Any person authorized by a company to act as its agent, dealer, or distributor—and who receives payment or incentives (whether monetary or non-monetary)—is required to issue a Form CP58. Also known as CP58 LHDN or Form 58, this document is essential for declaring benefits or commissions received from a company in relation to sales, transactions, or business schemes.

This requirement also applies to foreign companies and branches operating in Malaysia, except for individuals running a sole proprietorship or those in partnerships.

Form CP58

Statement of monetary and non-monetary incentive payment to an agent, dealer or distributor

CP58 LHDN only need to be prepared for those recipients where the monetary and non-monetary incentive payment are of an amount exceeding RM5,000 per annum.

For non-monetary incentives such as motor vehicle or house, the actual value/amount incurred by the payer company will be the incentive deemed received by the recipient.

Incentives which are not required to be disclosed

Form CP58 | CP58 LHDN | Form 58 | CP 58 include:

- trade discounts and bulk discounts;

- promotional items/gifts received which are not stipulated in the contract;

- incentives are given for an open invitation to encourage the public/ customers to introduce more customers;

- special treatment in the form of preferential rate given to an independent agent who buys and sells goods on his own accord. He is a customer to the producers/wholesalers, except that he enjoys preferential rate due to his purchasing power;

- credit rebate – i.e. Company selling products to supermarkets, sundry shops, minimarkets, etc. The company gives customers a credit rebate (credit notes to offset their account) when they make a prompt payment & hit the yearly target/quota;

- Sub-contractors;

- handling fees (i.e. loading and unloading of goods or luggage, etc) – i.e. company is in the air transport business and sells air tickets to travelers. The company sub-contracts its ground handling services to an agent. The agent solely provides ground-services and does not sell air tickets to travelers. The agent is merely a sub-contractor to the company and merely receives handling fees; and

- items such as umbrellas, pens, calendars, etc. given to all agents, dealers, and distributors which are not based on performance.

Example of Form CP58

The Form, commonly known as CP58 LHDN, must be provided to the agent, dealer, or distributor no later than 31 March of the year following the year in which the incentives were paid. Failure to issue the Form CP58 as required may result in the payer being found guilty of an offense and, upon conviction, subject to a fine between RM200 and RM2,000, imprisonment for up to 6 months, or both.

The latest version of the form both PDF and Excel formats, along with the official guidelines, can be downloaded from the Inland Revenue Board of Malaysia.

Watch Form CP58 LHDN works using QNE AI Cloud on YouTube

In summary, complying with Form CP58 LHDN requirements is crucial for businesses engaging agents, dealers, or distributors in Malaysia. Ensuring proper documentation of incentives through the Form not only supports tax compliance but also protects your company from potential penalties. Always stay updated with the latest Form guidelines and formats as provided by the Inland Revenue Board Malaysia to maintain seamless operations and meet annual reporting obligations.

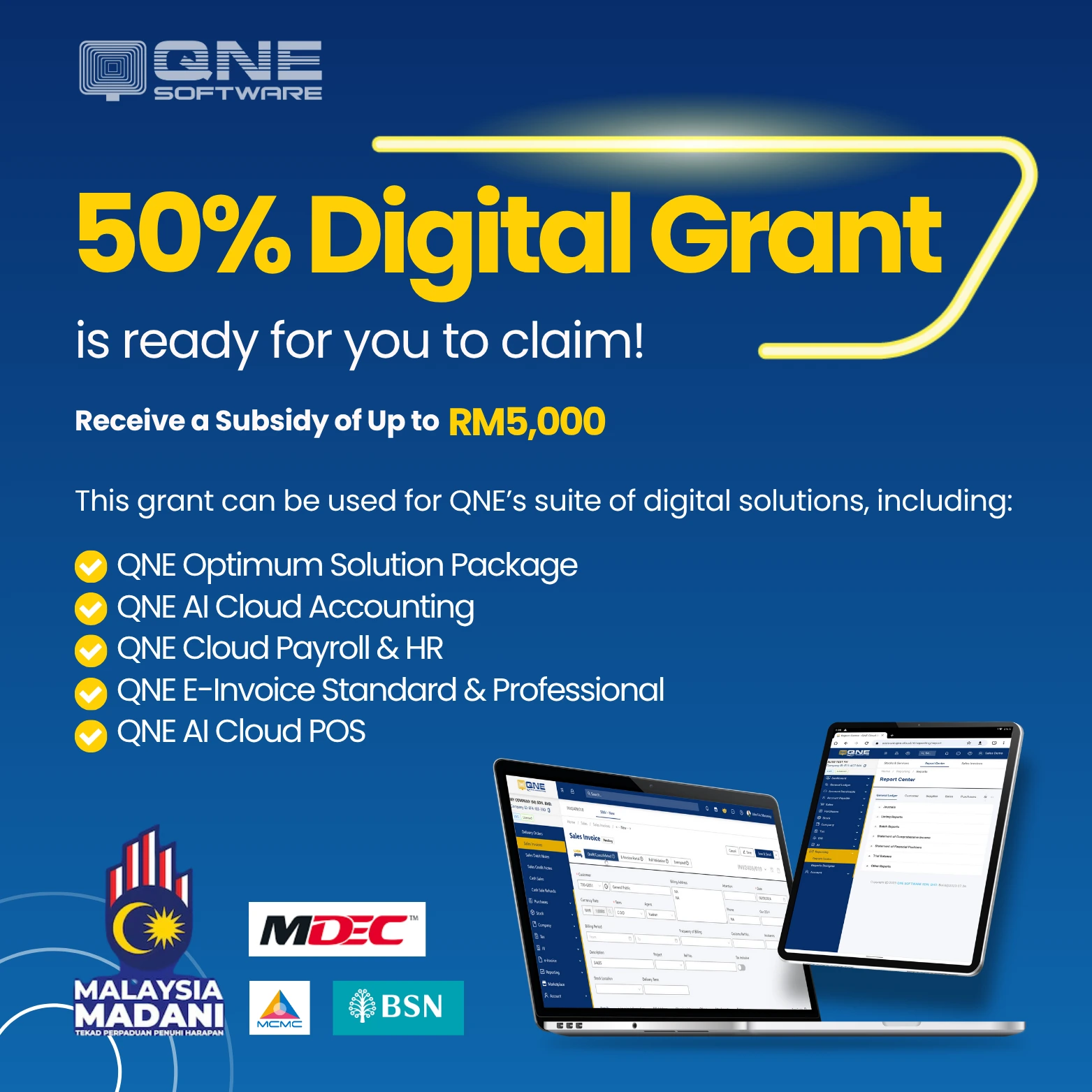

Digitize Your Software & Build Your Smart Business Today!

Digitize Your Software & Build Your Smart Business Today. Enjoy 30 Days Free Trial of QNE AI Cloud Accounting Software, your #1 Hybrid Cloud Accounting Software & Cloud Payroll Software in Malaysia

To find out more about Mr. Patrick Luah, kindly visit PLC Consulting & Solution homepage by clicking on the link below

MR. PATRICK LUAH

PLC Consulting & Solution https://www.plctax.solutions

- Corporate Coach

- Tax Consultant

- Chartered Accountant

- Corporate Secretary

- PSMB/HRDF Trainer

- Vistage Member