The EIS Table plays a crucial role in guiding employers on proper contribution rates under the Employment Insurance System. On January 1, 2018, SOCSO introduced the EIS PERKESO portal to help employers manage their records, update, and make contributions. This insurance, regulated by the Employment Insurance System Act 2017 and administered by the EIS SOCSO, protects workers between the ages of 18 and 60 who have lost their jobs. The EIS Table provides a structured breakdown of employee and employer contributions, making compliance easier. It applies in cases such as contract expiration—except for voluntary resignations, unconditional termination, retirement, project completion stated in the contract, or dismissals due to misconduct. Employers can refer to the EIS Table for accurate deductions.

What is Employee Insurance System (EIS)?

The EPA is responsible for administering the Environmental Impact Statement process. Employment Insurance (EIS) contributions are set at 0.4% of an employee’s estimated monthly wage. According to the EIS contribution table, 0.2% will be paid by the employer, and 0.2% will be cut from the employee’s monthly wages.

According to EIS contribution table contribution rates are specified in the second annex and are governed by the rules of section 18 of the Employment Insurance System (EIS) Act 2017. Private-sector employers are required to pay monthly contributions on behalf of each employee. (Civil servants, domestic workers, and self-employed are exempt from paying taxes).

The process of EIS filing includes:

- Receiving and recording EIS in the EIS Table EPA database,

- For draft and final EISs, setting start and end dates for comment and review periods,

- Publishing comment and review dates in weekly availability notice in the Federal Register.

Eligibility To Claim Benefits EIS PERKESO

- All employees who are insured under the Law EIS PERKESO (known as insured persons) who lose their jobs are entitled to do so with the following exceptions:

- Voluntary care of the insured person

- Expiration of the fixed-term contract of the insured person

- Unconditional termination of the contract for the provision of services by agreement between the Insured person and his employer

- Completion of the project specified in the service agreement

- Retirement of the insured person

- Dismissal due to misconduct of the Insured Person

- Benefit applicants must prove that they can work, are willing to work, and are actively looking for work.

When should you pay the EIS fee?

In EIS contribution table for Employee and Employer Shares is paid along with the SOCSO contribution.

EIS Contribution Table

According to EIS Table and EIS contribution table following rules should be followed by both employees and employers:

Employment Insurance System (EIS) – Rate of Contribution

Employer’s responsibility

You only need to register your employees as SOCSO members once, and they will automatically be eligible for the EIS PERKESO.

Employee Status Employer EIS Contribution Rate

Age 18-60 0.2%

The EIS contribution rate is shown in this table does not apply to new employees aged 57 and over who have not previously made a contribution.

Remember that the premium should be calculated based on the premium rate specified in the second annex of the Employment Insurance System Act 2017, and not on the exact calculation of interest. The maximum monthly contribution is RM 4,000.

For your convenience, you might consider using payroll software for the EIS contribution table to take a break from manually calculating and recording EIS payments for each employee.

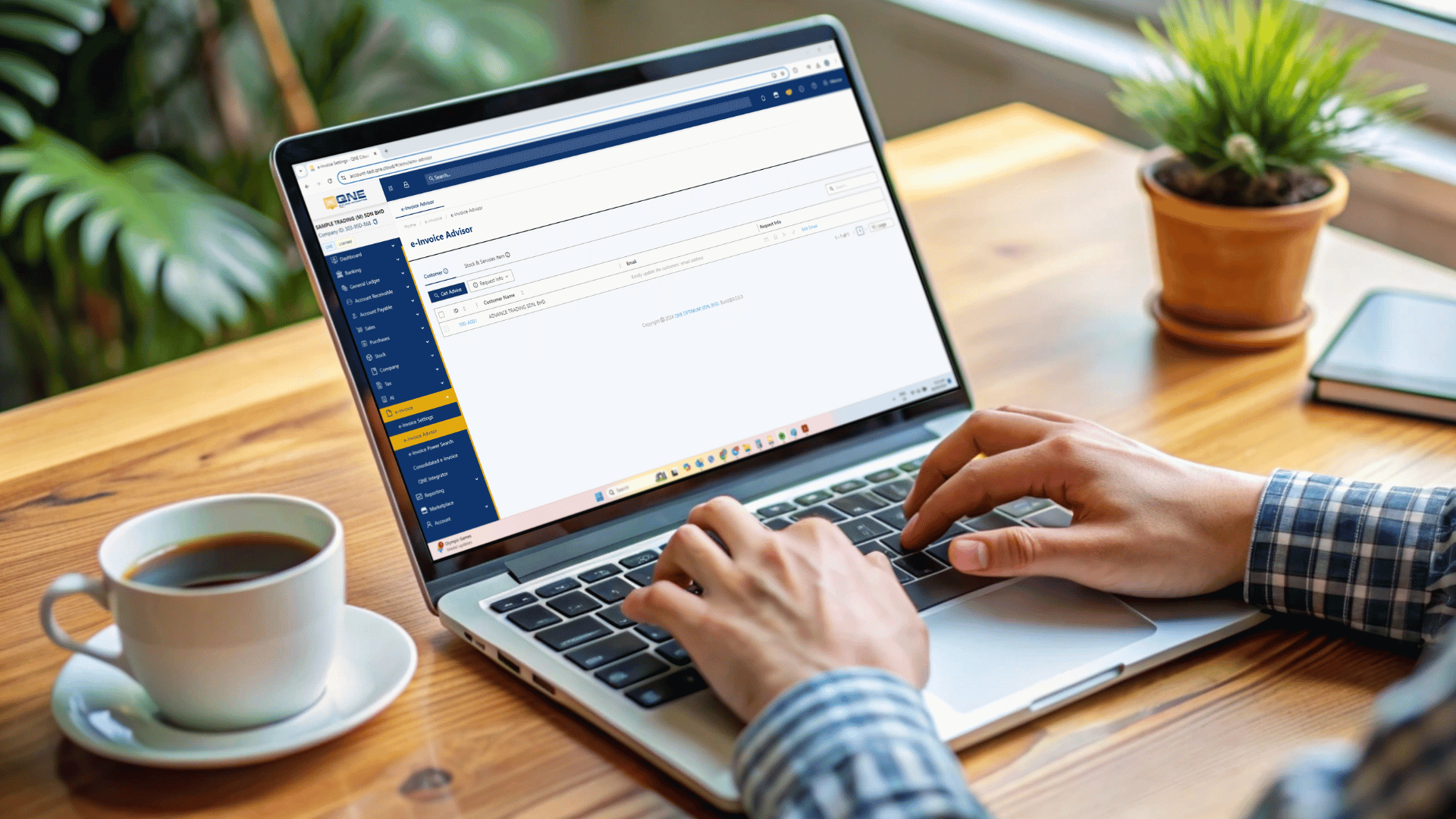

Digitize Your Software & Build Your Smart Business Today

Managing contributions and compliance with SOCSO’s Employment Insurance System (EIS) is now easier than ever with N3 AI Accounting (formerly QNE AI Cloud Accounting). Seamlessly integrated with payroll features, QNE allows you to automatically calculate and generate reports based on the latest table, ensuring accurate deductions and timely submissions

Enjoy 30 Days Free Trial of N3 AI Accounting (formerly QNE AI Cloud Accounting) Software, your #1 Hybrid Cloud Accounting Software & Cloud Payroll Software in Malaysia!