E-Invoice Malaysia for Accountants: Compliance Made Easy

E-Invoice Malaysia is transforming how accountants manage tax compliance and financial reporting across the country. For Malaysian accountants, staying compliant with E-Invoice Malaysia and LHDN’s evolving e-invoicing system is crucial in 2024 and beyond. Manual processes are no longer enough—businesses need accurate, efficient, and compliant invoicing systems. That’s where N3 AI Accounting (formerly QNE AI Cloud Accounting) comes in. It simplifies e-Invoicing, reduces human error, and helps ensure every transaction is properly documented. As regulations tighten, accountants who use modern tools like QNE stay ahead, saving time while remaining fully compliant with tax laws.

What is E-Invoice Malaysia?

E-Invoice Malaysia refers to the digitized format of invoices issued, received, and stored electronically, in accordance with LHDN’s e-invoicing framework. It enables real-time validation and automated reporting to tax authorities via systems like the MyInvois Portal or the PEPPOL network.

Unlike traditional invoices created in Excel or PDF and sent manually, e-invoices are structured digital files that:

- Can be validated by LHDN upon issuance

- Reduce human error and fraud

- Are stored in a secure, centralized system

- Help businesses automate compliance

The system will also standardize how businesses in Malaysia issue and track invoices, improving efficiency across industries.

E-Invoicing Malaysia Rollout Plan

In 2023, LHDN announced the phased implementation of the national e-invoicing system. Here’s how the timeline looked:

- Mid-2023: Consultation and pilot programs were initiated for selected large companies.

- Late 2023: Development of the MyInvois Portal and integration framework based on international standards like PEPPOL.

- 2024 Onward: Full implementation to be rolled out in phases, starting with businesses with annual turnover exceeding RM100 million, then gradually covering smaller businesses by 2025 and 2026.

Important for Accountants:

Even if you’re not yet required to comply, preparing your clients early will help ensure a smooth transition once e-invoicing Malaysia becomes mandatory for them.

Why Accountants Should Prepare Early?

Accountants play a key role in the e-invoicing transition—not only for their own practice, but for their clients as well. Here’s why early preparation is essential:

- Avoid Last-Minute Compliance Issues: Waiting until e-invoicing is mandatory can lead to rushed implementation, errors, and penalties.

- Position Yourself as a Trusted Advisor: Help clients understand and implement digital solutions now to build stronger relationships.

- Boost Internal Efficiency: e-Invoicing streamlines the entire invoice-to-reporting workflow, saving time on manual tasks.

- Stay Ahead of the Competition: Early adoption shows you’re a forward-thinking professional, ready for Malaysia’s digital economy.

Why E-Invoice Matters to Malaysian Accountants?

Accountants in Malaysia are now navigating an increasingly digital landscape. Here’s how e-invoicing software makes their jobs easier:

- Time-saving automation: Auto-generate invoices and eliminate repetitive data entry.

- Reduced human error: Minimize mistakes in client records and reporting.

- Real-time status updates: Easily track invoice status: sent, received, or rejected.

- Tax compliance: Stay compliant with Malaysia’s e-Invoice framework with built-in tax rules.

- Cloud accessibility: Work remotely or across branches with real-time data sync.

Learn more about the benefits of e-invoicing for Malaysian SMEs.

An e-invoicing software or e-invoice system embedded in an accounting solution can help Malaysian accountants and businesses in several transformative ways:

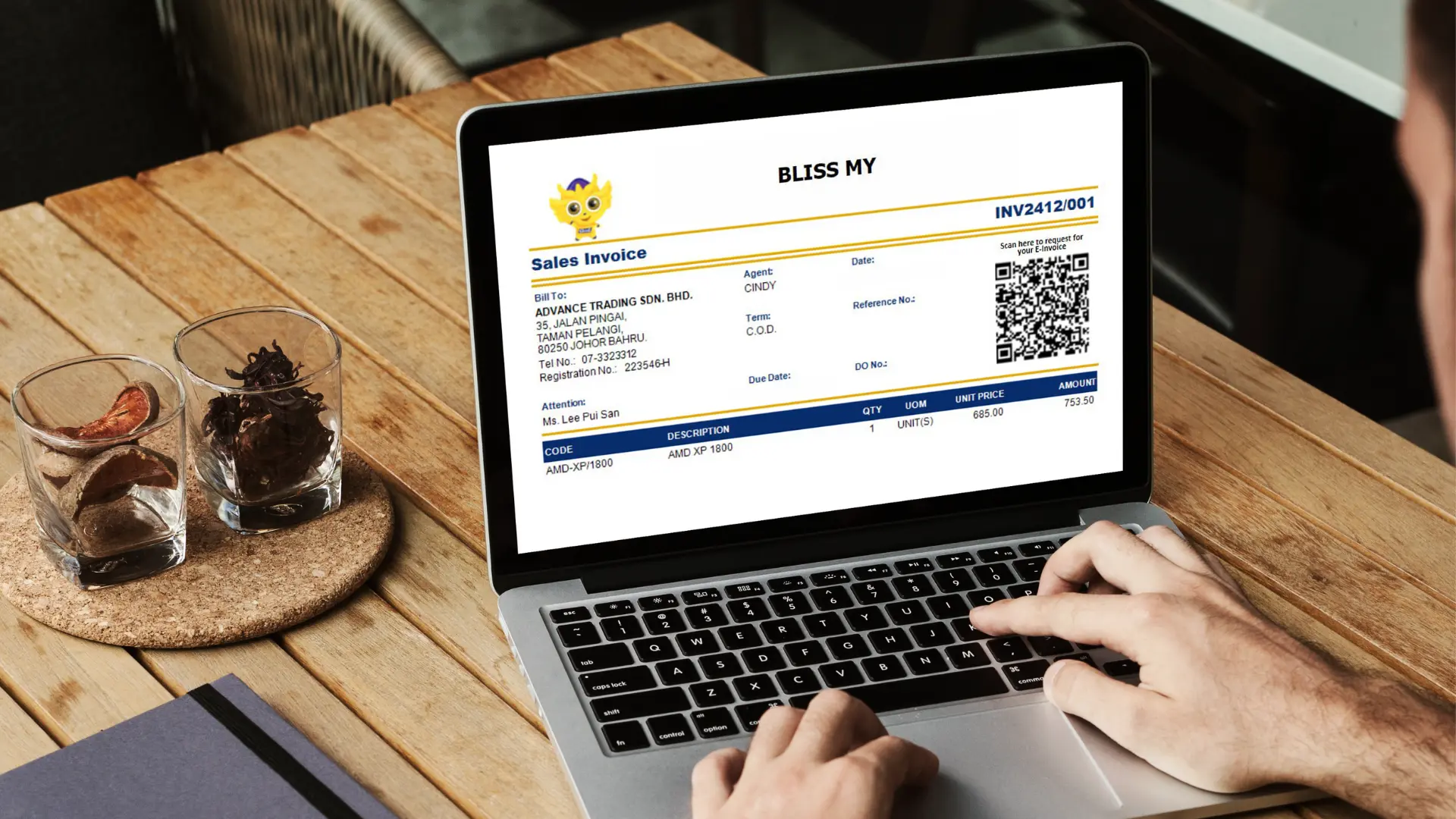

Invoice Creation

An accounting system equipped with e-invoicing software functions allows users to create invoices electronically with ease. Users can input essential details in the e-invoice Malaysia such as customer information, billing details, product or stock items, quantities, prices, and applicable SST taxes.

This automation not only reduces the time spent on invoice creation but also minimizes the risk of human error—benefiting both businesses and Malaysian accountants who manage high-volume transactions.

Electronic Delivery

E-invoicing through an accounting system facilitates the electronic delivery of invoices to customers. Invoices can be sent via multiple channels including email, instant messaging platforms like WhatsApp and Telegram, secure online portals, or electronic data interchange (EDI).

This flexibility enhances customer engagement and accelerates payment processes. For Malaysian accountants, these capabilities are invaluable as they help businesses maintain a professional and efficient billing process using the latest invoicing technology.

Invoice Tracking and Management

An accounting system with e-invoicing software Malaysia capabilities allows users to monitor the status of invoices—whether they have been delivered, viewed, or paid. An e-invoice system may offer reminders or notifications for overdue invoices, helping businesses manage receivables more effectively.

This tracking function is crucial for Malaysian accountants who need real-time visibility into cash flow, outstanding payments, and client account statuses, enabling them to offer better financial advice and cash flow projections.

Integration with Accounting Software

Another advantage of modern invoicing technology is its seamless integration with comprehensive accounting systems. The e-invoicing Malaysia automatically syncs invoice data with customer records, product or service details, tax rates, and payment terms.

This integration ensures that every transaction is accurately reflected in thae accounting system, reducing discrepancies and simplifying financial reporting—a benefit especially important to accountants handling multiple clients or complex financial statements.

Compliance with Legal Requirements

Different countries have distinct legal standards for electronic invoicing, including specific invoice formats, digital signatures, and tax compliance regulations.

In Malaysia, the government has mandated Malaysia SST e-invoicing, and solutions like QNE Accounting Software are built with an e-invoice software that supports these requirements. With built-in compliance features, Malaysian accountants can confidently navigate regulatory landscapes while ensuring that businesses remain aligned with government expectations.

How E-Invoice Malaysia Supports Accountants and Tax Agents?

With E-Invoice Malaysia, accountants can automate repetitive tasks, ensure accurate invoicing, and comply with LHDN’s MyInvois system. It also reduces the risks of manual errors and improves transparency for audits and reporting.

How E-Invoice Malaysia Helps Accountants Stay LHDN-Compliant

With the rollout of LHDN’s e-Invoicing Malaysia mandate, choosing the right software is more than just a tech decision—it’s a strategic move for long-term compliance and efficiency.

When evaluating e-invoicing Malaysia, here are the key features accountants should look for:

- LHDN-Ready and Peppol-Compliant

Ensure the software is fully integrated with the MyInvois Portal and compliant with Malaysia’s Peppol framework for seamless e-invoice transmission and validation. - Cloud-Based and Accessible Anywhere

Look for a cloud-native solution that allows your team to access and manage invoices remotely—whether you’re working from the office, home, or multiple branches. - Real-Time Automation & Reporting

The right software should automate invoice generation, validation, and status tracking while offering real-time insights into your transactions and compliance standing. - Scalable for SMEs and Growing Firms

Whether you’re a freelancer, a small accounting firm, or part of a large enterprise, the system should grow with you. Flexibility and customization are key.

Benefits of E-Invoicing for Accountants in Malaysia

As Malaysia transitions into a digital tax environment, E-Invoicing Malaysia offers numerous advantages beyond just regulatory compliance. From reducing paperwork to improving real-time financial visibility, e-invoicing is designed to make operations faster, smarter, and more secure.

For accountants and business owners, adopting an e-invoicing system in Malaysia means:

- Reduced manual errors through automation

- Faster invoice validation and tax reporting

- Better tracking of financial data across departments

- Improved client and vendor trust due to transparency

By understanding how E-Invoicing Malaysia transforms traditional invoicing processes, businesses can better prepare for future compliance while enjoying operational efficiency today.

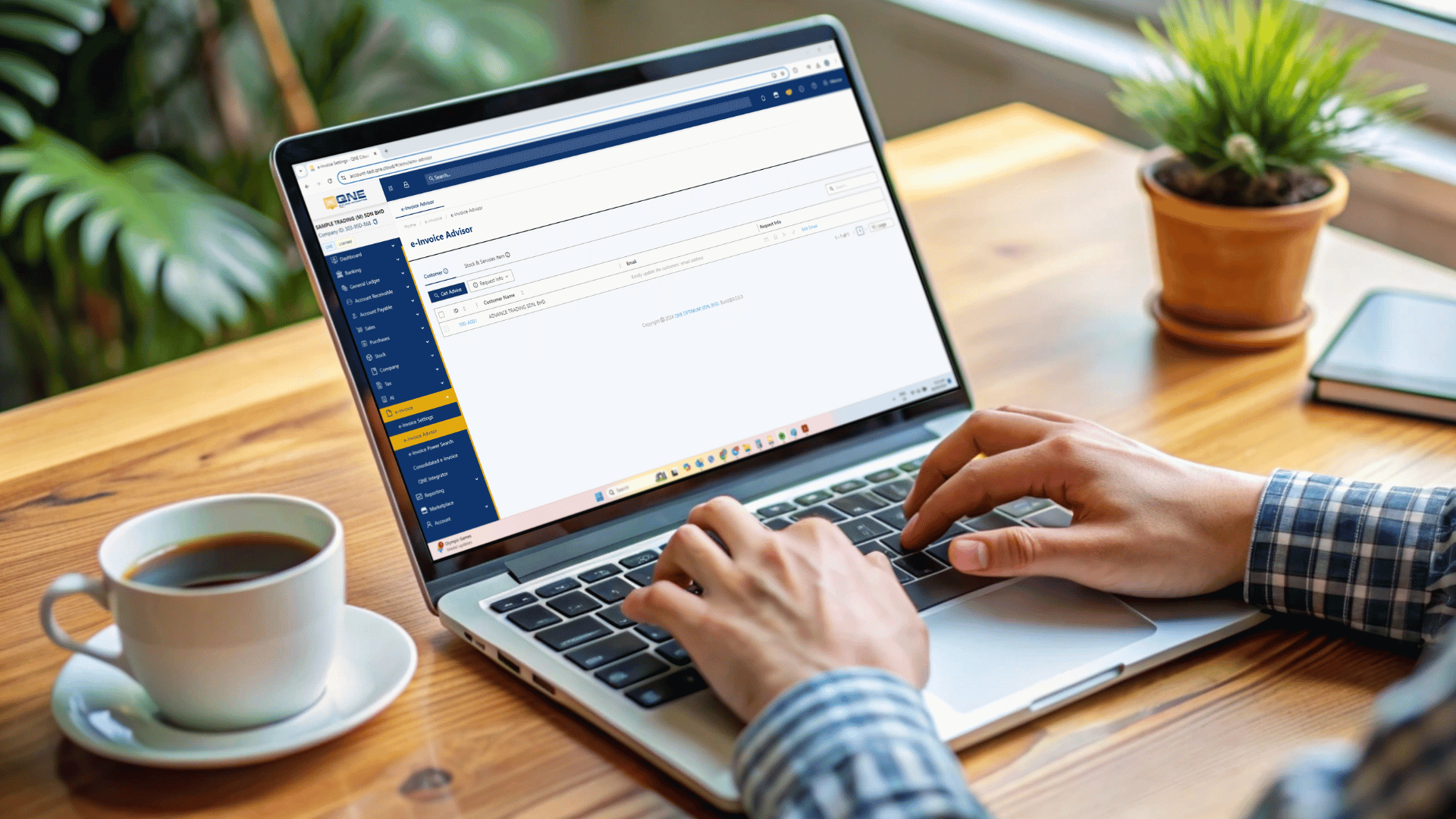

Why N3 AI Accounting (formerly QNE AI Cloud Accounting) is the Ideal Choice?

N3 AI Accounting (formerly QNE AI Cloud Accounting) is a locally developed solution trusted by thousands of Malaysian businesses. It’s designed with the LHDN’s electronic Invoicing roadmap in mind and includes all the features accountants need to stay compliant and productive.

What sets QNE apart?

- Built-in e-Invoicing Module: Ready for LHDN integration and Peppol compliance.

- Automation Powered by AI: Simplifies billing, tax computation, and reconciliation.

- Smart Dashboards & Analytics: Get real-time insights on your invoices and cash flow.

- Cloud Access Anytime, Anywhere: Perfect for remote work and multi-branch operations.

- Local Support & Training: Get expert guidance from a team that understands Malaysian tax law.

Real Stories from Accountants Who Trust N3 AI Accounting (formerly QNE AI Cloud Accounting)

At QNE, we don’t just talk about results—we deliver them. Our clients, especially accountants and tax professionals, have experienced how our N3 AI Accounting (formerly QNE AI Cloud Accounting) software makes the transition to E-Invoice Malaysia easier, faster, and fully compliant with LHDN standards.

Want to know how QNE is making a difference? Hear from our clients as they share their real experiences—how they transitioned to QNE, reduced errors, and embraced digital transformation with confidence.

Ready to Switch to Smarter E-Invoicing?

Automate your e-invoicing with confidence using N3 AI Accounting (formerly QNE AI Cloud Accounting)—trusted by accountants across Malaysia. Digitize Your Software & Build Your Smart Business Today!

Enjoy 30 Days Free Trial of N3 AI Accounting (formerly QNE AI Cloud Accounting) Software, your no. 1 Hybrid Cloud Accounting Software & Cloud Payroll Software in Malaysia!

Frequently Asked Questions (FAQs)

What is e-invoice Malaysia?

E-invoice Malaysia refers to invoices issued, received, and stored electronically under the Inland Revenue Board’s (LHDN) e-invoicing framework. These invoices are structured digital files that can be validated in real time and help automate compliance.

Why is e-invoice Malaysia important for accountants?

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

How does e-invoice Malaysia work with accounting systems?

An e-invoice system within accounting software lets users create, send, track, and sync invoices automatically. Invoice data is integrated with tax rates, customer records, and financial reporting for accurate accounting.

Does e-invoice Malaysia reduce errors?

Yes. Because transactions are digitally structured and validated, e-invoice Malaysia reduces human error and enhances accuracy in invoicing and reporting.

What benefits does e-invoice Malaysia offer accountants?

Yes. Because transactions are digitally structured and validated, e-invoice Malaysia reduces human error and enhances accuracy in invoicing and reporting.