LHDN e filing season kicks off every March as tax filing season begins. All Malaysian businesses, whether large, medium, or small, must file Form E with the Inland Revenue Board (IRB) by the end of this month.

Understanding the LHDN e filing 2021 system not only helps ensure compliance but also improves your business’s overall financial management. Companies that stay proactive with e filing can better plan their tax obligations, avoid unnecessary penalties, and maintain a clean record with the authorities.

Form E (Borang E) is a form that an employer must complete and submit to the Internal Revenue Board of Malaysia (IBRM) or Lembaga Hasil Dalam Negeri (LHDN). Basically, it is a tax return form informing the IRB (LHDN) of the list of employee income information and number of employees, it must be submitted by March 31 of each year.

Employers are required to complete Form E filing 2021 via electronic registration.

Two Basic information employers must provide on Form E:

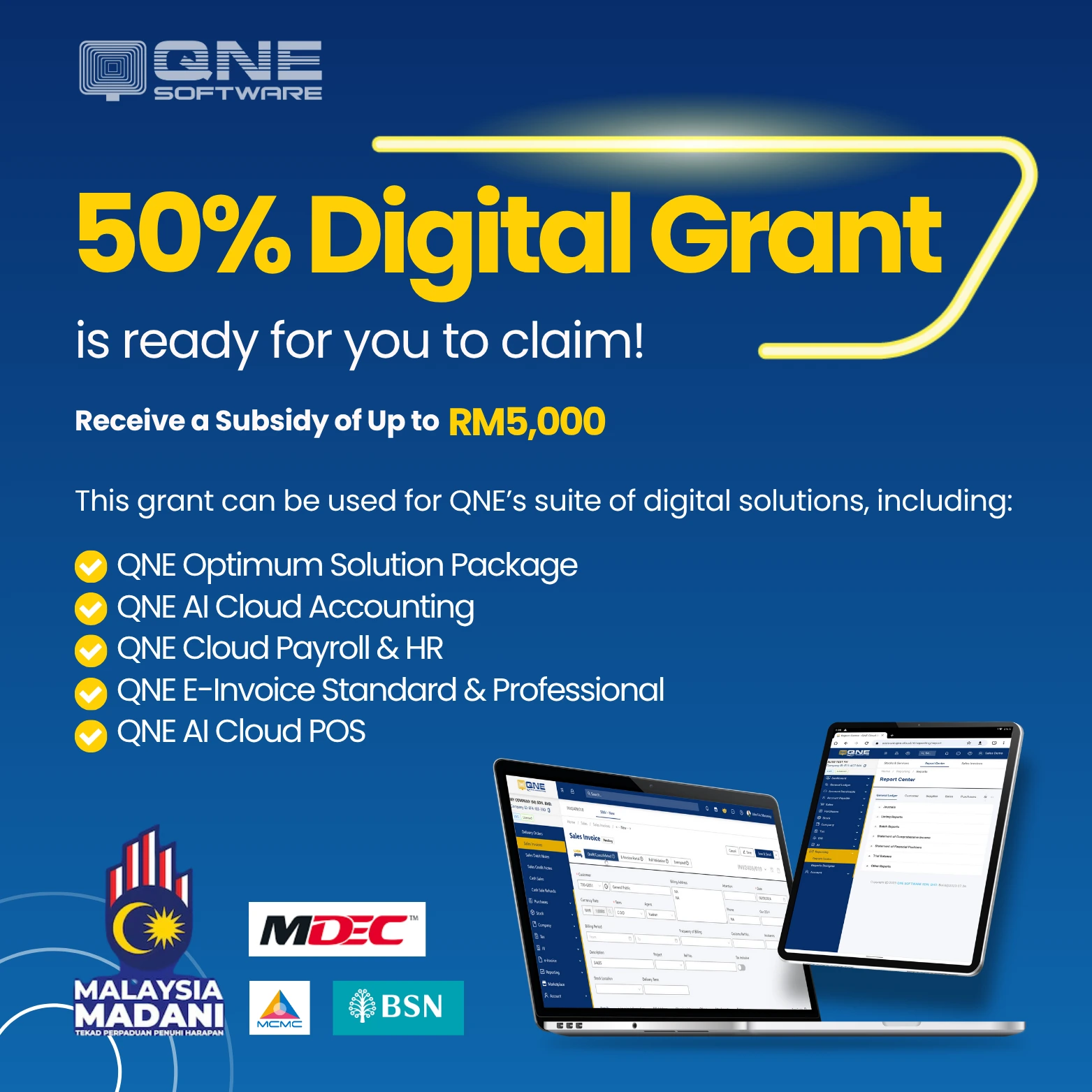

QNE Cloud Payroll is s a secure online platform that offers taxpayers the ability to prepare and submit E Filing 2021 tax returns electronically. A taxpayer can make electronic payments in several ways.

You must use your user ID and password to submit your return.

The LHDN E Filing 2021 by QNE Cloud Payroll has implemented an electronic individual filing system with enhanced security features. Taxpayers must use their user ID (login) and password to access the system.

Taxpayers accessing the service are advised to use the latest version of Firefox, Google Chrome or Internet Explorer as the browser for filing the tax return.

Companies: effective from 2021, all companies are required to file Form E (LHDN E Filing) regardless of whether they have employees or not. Any dormant or non-performing company must also file LHDN E Filing.

Partnerships and sole proprietorships: All partnerships and sole proprietorships must file LHDN E Filing.

All companies must submit their Form E (Borang E) by E filling 2021 only. IRBM (LHDN) will not entertain or accept any companies E filling 2021 that submit their Form E by hand or by mail.

To prepare Form E for printing for electronic filing, you can refer to the guide below or follow these steps:

The deadline for filing tax returns has always been April 30 for manual submission and May 15 for electronic filing. It is wise to remind taxpayers not to wait until the last minute to file tax returns.

Why choose QNE Cloud Payroll & HR Software?

Digitize Your Software & Build Your Smart Business Today. Enjoy 30 Days Free Trial of QNE AI Cloud Accounting Software, your #1 Hybrid AI Cloud Accounting Software & Cloud Payroll Software in Malaysia!