CP22, CP22A, Personal Tax, Tax Clearance are essential considerations when handling employee exits and new hires in Malaysia.

The Tax Clearance Letter (Surat Penyelesaian Cukai (SPC) is a letter issued by MIRB to notify the employer of a deceased / retiring / resigning employee’s tax liability to enable the employer to make the final payment of salary / compensation / gratuity to the employee.

Therefore, it is necessary to consider the obligations under the law as these obligations are mandatory and failure to comply with these obligations will result in penalties to be levied. Among other items, one of the duties of the employer is to inform the Malaysian Inland Revenue Board (MIRB) of the employee’s cessation of jobs, retirement, death or departure from Malaysia otherwise penalty will be imposed.

Notification of New Employee - Form CP22

Form CP22 is a report from the government issued by the LHDN and also a form for New Employee Notification.

Employer is not required to send notification using the form to the IRBM if:

- The new employee is not subject to income tax

Employer’s Responsibility

- The employer is obligated to inform the assessment branch of IRBM by filing and submitting a CP 22 form within one month from the date of commencement of an employment.

- Employer to submit Form CP 22, which is Notification of new employees

If Not Notify:

Failure to do so IRB will render an employer liable to:

- Fine of not less than RM200 and not more than RM2,000. OR

- Imprisonment for a term not exceeding six months or to both.

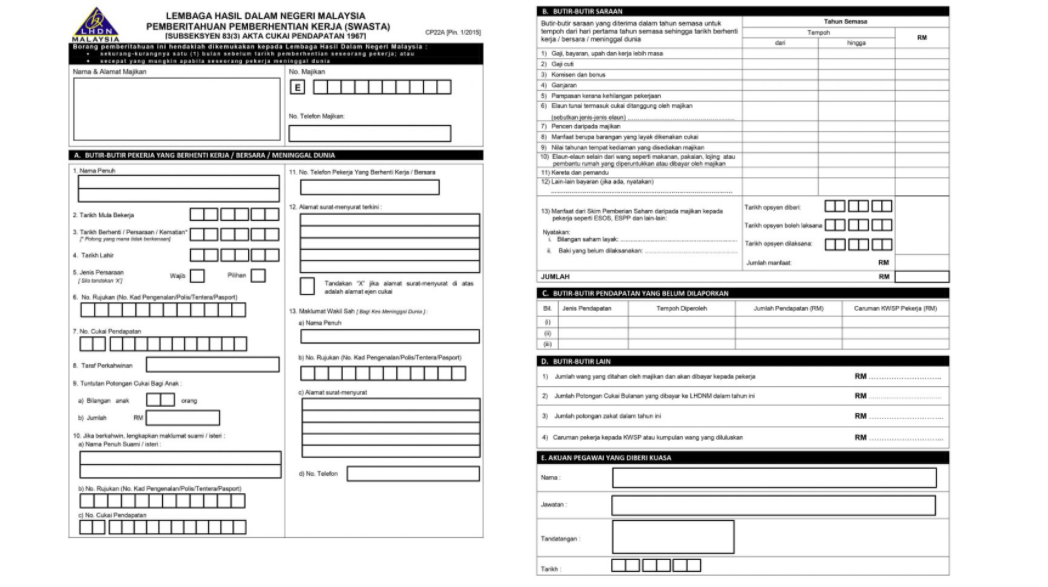

Retire or Cease from Employment in Malaysia– Form CP22A

Employer is responsible for notifying Inland Revenue Board, Malaysia, where the employee ceases employment if:

- Employee is about to retire

- Employee is subject to MTD and employer has not made any deduction

- Employee is about to leave Malaysia permanently

However, employer is not required to send notification about employee ceasing of employment if:

- Employee is subject to MTD and deduction has been made by employer

- Employee’s remuneration is less than minimum income subject to MTD

- Employer is aware that the employee is to be employed elsewhere in Malaysia.

Again, Employer’s Responsibility

- Employer shall notify IRBM at least 30 days before the date employment ceases.

- Employer to submit form – Notification of cessation of employment of Private sector employees

- Withhold money payable respectively to the employee until they receive a Clearance Letter from Assessment Branch

Failure to Notify:

Likewise, Failure to inform IRBM will render an employer liable to:

- Fine of not less than RM200 and not more than RM2,000. OR

- Imprisonment for a term not exceeding six months or to both.

Additional Information on CP22, CP22A, and Tax Clearance

To ensure compliance with Malaysian tax laws, employers are strongly encouraged to maintain up-to-date internal HR and payroll records. This helps avoid delays in submitting forms, especially when employees are transferred, terminated, or retire. Proper planning ensures timely issuance of the Tax Clearance Letter (SPC), minimizing disruptions in the employee’s final salary disbursement and protecting the company from legal penalties.

Employers should also advise employees to settle any outstanding personal tax liabilities ahead of their departure or cessation. This cooperation between employer and employee is essential in the proper closing of tax accounts and smooth finalization of employment records with the Inland Revenue Board (LHDN).

In addition, understanding the timeline and documentation involved in both form processes will help streamline employee onboarding and offboarding. Employers must treat both forms as critical compliance obligations—not optional steps. Failure to manage either may not only cause financial penalties but could also harm the company’s reputation with the authorities.

It is also worth noting that clearance is not just a formality. It is a key step in validating an individual’s tax record before their exit from employment or Malaysia. From an employer’s perspective, ensuring this step is properly executed helps close the payroll process cleanly and legally.

Ultimately, the responsibilities are part of a larger commitment to corporate accountability. By staying informed and compliant, employers contribute to a transparent, tax-responsible workforce and avoid unnecessary legal complications in the future.

Digitize Your Software & Build Your Smart Business Today Enjoy 30 Days Free Trial of N3 AI Accounting (formerly QNE AI Cloud Accounting) Software, your #1 Hybrid AI Cloud Accounting Software & Cloud Payroll Software in Malaysia!