According to the Inland Revenue Board of Malaysia, an EA Form Malaysia / Borang EA is an Annual Remuneration Statement that every employer shall prepare and render to his employee statement of remuneration of that employee before 1st March in the year immediately following the first mentioned year.

Watch LHDN – BORANG EA | EA Form Malaysia on YouTube

You will usually use this form to file personal taxes during tax season.

The reason you need this is to ensure that if you are above the paygrade that requires you to pay taxes – the form ensures that you are aware of this and this is the form you use when you go online and do your E-Filing.

Taken directly from the LHDN website, it is cited that referring to Section 83(1A) Income Tax Act 1967, “that every employer shall, for each year, prepare and render to his employee statement of remuneration of that employee on or before the last day of February in the year immediately following the first mentioned year”.

Legal Requirement Under Income Tax Act 1967

Pursuant to Section 83(1A) of the Income Tax Act 1967, employers are obligated to prepare and render the EA Form to employees on or before 28 February each year. This ensures employees receive a formal breakdown of their remuneration and deductions.

Example of EA Form Malaysia / Borang EA

Breakdown of the EA Form

B1 (a)-(f) : Gross Salary, Wages, Leave Pay, Fee, Commission, Bonus, Perquisites, Allowance, Income Tax, Shared Benefits & Gratuity

B2 : Type of income

B3 : Benefits in kind

B4 : Value of living accommodation

B5 : Refund from unapproved Provident/Pension Fund

B6 : Compensation for loss of employment

Don’t know what to do?

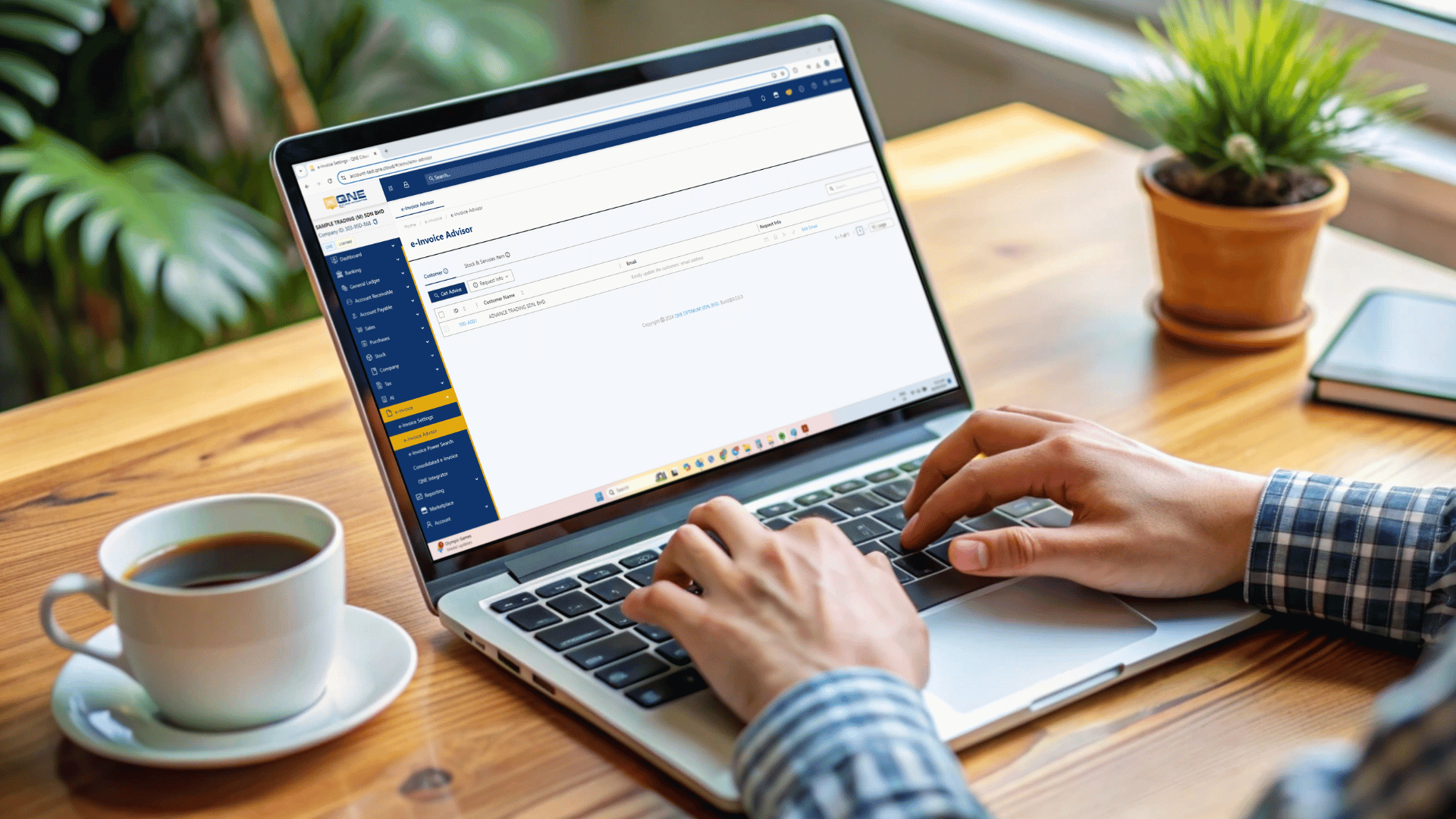

Don’t worry, by using QNE Cloud Payroll & HR Software is the most user friendly payroll software malaysia, with just a few simple clicks, we can help you to generate EA Form Malaysia / Borang EA for all your employees accurately!

Employers have to prepare and distribute the EA Form Malaysia / Borang EA before the last day of February every year.

NOTE: A fine of RM 200 to RM 20,000 or imprisonment for a term not exceeding 6 months or both if fail to prepare and render EA Form to employees before last day of February.

Best Practices & Tips

Plan Ahead

Begin collecting employee payroll data early (e.g. December or January). Regular monthly reconciliation ensures your year-end figures require minimal adjustments.

Consistent Record-Keeping

Maintain up-to-date records of all salary components: commissions, bonuses, benefits in kind, pension fund contributions, and housing allowances. These elements feed directly into Form B1–B6.

Employee Communication

Notify employees of upcoming EA Form distribution dates. Provide guidance on interpreting sections and accessing their forms via HR portals.

Ensure Secure Delivery

Ensure forms are distributed securely—either via password-protected PDFs or the company’s centralized HR system. Keep a signed acknowledgment of receipt on file.

Coordinate With E-Filing Season

Align your EA Form issuance with the tax authority’s e-filing schedule. Encourage employees to file early to avoid last-minute rushes.

Issuing the EA Form accurately and on time is more than just compliance—it reflects a well-run organization. With QNE Cloud Payroll & HR, your business stays legally compliant, simplifies administrative tasks, and empowers employees to manage their tax filing more effectively.

To find out more about Mr. Patrick Luah, kindly visit PLC Consulting & Solution homepage by clicking on the link below

MR. PATRICK LUHA

PLC Consulting & Solution

https://www.plctax.solutions

- Corporate Coach

- Tax Consultant

- Chartered Accountant

- Corporate Secretary

- PSMB / HRDF TRainer

- Vistage Member

Ready to Simplify Your EA Form Process?

Digitize Your Software & Build Your Smart Business Today. Enjoy 30 Days Free Trial of QNE AI Cloud Accounting Software, your #1 AI Cloud Accounting Solution in Southeast Asia.