The cloud-based account software or accounting system Malaysia is specialized to cater the needs of Accountants, Bookkeepers and Auditing Firms, Micro, Small and Medium Businesses. QNE Cloud AI Accounting System Malaysia enables businesses to manage finances, streamline operation and comply with SST and e-Invoice!

![accounting-software-113[1]](https://qne.cloud/my/wp-content/uploads/sites/8/2025/10/accounting-software-1131-300x169.webp)

Skip the manual work with our accounting software! Automatically match payments with invoices for a hassle-free process.

*All prices are subject to 8% SST.

| PRICING PLAN | PRIME | ESSENTIAL | PROFESSIONAL | GROWTH | ENTERPRISE | |

|---|---|---|---|---|---|---|

| MONTHLY FEE (BILLED ANNUALLY) | In Malaysian Ringgit | RM62 | RM100 | RM130 | RM180 | RM500 |

| LHDN e-Invoice Module E-Invoice Validation, Integration w/ LHDN MyInvois system | ✔ | ✔ | ✔ | ✔ | ✔ | |

| No. of Concurrent Users Included (Unlimited users can be enrolled; only concurrent connections are counted, plus 1 extra user for your QNE Certified Accountant Partner.) | 2 Users + 1 Accountant | 3 Users + 1 Accountant | 3 Users + 1 Accountant | 3 Users + 1 Accountant | 10 Users + 1 Accountant | |

| ARTIFICIAL INTELLIGENCE MODULE | Quinny AI Credits | 10 Credits Per Month | 30 Credits Per Month | 30 Credits Per Month | 1,000 Credits Per Month | 2,000 Credits Per Month |

| Quinny AI Chat History | - | Up to 3 days | Up to 3 days | Up to 1 month | Up to 1 year | |

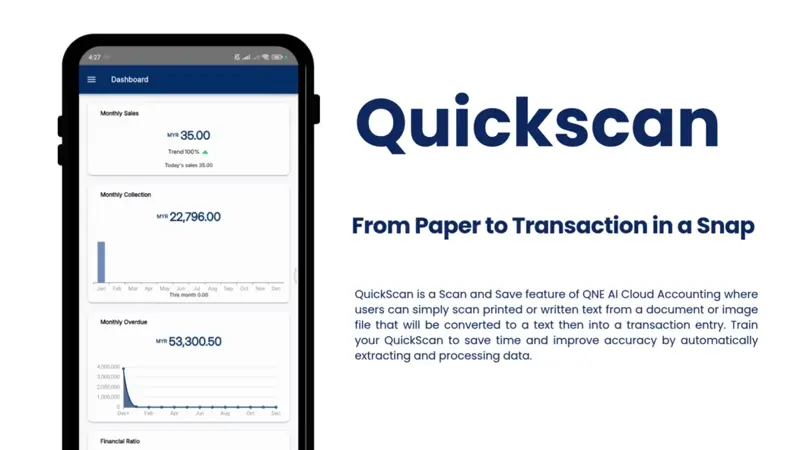

| QuickScan* | 200 OCR credit per month ** | 200 OCR credit per month ** | 200 OCR credit per month ** | 200 OCR credit per month ** | 200 OCR credit per month ** | |

| Train my QuickScaN | - | ✔ | ✔ | ✔ | ✔ | |

| Qbot | ✔ | ✔ | ✔ | ✔ | ✔ | |

| e-Invoice Advance Automation | ✔ | ✔ | ✔ | ✔ | ✔ | |

| WhatsApp QuickScan Billing Upload | UNLIMITED | UNLIMITED | UNLIMITED | UNLIMITED | UNLIMITED | |

| SST MODULE | Track SST, Print SST Forms and Reports | - | ✔ | ✔ | ✔ | ✔ |

| RESOURCE ALLOCATION | Attachment | ✔ | ✔ | ✔ | ✔ | ✔ |

| Cloud Storage | 100GB | 100GB | 100GB | 200GB | 300GB | |

| Email Allocation | 1,500/month | 10,000/month | 10,000/month | 12,000/month | 15,000/month | |

| GENERAL LEDGER MODULE | Journal, Receipt, and Payment Voucher | ✔ | ✔ | ✔ | ✔ | ✔ |

| Fixed Asset Ledger & Depreciation | - | ✔ | ✔ | ✔ | ✔ | |

| AI Auto-Bank Reconciliation | ✔ | ✔ | ✔ | ✔ | ✔ | |

| Journal Vouchers allows contra-entries for Customer-Supplier | ✔ | ✔ | ✔ | ✔ | ✔ | |

| Financial Reports | ✔ | ✔ | ✔ | ✔ | ✔ | |

| Budget Maintenance | ADD-ON | ADD-ON | ✔ | ✔ | ✔ | |

| CUSTOMER MODULE | Customer Invoice, Receive Payment and Credit Notes | ✔ | ✔ | ✔ | ✔ | ✔ |

| Customer Refund Form, Debit Notes | - | ✔ | ✔ | ✔ | ✔ | |

| Customer Reports | ✔ | ✔ | ✔ | ✔ | ✔ | |

| SALES MODULE | Sales Invoice, Sales Credit Note | ✔ | ✔ | ✔ | ✔ | ✔ |

| Cash Sales | ✔ | ✔ | ✔ | ✔ | ✔ | |

| Quotation, Sales Debit Note | - | ✔ | ✔ | ✔ | ✔ | |

| Sales Order, Delivery Order | - | - | ✔ | ✔ | ✔ | |

| Sales Reports | ✔ | ✔ | ✔ | ✔ | ✔ | |

| SUPPLIER MODULE | Bills, Pay Bills, and Credit Notes | ✔ | ✔ | ✔ | ✔ | ✔ |

| Supplier Refund Form, Debit Notes | - | ✔ | ✔ | ✔ | ✔ | |

| Supplier Reports | ✔ | ✔ | ✔ | ✔ | ✔ | |

| PURCHASE MODULE | Purchase Invoice, Purchase Return | ✔ | ✔ | ✔ | ✔ | ✔ |

| LHDN Self-Billed e-Invoice | ✔ | ✔ | ✔ | ✔ | ✔ | |

| Purchase Order, Purchase Debit Note | - | ✔ | ✔ | ✔ | ✔ | |

| Purchase Requisition, Good Receive Note, Cash Purchases | - | ✔ | ✔ | ✔ | ✔ | |

| Purchases Reports | ✔ | ✔ | ✔ | ✔ | ✔ | |

| INVENTORY MODULE | Stock and Service Listing | ✔ | ✔ | ✔ | ✔ | ✔ |

| Inventory Balance Tracking | - | - | ✔ | ✔ | ✔ | |

| Stock In, Stock Out, and Negative Stock Control | - | - | ✔ | ✔ | ✔ | |

| Stock Adjustment | - | - | ✔ | ✔ | ✔ | |

| Tracks Location / Multi-Location | - | - | ADD-ON | ✔ | ✔ | |

| Stock Reports | - | - | ✔ | ✔ | ✔ | |

| OTHER MODULES | Multi-Currency Accounting | ADD-ON | ADD-ON | ✔ | ✔ | ✔ |

| Project Accounting | ADD-ON | ADD-ON | ADD-ON | ✔ | ✔ | |

| User Default Setting Module | COMING SOON | COMING SOON | COMING SOON | COMING SOON | COMING SOON | |

| Customizable Role Permissions | ✔ | ✔ | ✔ | ✔ | ✔ | |

| 3rd Party MFA Integration | - | - | - | - | ✔ | |

| API Integration | - | - | - | - | ADD-ON | |

| LOCAL SUPPORT | Qbot AI Support | ✔ | ✔ | ✔ | ✔ | ✔ |

| Email Ticketing & Live Chat | ✔ | ✔ | ✔ | ✔ | ✔ | |

| Priority Support | - | - | - | ✔ | ✔ | |

| Phone Support | ADD-ON | ADD-ON | ADD-ON | ✔ | ✔ |

QNE AI Cloud Accounting is a cloud-based accounting solution designed to simplify and automate financial management for businesses. It offers innovative features powered by AI, such as QuickScan, Qbot, and advanced e-Invoice automation, making it an ideal choice for businesses seeking efficiency, compliance, and real-time financial insights.

QNE AI Cloud Accounting systemis ideal for small to medium-sized businesses, accountants, and bookkeeping firms that require a reliable and compliant accounting system.

QNE AI Cloud Accounting system malaysia stands out with its cutting-edge AI-powered features, including QuickScan, QuickScan Robot, Qbot, Financial Advisor, and advanced e-Invoice automation. These tools streamline processes, enhance accuracy, and provide valuable insights, ensuring an efficient and intelligent accounting experience tailored to modern business needs.

Yes, it is fully compliant with SST and e-Invoice implementation, allowing businesses to meet government requirements effortlessly.

Yes, uploading bank statements for reconciliation is one of the AI-powered features of QNE AI Cloud Accounting system. You can easily upload PDF bank statements, import files, or directly connect your bank account, and the system will automatically match transactions, saving you time and effort in reconciling your accounts.

Yes, the QCA Mobile App for Android allows you to manage client records and create transactions on the go.

Yes, the QCA Mobile App for Android allows you to manage client records and create transactions on the go. You can try our accounting software malaysia.

QNE AI Cloud Accounting system malaysia is accessible on any device with a web browser and internet connection, including desktops, laptops, tablets, and smartphones.

No, our accounting system malaysia pricing is transparent and includes all listed features. Additional fees may apply only for optional add-ons or extra user licenses.

No, since it is a cloud-based solution, an internet connection is required for access.

Yes, you can enroll an unlimited number of users under your account in our accounting software. However, each subscription plan has a limit on the number of concurrent users who can access the system at the same time. If you need more concurrent users, additional user licenses can be purchased to accommodate your requirements in our accounting system malaysia.

No, authorized support emails do not occupy user licenses.

Yes, you can upgrade or downgrade your subscription plan. Please contact our sales team for assistance.

Our published subscription fees are designed for annual plans, which offer the best value and significant savings compared to monthly rates. However, if you prefer flexibility, we also offer monthly subscriptions at the following rates:

Prime: RM80/month

Essential: RM120/month

Pro: RM160/month

Accountant: RM20/month

By choosing an annual plan, you not only enjoy cost savings but also gain uninterrupted access to all the powerful features of QNE AI Cloud Accounting throughout the year.

Have another question? Talk to our team →

QNE is a leading provider of innovative business solutions tailored specifically for Malaysian businesses. We offer a range of products, including advanced accounting system in Malaysia, payroll solutions, and e-Invoice tools. Designed to comply with local regulations such as SST and e-Invoice requirements, QNE accounting software delivers powerful, user-friendly solutions to streamline your operations and help your business grow.

Our products are ideal for businesses of all sizes across various industries in Malaysia, as well as accountants and bookkeeping firms seeking efficient and compliant solutions.

What sets QNE accounting system Malaysia apart is its innovative features, including AI-powered tools such as QuickScan, Qbot, and Financial Advisor. Our products are specifically built to meet the unique needs of Malaysian businesses, ensuring compliance with local regulations while providing reliable and efficient localized solutions.

QNE AI Cloud Accounting Software can help your business in the Digital Era.

Experience a faster, smarter way to explore QNE solutions, all in one place. Don’t forget to bookmark this site for your future visits.