Sales and Service Tax (SST)

SST (Sales and Service Tax) shall be levied and charged on the taxable supply of goods and services made in the course or furtherance of business in Malaysia by a taxable person…

Cloud Accounting ERP Software vs Local-Host Accounting ERP Software

Before starting up a new business, you might need to spend some time for surveying which Accounting System Software or ERP Software in Malaysia that you would like to apply…

5 Tips for Selecting the Best Accounting Program Malaysia

Starting up a business can be super challenging, while tirelessly looking for customer and better bargain supplier, business owner has to put effort on filling the accounts precisely and…

GST Compliance

The government has recently announced its new plan in replacing the existing sales and service tax with the goods and services tax (GST) starting from April 2015 onwards…

Form CP58

Form CP 58 only need to be prepared for those recipients where the monetary and non-monetary incentive payment are of an amount exceeding RM5,000 per annum…

In Partnership with CapBay

Exclusively for QNE customers, we are partnering with CapBay to provide better financing solution for your business. Receive up to 80% cash on your invoices instantly and free up more cash flow for your […]

Most of our QNE Delphi Users has changed to QNE Optimum!

Proven that over 80% of our Delphi customers have already converted to QNE Optimum with greater efficiency and better performance. Reasons To Choose QNE Optimum Windows & Web-Based ApplicationThe only […]

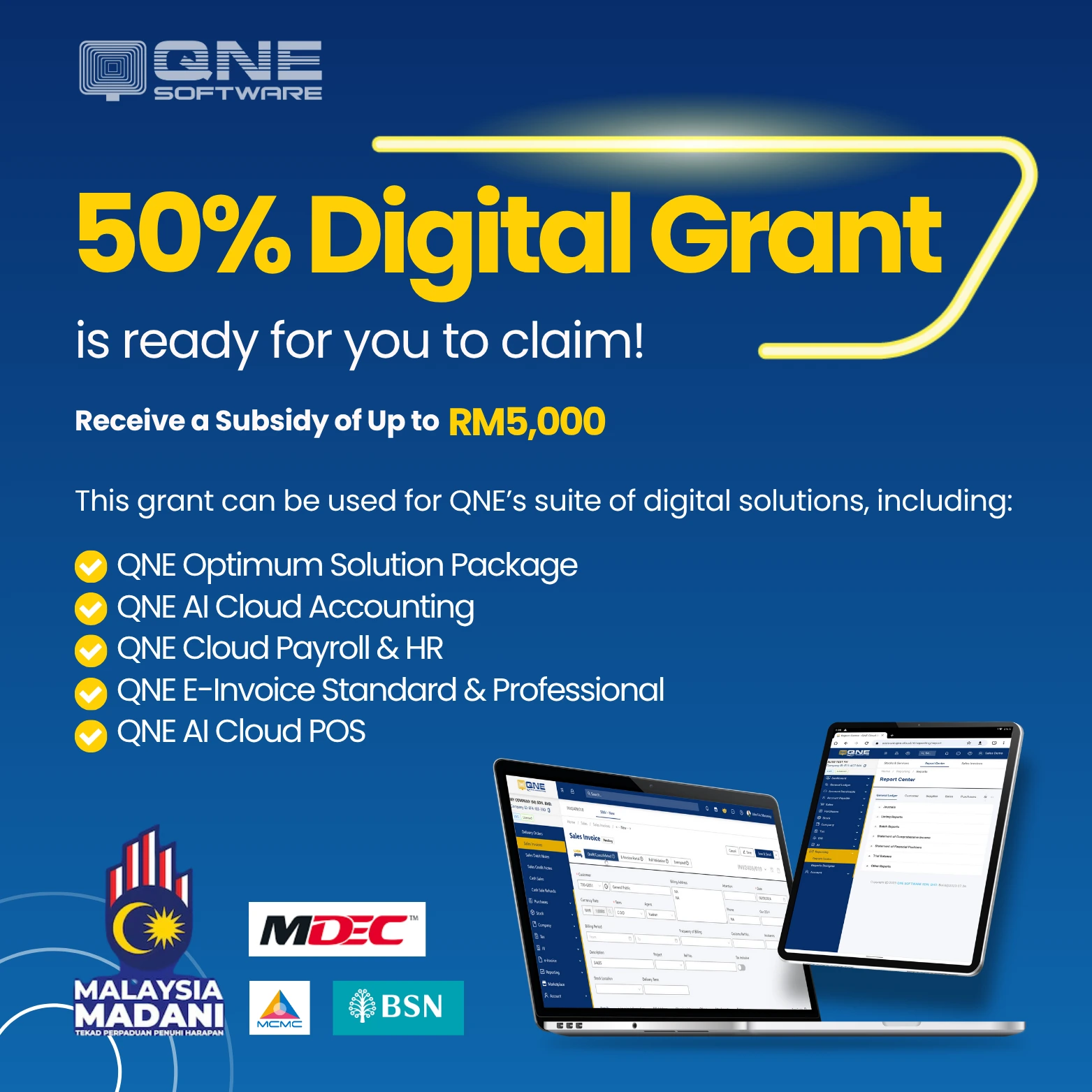

Matching Grant Up to RM 5000 for first 100,000 SME’s only.

In order to build a Digital Malaysia, Small Medium Enterprise (SMEs) are called to adopt the digitalization measures for their business operations. This includes electronic Point of Sales systems (e-POS), […]

Boostorder is now Integrated with QNE Accounting Software Malaysia!!

Good News! QNE Accounting Software is now collaborated with Boostorder, this will benefit you in time saving for your customer, browsing catalog and place order easily anywhere anytime. The integration will […]

Amendments to Service Tax

Please be informed that effective 1st of January 2019, there will be amendments to service tax treatment as follows:- 1. 犀利士tps://goo.gl/pwrvU1″>EXEMPTION FROM PAYMENT OF SERVICE TAX UNDER THE SERVICE TAX (PERSONS EXEMPTED FROM […]