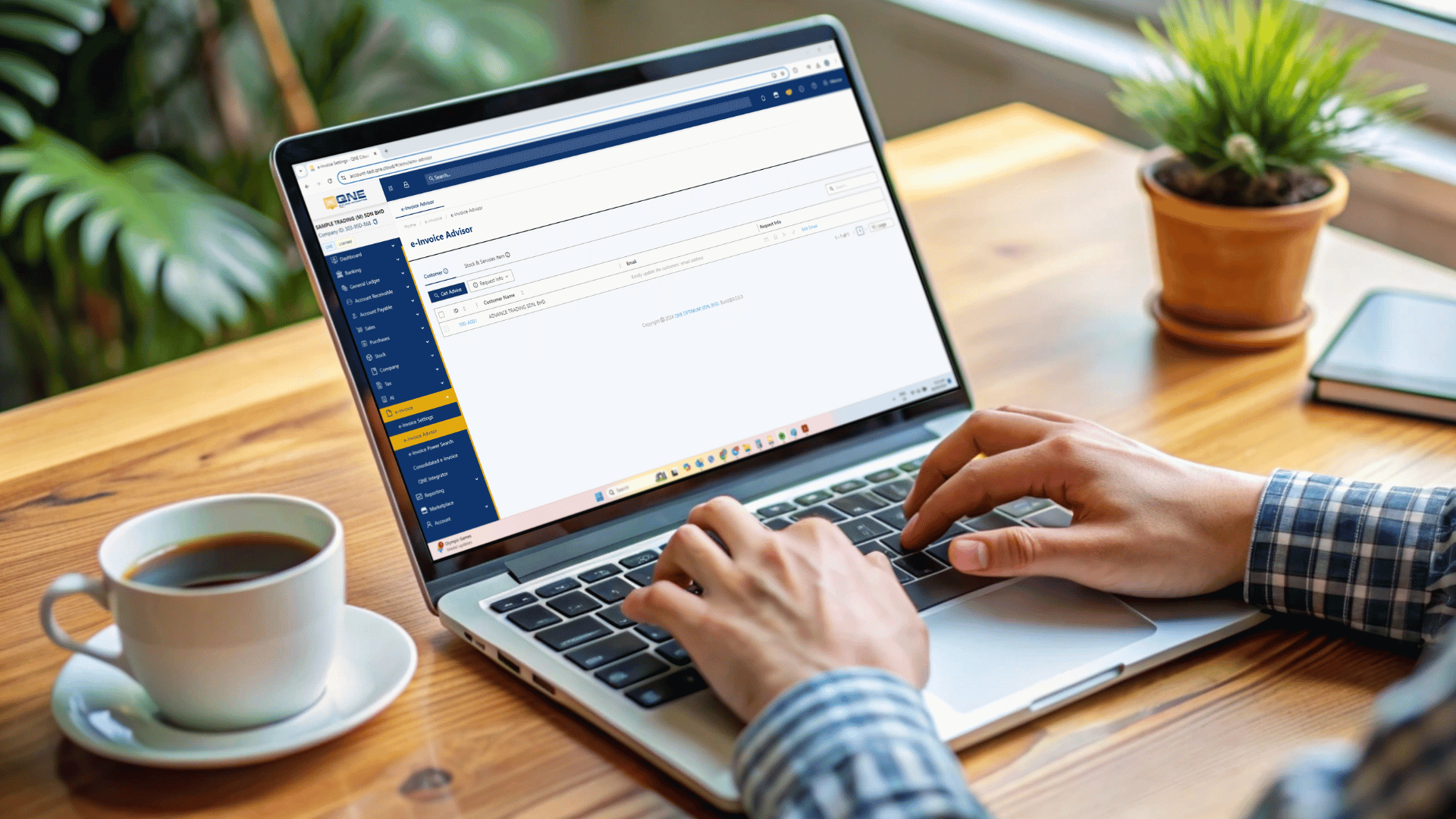

Cloud Accounting System | Cloud ERP Software are more common now in Malaysia. Today, still not many Accounting and ERP Software Malaysia Vendor are able to offer cloud-based system, and only some vendor are able to package with the latest technology with their hybrid cloud accounting software which is a latest technology that allows users to access their data in the cloud from their windows application, web portal and mobile application, for example, QNE Hybrid Cloud Accounting Software

However, there are still some vendor in the market did not managed to development 犀利士 or enhance their solutions to cloud-based and maintaining on-premise Accounting System with the use of remote desktop server feature for wide area network connection. By doing this, users are exposed in the risk of ransomware to block their access to server data. The disaster happens in Malaysia back in 2016, many companies have no option but to pay the sum of huge amount just to restore the data from the ransomware.

But there are still several reasons why a small or midsize business might choose a traditional on-premise accounting or ERP Software Malaysia such as high up-time, risk-free for poor internet bandwidth and flexibility on data backup. But which one is right for your organization? Well, only you can make that decision, but this rundown on the pros and cons of each should make it easier.

By knowing the advantages and disadvantages of each type of Cloud Accounting System and ERP Software Malaysia, business owners can determine the best fit for their small-medium business, allowing for a more informed allocation of resources and a more efficient system workflow.

Deployment and Pricing of Cloud Accounting Software

Cloud ERP software VS. In-House Server Accounting ERP software

The biggest difference between these two systems is how they are deployed. Cloud Accounting Software | Cloud ERP Software is hosted on the vendor’s servers and accessed through a web browser. In-House Accounting Software | ERP Software is installed locally, on a company’s own computers and servers.

Some vendor is able to offer with the latest technology with their hybrid cloud accounting software which is the latest technology that allows users to access their data in the cloud from their windows application, web portal and mobile application, for example, QNE Hybrid Cloud Accounting Software

Another key difference between cloud and on-premise solutions is how they are priced:

While there are many exceptions to this rule, in general, Cloud Accounting Software | Cloud ERP Software Malaysia is priced under a monthly or annual subscription, with additional recurring fees for support, training and updates.

In-House accounting software is generally priced under a one-time perpetual license fee (usually based on the size of the organization or the number of concurrent users). There are recurring fees for support, training and updates.

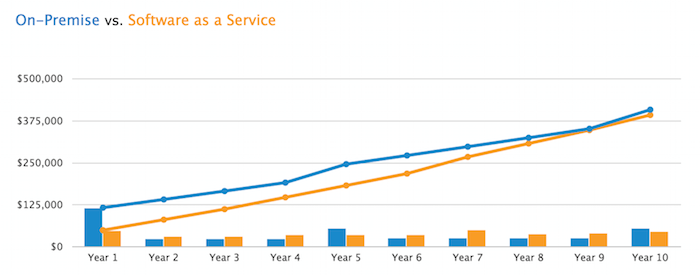

Thus, in-house accounting software are generally considered a capital expenditure (one large investment upfront). Cloud Accounting Software | Cloud ERP Software, on the other hand, are typically considered an operating expenditure (an additional overhead cost the organization will continue to pay).

Cloud Accounting Software | Cloud ERP Software Malaysia is a low cost of entry, especially compared to hefty upfront perpetual license fees, which has contributed to its widespread adoption. According to one recent study, 93 percent of enterprises currently use cloud-based software or system architecture, and the use of hybrid cloud accounting software increased from 19 percent to 57 percent in one year make it the most popular accounting software in Malaysia.

Over time, however, system costs tend to converge. Below is a chart showing total costs of ownership (TCO) over 10 years for both Cloud Accounting Software | Cloud ERP Software and on-premise Accounting Software | ERP Software.

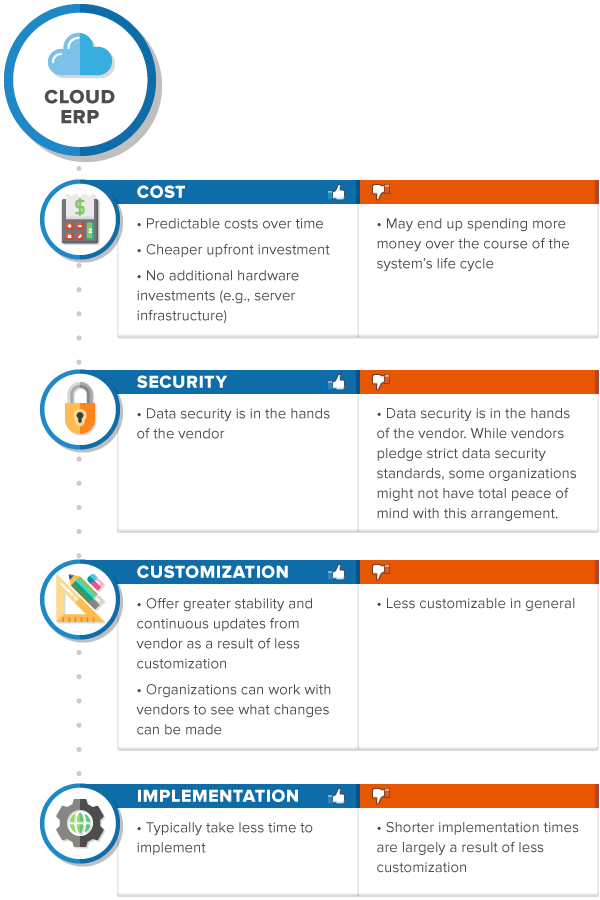

Advantages and Disadvantages of Cloud Accounting System and cloud ERP Software Malaysia

Security is often the top concern for prospective ERP buyers. Small wonder, considering the critical the information stored in an ERP system—including company financials, corporate trade secrets, employee information, client lists and more.

But while buyers once were wary about the security of cloud accounting software or cloud erp software malaysia, many are becoming less skeptical today (evidenced by the adoption rates above).

Reputable cloud vendors have strict standards in place to keep data safe. To further ease concerns, prospective buyers can seek a third-party security audit of a vendor they’re considering. This can be especially useful if the vendor is less well-known.

Most cloud accounting software and cloud erp software malaysia enables easy mobile accessibility, and many even offer native mobile apps. But this ease of access also comes with greater security considerations, especially if employees are accessing company files on their personal mobile devices.

Similarly, more accessibility means less customization—and cloud accounting software and cloud erp software malaysia offer less flexibility for businesses that seek to tailor their system to their hearts’ content. But organizations with less specialized needs, such as general consulting firms, can get by just fine with a cloud system’s out-of-the-box capabilities.

Cloud Accounting System or Cloud ERP Software Malaysia is, therefore, best suited for small and midsize businesses seeking lower upfront costs, system stability, and ease of access.

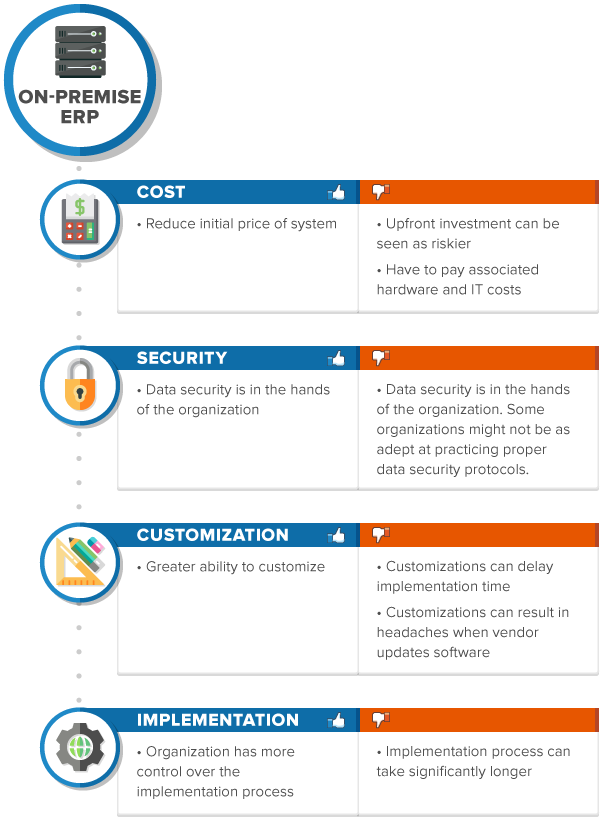

Advantages and Disadvantages of In-House Accounting System

You’ll typically find many of the same features in an on-premise ERP system. However, there are a few notable differences in the two deployment strategies.

In general, on-premise systems are much easier to modify. The ability to customize to their specific needs and requirements is paramount for many organizations, especially in niche industries, such as specialized manufacturers with unique processes.

On-premise ERP systems put more control in the hands of the organization, up to and including the security of its data. It’s therefore essential that a business be capable of safeguarding an ERP system’s most sensitive information, which also made it a frequent target of cybercriminals.

Mobile accessibility can pose an issue for on-premise deployments. These often require a third-party client to communicate between a mobile device and the on-premise software. It’s definitely not an insurmountable problem, but it can be a pain point.

On-premise ERP systems are therefore best suited for larger enterprise businesses with higher budgets; a desire to customize system operations; and the existing infrastructure to host, maintain and protect its ERP data.

Conclusions and Next Steps

When it comes to choosing a new Accounting System or ERP System, there are more options than ever for businesses of all sizes. Cloud-based accounting deployment models have made this software more accessible for Small Medium Businesses and enterprises, though these systems come with a few drawbacks, such as more limited customization and potential security concerns.

Conversely, localhost Accounting Software or ERP Software Malaysia offers advantages in customization and control but are more expensive upfront, and many don’t support mobile. This can be problematic for smaller buyers but, as is usually the case, it depends on the specific needs of the individual business.

But there is a hybrid accounting software solution developed locally to overcome the Cloud-Based Accounting and Local Host Accounting Software problem. With the hybrid solution, many businesses can achieve the expected result in cost-effective ways which brings the highest value to the business also the users.

Digitize Your Software & Build Your Smart Business Today!

Enjoy 30 Days Free Trial of N3 AI Accounting (formerly QNE AI Cloud Accounting) Software, your #1 Hybrid Cloud Accounting Software & Cloud Payroll Software in Malaysia!