SST Accounting Software Malaysia – As businesses in Malaysia adapt to tax regulation changes, selecting the right software is vital. With the move from Sales and Service Tax (SST) to Goods and Services Tax (GST) in 2015, and future tax transitions expected, being equipped with reliable sst accounting software is no longer optional—it’s essential.

Watch GST in General Ledger using QNE Optimum on YouTube

Understanding the Transition from SST to GST

The government introduced GST in April 2015, replacing SST. This change aimed to increase tax efficiency, transparency, and compliance. The new GST system shifted the responsibility of tax payment to multiple stages of the supply chain—from manufacturers to distributors—highlighting the importance of accurate and up-to-date.

How Does This Impact My Business?

Whether you’re in retail, manufacturing, or services, GST (and SST previously) affect nearly every business process. With broad-based consumption tax principles, your business needs to ensure every transaction is compliant.

Failure to comply can lead to penalties or audit issues. Hence, many businesses now rely on modern to track tax components, automate calculations, and generate compliant reports.

Start Preparing with SST Accounting Software Malaysia

With every transition—be it SST, GST, or upcoming changes in tax policy—understanding the principles behind tax implementation is crucial. This is where attending seminars, consulting tax professionals, and leveraging modern tools will empower you.

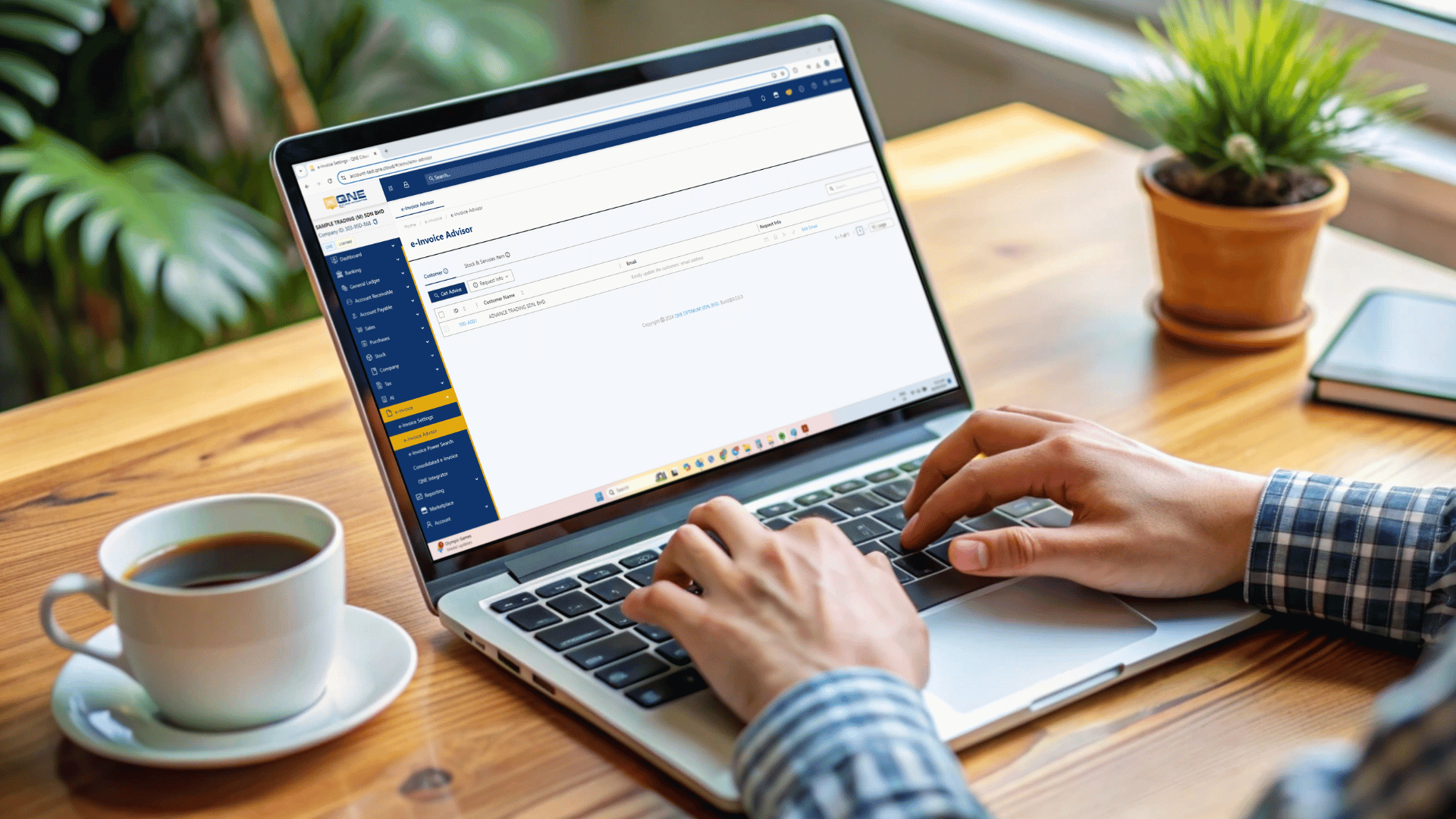

Should I use QNE business software as a GST tool?

QNE Software offers a reliable and locally adapted sst accounting software that complies with government tax standards. Not only is it GST-compliant (as tested in Singapore), but it also includes robust modules to ensure SST and other Malaysian tax formats are fully supported.

GST transactions are similar to all business transactions. Likewise, you need to have your business transactions recorded in order to comply with GST. Using our GST compliant malaysia business software is highly recommended.

Benefits of Using SST Accounting Software

Automated SST Reports

Create SST-02 or GST-03 reports effortlessly.

Export DAT files and tax summaries.

Track input and output taxes using a reliable sst accounting software.

Simplified Audit Trail

Maintain clean, traceable records with every transaction logged.

Ensure smooth audits with pre-generated and sorted documentation using sst software.

Time & Cost Efficiency

Reduce manual tax computation errors.

Save administrative time by using a well-integrated sst accounting module.

Easy Migration to GST or Other Tax Models

If Malaysia reinstitutes GST or updates SST, your sst accounting software malaysia is already built for scalability and adaptability.

SQL Accounting Software for Local Businesses

Prefer to store your data locally? Then sql accounting software might be your best fit. Many Malaysian SMEs choose sql accounting software due to:

Local data hosting control

Compatibility with legacy systems

Reliable performance for on-premise environments

Whether cloud-based or server-based, both sst software and sql accounting software aim to future-proof your tax operations.

Tax compliance isn’t just about meeting deadlines—it’s about ensuring long-term sustainability and avoiding financial pitfalls. With reliable modern tool, businesses are better equipped to face audits, prepare reports, and implement tax updates with ease.

Investing in dependable accounting software or sql accounting software today means peace of mind tomorrow. Whether you’re migrating from SST to GST, or ensuring current compliance, the right tools make a lasting difference.

Is QNE software GST compliant in Malaysia?

Yes, indeed. In fact, our customers in Singapore are using our GST module which has been proven by IRAS (Inland Revenue Authority of Singapore) as a software with GST Compliant in Singapore.

Jabatan Kastam Diraja Malaysia had also provided us with the guidelines and requirements of the GST compliant module.

We had successfully passed the GST compliance requirements, and Jabatan Kastam Diraja Malaysia has currently issued us a certificate with the approval number: KE.HF(121)426/05-21, which grant our customers can apply when purchasing our QNE GST compliant software in Malaysia.

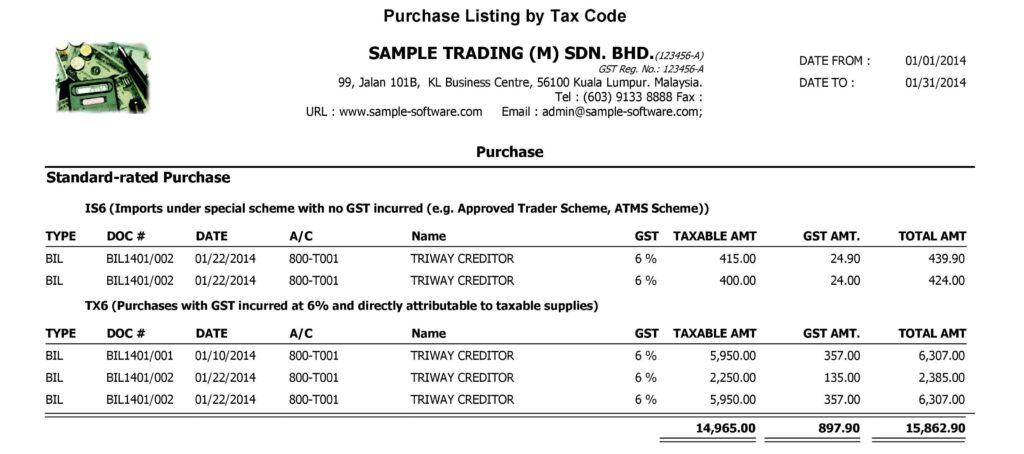

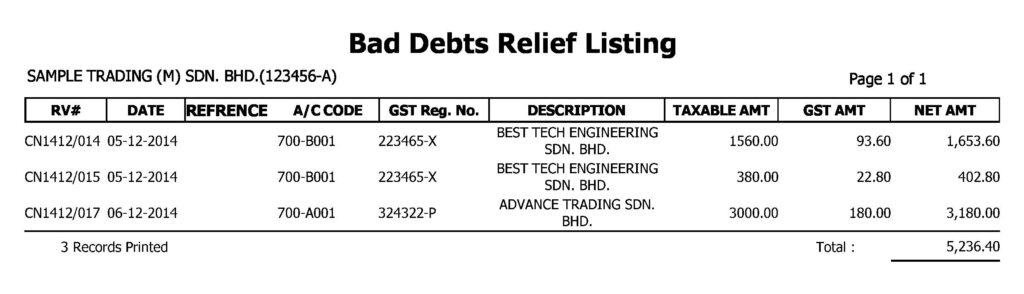

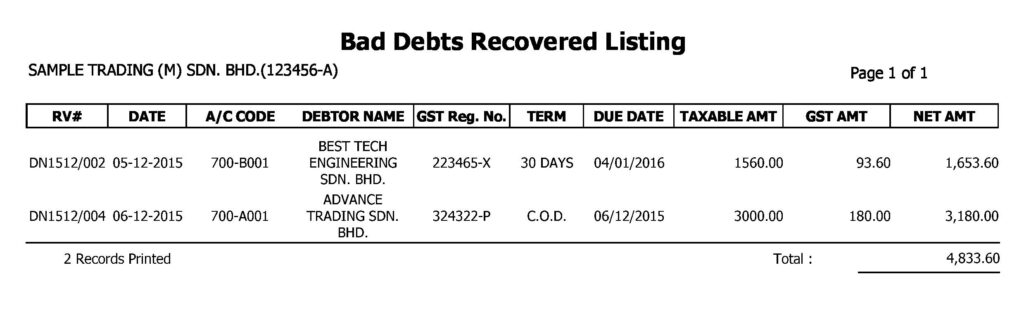

Below are some examples of GST reports:

Digitize Your Software & Build Your Smart Business Today!

Enjoy 30 Days Free Trial of N3 AI Accounting (formerly QNE AI Cloud Accounting) Software, your #1 Hybrid Cloud Accounting Software & Cloud Payroll Software in Malaysia